Polkadot price analysis shows that the cryptocurrency is bullish today and is looking to break out of its current trading range. The digital asset has been in a narrow channel since the beginning of the month, but yesterday it broke through the upper resistance and has been on a bullish trend since then. The price has increased by nearly 0.16% in the past 24 hours, reaching a high of $4.35.

The recent surge in price is being driven by strong fundamentals and increasing institutional interest in the asset. The trading volume for the DOT/USD pair has increased significantly and is currently at $84,831,027 in the past few days as more investors are looking to enter the market while the market capitalization is trading at $5,013,899,111.

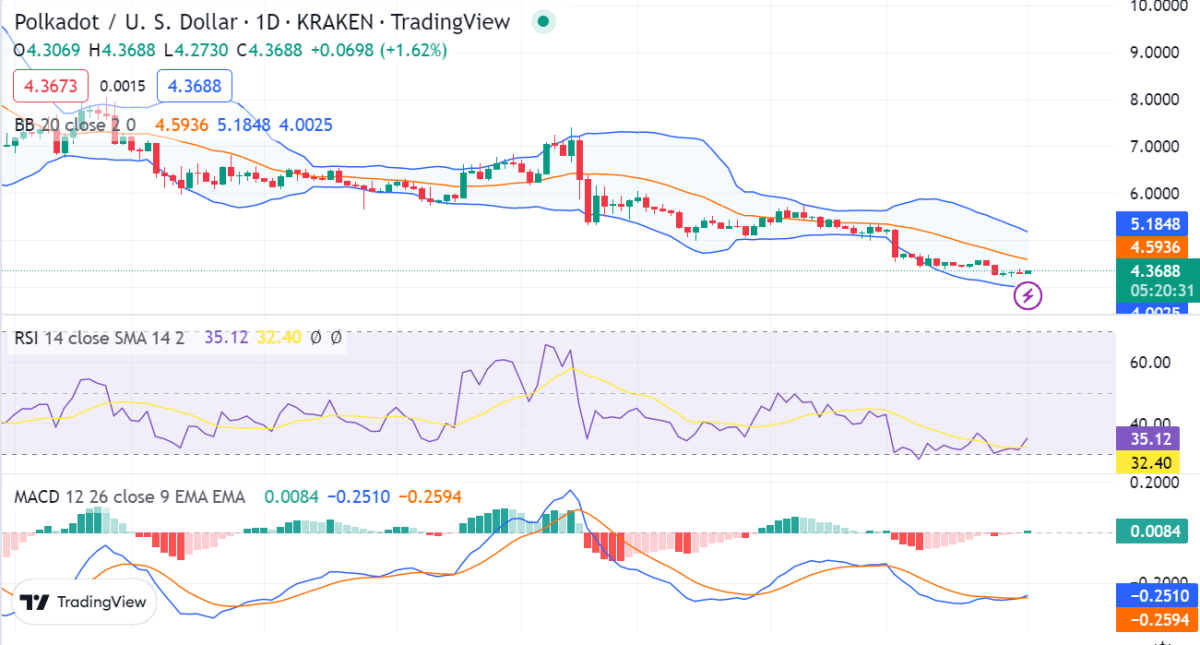

Polkadot price analysis 1-day chart: Price movement is positive, as the price nears $4.35

The one-day chart shows that the Polkadot price is in an uptrend, with the price trading above all its key moving averages. The DOT/USD has gained upward momentum and is currently trading above the $4.35 mark.

The Relative Strength Index (RSI) is also in the bullish zone, indicating that the buyers are in control of the market. The moving average convergence divergence (MACD) indicator is above the signal line, indicating that the momentum is in favor of the bulls. Moreover, market volatility has also been increasing, showing a higher level of activity in the market. The upper limit of the Bollinger Band is $5.1853, and the lower limit is $4.0025.The long-term outlook for Polkadot remains bullish as more investors are looking to

DOT/USD 4-hour price chart: Latest development

The 4-hour Polkadot price analysis reveals that the market is in a bullish trend, with buyers in control of the market. The price has broken out of its previous trading range and is now looking to test the next resistance at $4.35. The relative strength index (RSI) score is trading at 44.93, this shows that is in the overbought zone, indicating that the buyers are aggressively pushing the price higher.

The MACD indicator is also trending higher, confirming the strength of the bulls. The Bollinger Bands in the four-hour price chart show that the volatility has increased in the past few days, which is a sign of higher market activity. As a result, the upper limit of Bollinger’s band rests at $4.3732, serving as the most substantial resistance for DOT. Contrariwise, the lower limit of Bollinger’s band rests at $4.2580, serving as the strongest support for DOT.

Polkadot price analysis conclusion

In conclusion, the short-term outlook for Polkadot is bullish, and we could see further upside in the near future if the current bullish momentum continues. The long-term outlook for Polkadot remains positive as more investors look to enter the market and take advantage of its potential.