Polkadot price analysis indicates a bearish movement after the bears have currently taken hold of the market. The support level for Polkadot stands at $6.00, which means if broken could lead to a further downgrade of the DOT/USD pair. The resistance is currently at $6.70, which, if retraced and broken, could lead to a positive setback for the coin.

The digital asset has seen a decline of -2.29% over the last 24 hours and currently trading at $6.48, down from its time high of $6.70.Polkadot opened today’s trading session on a bullish note and was able to tap a high of $6.6225.The bears came in and have pushed DOT prices to trade near the support level of $6.00.

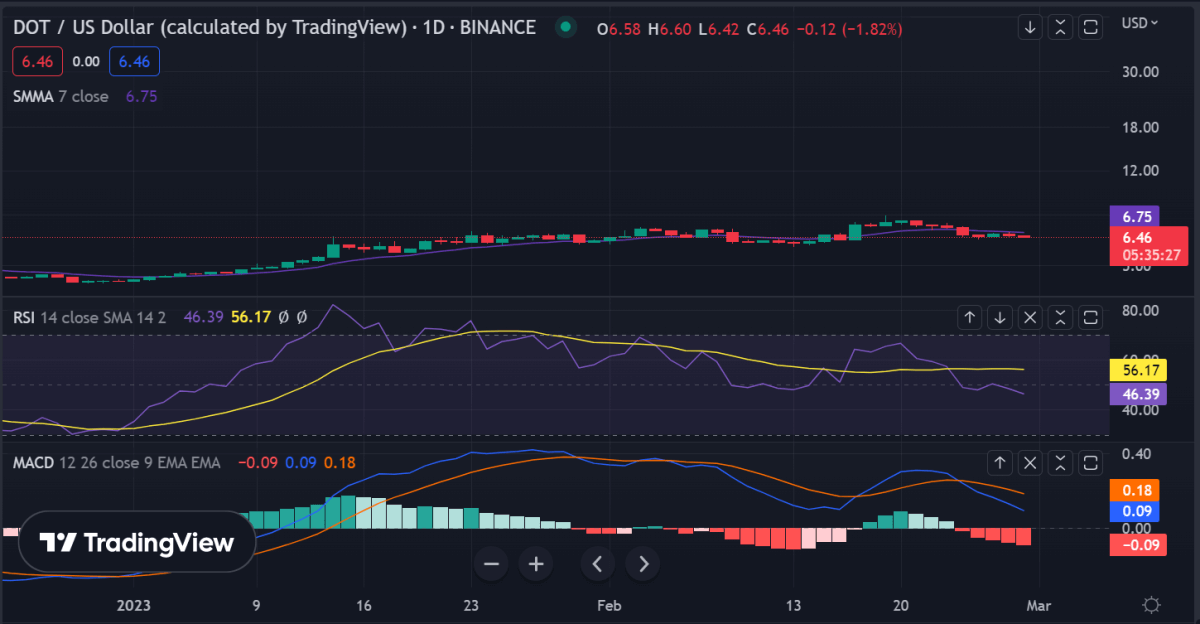

Polkadot price analysis 1-day chart: Bears overcome bulls’ charge towards $7.0

The 1-day chart for Polkadot price analysis shows that the DOT/USD pair has been trading in a declining trendline, forming a bearing triangle formation. The bears have continued to put pressure on the market, pushing the price levels lower toward the support level of $6.00.

A bearish flag is starting to form as the bears charge $7.0. The bears have been in control of the market since the opening of today’s trading session, and unless there is a sudden surge of buying pressure, DOT price may see major corrective action to the downside in the coming days or weeks.

It is likely that Polkadot will find some support at around $6.00, but a further decline in prices cannot be ruled out. The price of DOT is declining below the daily Moving Average MA(20) line, which is a bearish indicator. The Relative Strength Index (RSI) is headed to the oversold region as it is currently at 46.89, indicating bearish momentum in the near term.

The technical indicators on the daily chart show the altcoin has been trading in a sideways direction for most parts of the day, hence the volatility has been high as indicated by the bulging Bollinger bands. The daily candle close shows the green candlesticks are more than the red bars, indicating the bulls have had the upper hand.

