Polkadot, the blockchain ecosystem devised by Ethereum co-founder Gavin Wood, has laid the foundations for a network that could ultimately become more decentralized than any of its peers. In recent months, it has made significant strides towards that objective, setting the stage for it to play a pivotal role in the blockchain industry for years to come.

When it was launched in 2020, Polkadot immediately gained significant traction, swaying the crypto community with its unique approach to overcoming blockchain’s scalability challenges. But as crypto winter descended on the industry in early 2022, much of this progress was undone, as Polkadot was among the hardest-hit projects.

Last October, Parity Technologies, the organization that oversees the development of Polkadot, announced that it was laying off 30% of its workforce. It said at the time that by doing this, it could free up more resources and utilize them for development, hence most of the layoffs came within its marketing and business development teams. Instead of marketing itself, Polkadot decided it would rely on its community to do that for it.

It was a difficult choice for Parity to make, as it came at a time when Polkadot was losing ground on its competitors, but it is looking more and more like a masterstroke as the project regains the initiative with the end of crypto winter.

What is Polkadot?

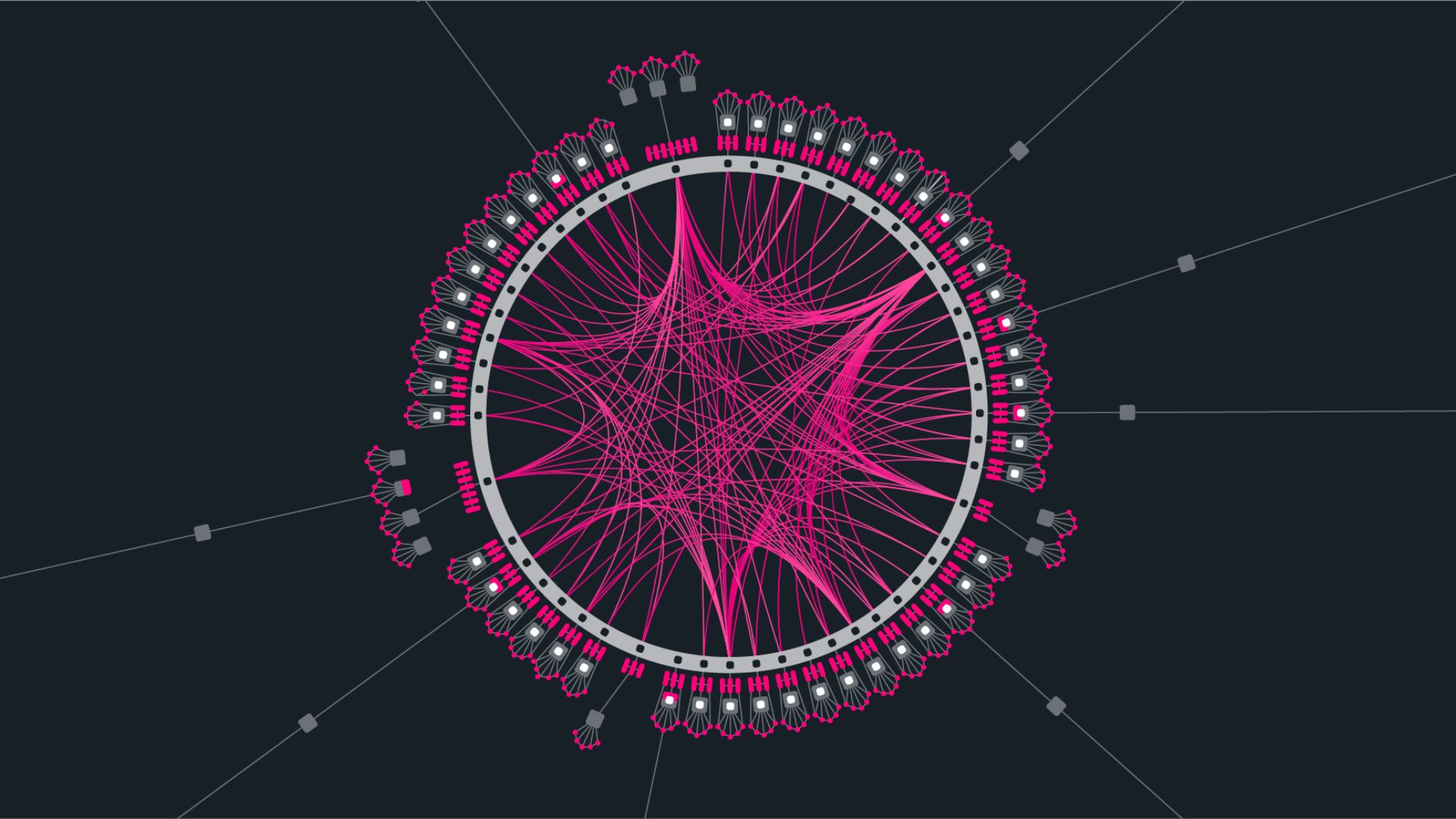

Polkadot is the original Layer-0 blockchain, with its Relay chain playing a central role that links its wider ecosystem. The Relay chain supports numerous Layer-1 blockchains, known as “Parachains”, which support various different applications that share the robust security of the Relay chain. In this way, Polkadot has created a robust infrastructure that optimizes security and interoperability.

The Relay Chain acts as the security provider for all of the Parachains in the Polkadot ecosystem. It doesn’t host smart contracts, but instead provides the essential tools for Parachains to build their own infrastructure, and acts as a final settlement layer for all of their transactions. The infrastructure provided by the Relay chain includes its consensus algorithm, state machines, and other foundational components. In this way, it serves as the backbone of the entire Polkadot ecosystem, facilitating interoperability between multiple projects and ensuring their security.

