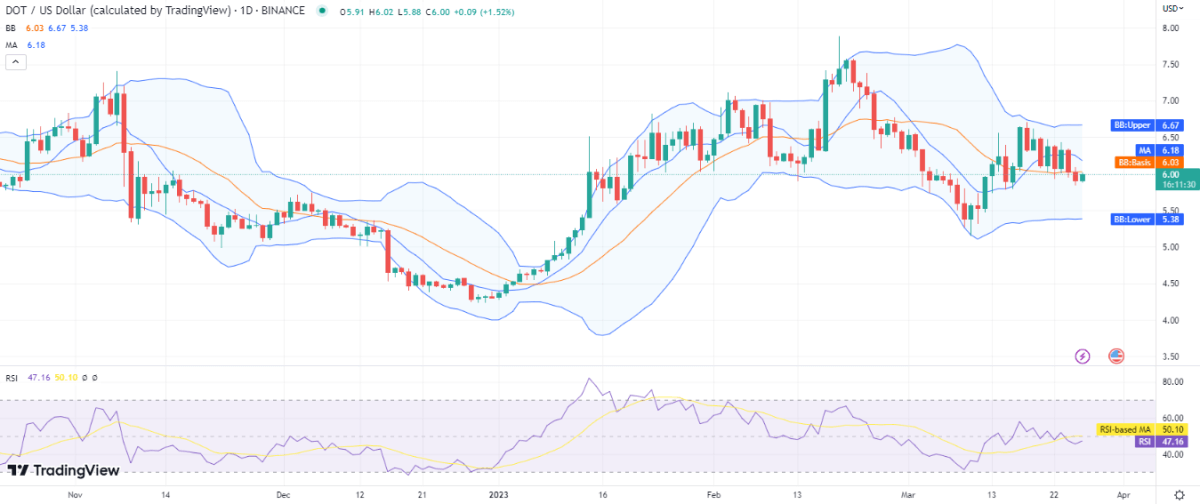

As a result of today’s small improvement in the DOT/USD value, a green candlestick has emerged on the chart, supporting the bullish Polkadot price analysis. Given that the market was in a constant downtrend, the previous week was crucial for the bulls. But as the price has returned to the $6 level after finding support, a small change in trends is now apparent.

DOT/USD 1-day price chart: DOT to pursue the upward trend?

The price has increased today, according to the 1-day Polkadot price analysis. Due to traders’ constant selling pressure, the DOT price was constantly falling, but today bulls acquired enough strength to move the price back up. Over the past day, Polkadot has lost more than 0.55 percent of its worth, and over the past week, it has lost 6.43 percent. Polkadot’s market dominance is currently 0.61 percent, despite a 34 percent decline in trading activity.

Bolling bands are keeping their distance from each other, which indicates increased volatility. The upper band at $6.67 represents the greatest resistance, and the lower band at $5.38 represents the strongest support. $6.03 is the mean average of the Bollinger bands. The relative strength indicator (RSI) is at 47 but rising while the moving average is at the $6.18 mark.

Polkadot price analysis: Recent developments and further technical indications

The price is increasing as DOT bulls secure green the candlesticks on the charts, according to the 4-hour Polkadot price analysis, which reveals that bulls have made a significant comeback today. Dot is quickly recovering from yesterday’s decline as bulls get ready to raise the bar.

More so than in the previous few hours, the volatility has grown. The top band of the Bollinger bands is at a reading of $6.42, and the lower band is at a reading of $5.82. At $6.12, the sum of the Bollinger bands is higher than the current price. The price has recently risen above the MA level, and the moving average is currently at $5.99, just below the price level, which reinforces the bullish trend. The relative strength indicator (RSI), which is currently at 43 but is moving sharply upward, indicates that buyers are active in the market.

Polkadot price analysis: conclusion

The DOT/USD may stay bullish for the next 24 hours, according to the hourly and daily Polkadot price analysis, as bulls are gaining strength and making up for previous days’ losses. As can be seen from the hourly RSI indicator movement, which displays a sizable area for a bullish move, there are enough possibilities for price recovery, and we can anticipate a further increase in price in the ensuing hours. The price has now touched local resistance at the present price level of $6, so a small correction could also occur.