The Moving Average Convergence Divergence is trending lower, below the red signal line, indicating an increase in bearish momentum. It’s likely that the price of DOT could extend its correction to the downside if the sellers continue to dominate the market.

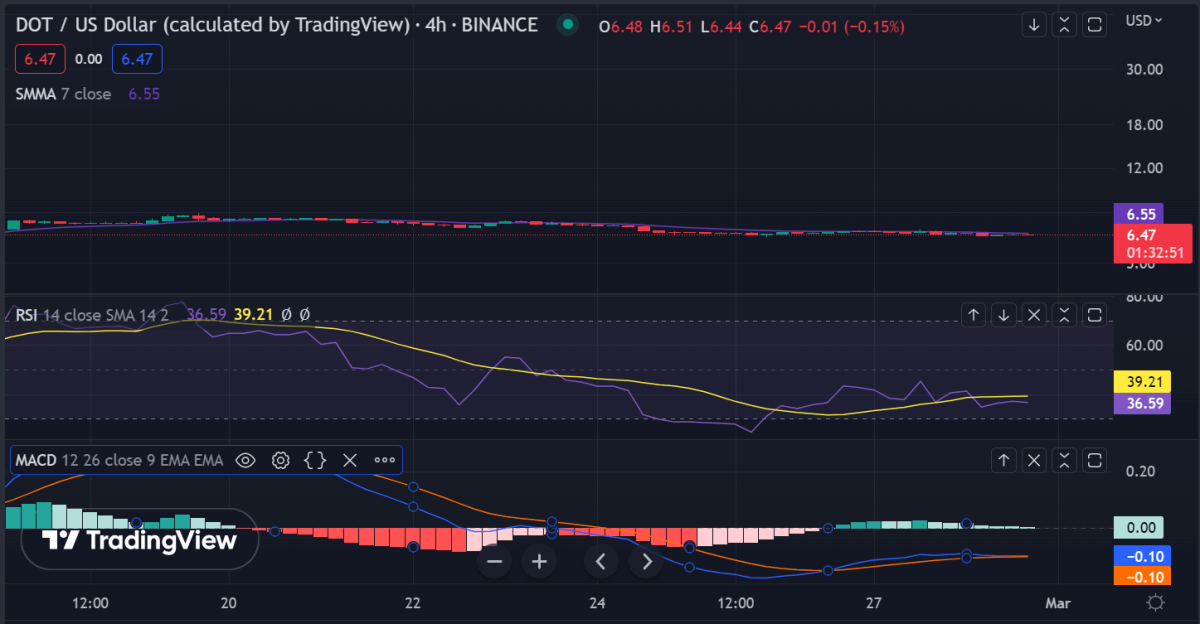

Polkadot price analysis 4-hour chart: Recent developments

The 4-hour chart of Polkadot price analysis shows that the price is a downtrend as it forms lower highs and lower lows. The trend pattern shows the selling pressure seems to intensify as the RSI is close to the oversold region. The bulls have successfully defended the key support level of $6.0, which represents the Fibonacci 23.60% retracement level of the recent wave from the low of $5.18 to the high of $7.29. A break below this support could see the DOT price extending its correction toward the next support level near $5.50, which represents the Fibonacci 38.20% retracement level of the same wave.

On the other hand, if buyers are able to push the price back above $6.70, then it could lead to a recovery toward the next resistance level near $7.0. The bulls are looking to challenge the Fibonacci 23.60% retracement level of the same wave.

At the same time, price dormancy has begun at the moment as the altcoin’s volatility is low on the 4-hour chart. The bands of the Bollinger indicators are currently touching each other and forming a symmetrical triangle pattern, which means if broken can lead to a further downgrade of the DOT/USD pair. The resistance is currently at $6.70, which, if retraced and broken, could lead to a positive setback for the coin.

Polkadot price analysis conclusion

The Polkadot price analysis shows that the market is bearish as the price slumped to $6.43 from a high of $6.70 today. We could see a further downside for Polkadot if the bears manage to break the support level of $6.43. The key support levels to watch for a bullish scenario are $6.00 and $5.50. In the same respect, if buyers manage to push the price above $6.70, then they may be able to restore some of its lost value in the near term.