Within Polkadot, validators play a key role too, collecting fees for validating transactions and creating new blocks to propose to the network. In order for validators to participate, they must stake a minimum amount of Polkadot’s native DOT token.

This unique, multichain architecture sets Polkadot apart from any other blockchain ecosystem, addressing issues around scalability in a way that doesn’t weaken decentralization or security, effectively solving the “blockchain trilemma”. Its inherent scalability has helped to build up a strong community following, which has recently made a number of key decisions to advance the decentralization of the network. It comes at a time when the legacy Ethereum network continues to struggle with scalability problems.

Ethereum’s Ongoing Struggles

Another of Ethereum’s co-founders, Vitalik Buterin, recently outlined a proposal that would shake up the staking requirements for validators of its network. His proposal calls for the minimum stake to increase dramatically, to 4,096 ETH. This would limit individual staking to all but the biggest whales. The idea is that more “staking pools” will arise to take their place, promoting greater decentralization of the network, but many have said it sounds like a very risky move.

One of the main questions is around how Ethereum can ensure validators are predominantly made up of decentralized pools, without effectively becoming a permissioned network. In addition, there are challenges regarding how to define and measure the decentralization of validator pools. As such, Buterin’s proposal has not yet gained many followers and it remains to be seen if it will ever be implemented.

But the fact that Buterin felt compelled to make such a dramatic proposal suggests Ethereum still has some way to go in its quest to solve its scalability challenges while remaining decentralized. In the meantime, more crypto advocates and developers are turning to alternative blockchains such as Polkadot, which becomes even more attractive with its commitment to becoming one of the most decentralized networks of all.

Power To The People

Polkadot’s quest for decentralization took a positive turn late last year when it decided that key non-engineering functions would henceforth be delegated to the community. The Polkassembly is a decentralized autonomous organization or DAO that enables community members to make proposals and vote on them, with the weight of their votes determined by the number of DOT tokens they hold. It’s a model that’s similar to shareholder voting in corporate entities, and it was this that led to the decision to lay off a number of Parity’s staff.

Although the layoffs may have seemed harsh at the time, Polkadot’s ecosystem has made substantial progress since then, suggesting it made a wise decision. Polkadot’s network saw major adoption in the last quarter of 2023, according to Messari data. The number of active wallets on both the Relay chain and the Parachains increased by more than 90% during that time, while communications via Polkadot’s XCM protocol rose by 150%, suggesting much more activity on the network. Moreover, Polkadot now boasts 2,100 developers, making it number two after Ethereum itself.

At the same time, Polkadot’s community has voted to put the funds held within the Polkadot Treasury to use, with multiple new initiatives launching that aim to promote and grow its ecosystem. Since Polkassembly was granted full governance powers over the network, more than 1.138 million DOT (approximately $8 million) has been awarded to various projects building on Polkadot, and there are numerous active proposals.

Growing Ecosystem Traction

One of the best measures of network decentralization is the vibrancy of its supporting ecosystem and in that regard, Polkadot is showing it is much stronger than most. Various projects building on Polkadot have hit the headlines in recent weeks, illustrating the rapid progress they’re making, and accelerating the overall growth of its network.

On February 1, the prediction market Zeitgeist announced the launch of its Dynamic Logarithmic Market Scoring Rule, or DLMSR. It was said to be a milestone achievement for the nascent blockchain predictions market, introducing a novel and dynamic liquidity model. The DLMSR model is truly a first-of-its-kind and enables the creation of more flexible and liquid markets with increased operational efficiency, reduced slippage, and increased trading efficiency and profitability, especially for bigger trades.

Just eight days later, Zeitgeist revealed it is integrating the popular stablecoin USDC via Polkadot’s cross-consensus messaging (XCM) protocol. It paves the way for streamlined USDC transactions between Parachains HydraDX and Moonbeam to wallets on Zeitgeist.

Elsewhere in the Polkadot community, the Web3 Foundation said on Feb. 9 that it’s providing significant funding support to Ideal Labs, creator of the Encryption to the Future network. The funding comes via the Foundation’s Decentralized Futures Funding Program, which has amassed $20 million and 5M DOT (worth around $51.4 million) to back various Polkadot initiatives. The ETF Network is based on Substrate, the primary blockchain SDK used by developers to create Polkadot parachains, and is focused on developing publicly verifiable on-chain randomness and timelock encryption to address the problem of secure, delayed transactions.

Finally, Polkadot’s canary network Kusama announced on Feb. 26 that it has activated a new consensus mechanism known as “Beefy” to enable the seamless verification of transactions on Ethereum and EVM-compatible blockchains. Beefy introduces two new bridges, including Snowbridge, which connects Kusama to Ethereum to facilitate transactions between the two chains, and Hyperbridge, which provides interoperability between Kusama and the various Layer-2 networks trying to solve Ethereum’s scalability questions.

Hyper-Decentralization Supercharges Polkadot

Polkadot’s encouraging growth underscores the wisdom of its decision to embrace decentralization and community-led governance. By embracing community-based business development and marketing, the project has created opportunities for a much broader selection of agents to propose actions and seek funding for their projects. In turn, this encourages greater community engagement, allowing every Polkadot community member to participate in the decisions that shape the future of its network. If Polkadot can keep up its rapid pace of growth, it could well encourage more blockchain networks to follow its approach.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.