POLY Price Prediction 2023-2032

- POLY Price Prediction 2023 – up to $0.20

- POLY Price Prediction 2026 – up to $0.65

- POLY Price Prediction 2029 – up to $2.07

- POLY Price Prediction 2032 – up to $6.59

Polymath makes simpler the legal procedure for producing and selling security tokens. This blockchain network establishes the ST20 as a new token standard and mandates governmental compliance. Token issuers may only keep ST20 tokens in a “list of allowed investors and their Ethereum wallet addresses.” As a result, they are not concerned about the legal repercussions of their asset ending up in the wrong hands. In this POLY price prediction, let’s look at the basis for considering crypto an excellent investment.

Picking a good coin to invest in could be pretty daunting unless you have a reputable source like this POLY Price Prediction. Regulators (SEC, Finra, govt) want nothing more than full transparency in the investment world. POLYMATH BRINGS THAT! That is an extremely important factor in token growth and will flip the scripts from IPO’s to STO’s.

As a blockchain-based supplier of trading and management services for digital securities, Polymath (POLY) is in business. The platform uses a safe Ethereum token standard to facilitate the tokenization of conventional assets. In order to satisfy the requirements of custodians, broker-dealers, law firms, and other elite investment service providers, the protocol includes a variety of characteristics. Notably, the term “Polymath” refers to a person having a wide range of competence.

The Polymath platform was the industry’s first public, authorized blockchain designed for regulated securities. This all-encompassing ecosystem’s self-serve token production and administration tools empower businesses.

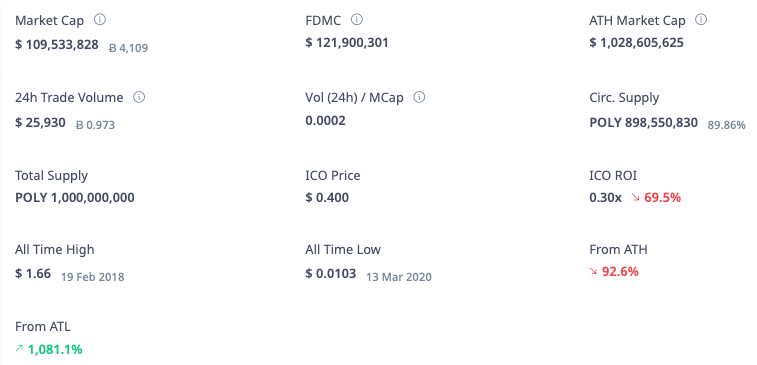

How much is POLY worth?

Today’s Polymath price is $0.1234 with a 24-hour trading volume of $26,252. Polymath is up 4.57% in the last 24 hours. The current CoinMarketCap ranking is #238, with a live market cap of $114,184,142 USD. It has a circulating supply of 924,998,413 POLY coins and the max. supply is not available.

POLY Price Analysis: Critical Juncture as Key Indicators Signal Opportunity and Risk

TL;DR Breakdown

- POLY nears crucial resistance at $0.1235

- Short term analysis shows increased selling pressure

- Fibonacci indicators suggest potential growth

POLY price analysis on a daily timeframe: Key Resistance and Support Levels in Focus

The 1-day price chart for POLY indicates a pivotal moment as the token approaches a critical resistance level at $0.1235. A successful breach above this resistance could trigger a bullish momentum, potentially driving the token to new highs of $0.1262. Conversely, a dip below the established support at $0.1195 would validate a near-term bearish outlook.

The Relative Strength Index (RSI) is at 44.34, signaling a currently neutral trend. Meanwhile, the Moving Average Convergence Divergence (MACD) displays a minor bullish crossover on the daily chart, suggesting the possibility of an upcoming price surge for POLY.

Polymath Coin price analysis on the 4-hour chart: Decisive Moment for Potential Bullish Turnaround Looms

The Moving Average Convergence Divergence (MACD) has recently transitioned into negative territory, signaling a rise in selling pressure for POLY. Concurrently, the Ichimoku Cloud presents a bearish outlook as the Conversion Line (Tenkan-sen) has crossed below the Base Line (Kijun-sen), and Leading Span A is positioned beneath Leading Span B.

From a Fibonacci perspective, POLY has found substantial support at the 61.8% retracement level of $0.1258 and additional support at $0.1201. This confluence of support levels suggests a potential for upcoming price appreciation. However, a critical resistance point lies at the 78.6% Fibonacci level of $0.1235. A breakthrough of this resistance is essential for initiating a bullish trajectory.

