Polkadot price analysis shows a bearish trend in the market today. DOT price has dropped by 0.25% in the last 24 hours and is currently trading at $5.85. The cryptocurrency market has seen a general bearish sentiment as investors seek to take profits from the recent rally in prices.

The support level for Polkadot is seen at the $5.83 level, while the immediate resistance is present at the $6.03 mark. Looking ahead, if the downtrend in DOT prices continues, we could see further declines toward the $5.75 or even $5.60 level. On the other hand, a breakout above the $6.03 resistance could signal a potential rally in prices toward the $6.20 or even higher levels.

In today’s market, most of the cryptocurrencies are trading in red, as BTC prices are currently down by 0.91%, while ETH prices are down by 0.76%. If the market sentiment remains bearish, we could see further declines in Polkadot prices.

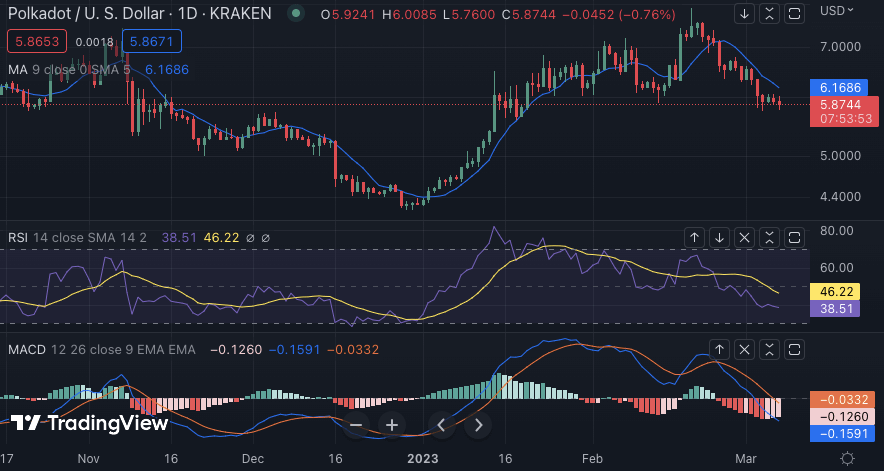

Polkadot price action on a 1-day chart: Bears are adamant as they push prices below $6.03

On 1-day timeframes, the Polkadot price analysis is bearish today as prices slip below the $6.03 resistance level. The bears have been in control of the market for the last 24 hours and are likely to push prices lower in the next few hours. The 24-hour market cap for the DOT is currently at $6,780,172,887, and the trading volume is at $196,590,280.

The 20-SMA is currently at the $5.86 level, and the 50-SMA is close to the $6.02 mark, suggesting that there could be further losses in prices in the near term. The RSI indicator is also in the bearish territory and pointing downwards, indicating selling pressure in the market. The moving average indicator is also bearish, as the short-term SMA is below the long-term SMA. The MACD indicator is also in the bearish zone, with the MACD line trading below the signal line.

Polkadot price analysis 4-hour price analysis: Latest developments

The 4-hour Polkadot price analysis confirms the downtrend, as the price has been trading in a range of $5.74-$6.03 for the past few hours. The price has formed lower highs and lower lows, which is a sign of bearish momentum in the market. The bulls have not been able to take the price above $6.03, which could indicate that the bears are in control of the market.

The RSI indicator is also in the bearish zone at 38.43 and is pointing downwards, indicating that the bears are in control. The MACD indicator also has a bearish bias as the histogram is in red, and the MACD line is trading below the signal line. The moving average indicator is also bearish at $5.91 as the short-term SMA is below the long-term SMA.

Polkadot price analysis conclusion

Overall, Polkadot price analysis on both 1-day and 4-hour timeframes suggests that the bears are in control of the market. The price is likely to remain bearish in the near term unless the bulls can take the price above $6.03. The support levels for the DOT/USD pair are at $5.74, and if bears break below this level, the price could fall to the next support level at $5.50.