Final Thoughts

In summary, POLY is at a critical point, with technical indicators showing mixed signals across different timeframes. A breach of the key resistance at $0.1235 could set the stage for a bullish trend, while failure to break could indicate bearish potential. Given these conditions, investors should closely monitor the $0.1235 resistance level and make trading decisions accordingly. Exercise caution and consider setting stop-loss or take-profit orders to manage risk.

Recent News/Opinion on Polymath Network

Exciting Announcement: Partnership Between @RE_Tokens and Polymath Network Set To Transform Real Estate Investment Through Tokenization!

https://x.com/PolymathNetwork/status/1702705186987233698?s=20

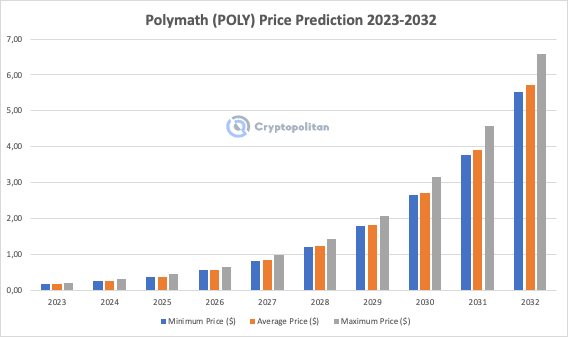

POLY Price Predictions by Cryptopolitan

According to a recent Polymath price analysis, the price of Poly is expected to see some positive price movement if the market sentiment shifts in favor of the bulls.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 0.17 | 0.18 | 0.20 |

| 2024 | 0.26 | 0.26 | 0.30 |

| 2025 | 0.37 | 0.38 | 0.44 |

| 2026 | 0.56 | 0.57 | 0.65 |

| 2027 | 0.81 | 0.83 | 0.97 |

| 2028 | 1.19 | 1.24 | 1.43 |

| 2029 | 1.78 | 1.83 | 2.07 |

| 2030 | 2.64 | 2.71 | 3.15 |

| 2031 | 3.77 | 3.90 | 4.58 |

| 2032 | 5.53 | 5.72 | 6.59 |

Polymath Price Prediction 2023

The POLY price is expected to reach a maximum value of $0.20 and a minimum trading value of $0.17, with an average price of $0.18 in 2023.

Polymath Price Prediction 2024

Our forecast for 2024 suggests that the Polymath POLY price could reach a maximum of $0.30 and a minimum value of $0.26. The average trading price is expected to be $0.26.

Polymath Price Prediction 2025

According to our findings for 2025, the POLY price could reach a maximum value of $0.44 and a minimum of $0.37. The altcoin is expected to trade at an average price of $0.38.

Polymath Price Prediction 2026

For the year 2026, the POLY price might potentially attain a maximum of $0.65 and a minimum of $0.56. The altcoin is expected to trade at an average price of $0.57.

Polymath POLY Price Prediction 2027

Based on our forecast for 2027, the Polymath POLY price could reach a maximum of $0.97, with the minimum expected to be $0.81. The average forecast price is expected to be $0.83.

Polymath POLY Price Prediction 2028

Our Polymath price forecast for 2028 indicates that POLY could reach a maximum value of $1.43 and a minimum value of $1.19. The predicted average trading price for the token is $1.24.

Polymath POLY Price Prediction 2028

Our Polymath price forecast for 2028 indicates that POLY could reach a maximum value of $1.43 and a minimum value of $1.19. The predicted average trading price for the token is $1.24.

Polymath POLY Price Prediction 2029

For 2029, our POLY price forecast shows a continuation of price rise. The POLY price could reach a maximum of $2.07, and the minimum price value would be $1.78. The average forecast price is expected to be $1.83.

Polymath POLY Price Prediction 2030

Our forecast for 2030 suggests that the price of Polymath will reach higher levels during the year. POLY could reach a maximum value of $3.15 and a minimum trading value of $2.64, and an average price of $2.71.

Polymath Price Prediction 2031

The POLY price prediction for 2031 suggests that the token will reach a maximum of $4.58 and a minimum value of $3.77. The average trading price is expected to be $3.90.

Polymath POLY Price Prediction 2032

The Polymath POLY price prediction for 2032 suggests that the token will reach a minimum value of $5.53. The POLY price can reach a maximum price value of $6.59, with an average trading value of $5.72.

The price predictions are positive in the long term. However, the incredibly low trading volumes of POLY token is something to look out for. As a potential investor, it is essential to conduct extensive research before investing in any cryptocurrency.

POLY Price Prediction by Wallet Investor

Wallet Investor’s bearish outlook suggests that Polymath’s POLY token could face a precipitous decline of approximately 91.34% within the next year, dropping from its current level of $0.123 to a mere $0.01065. This substantial decrease, if it were to come to pass, would represent a severe contraction in the token’s market value.

POLY Price Prediction by Digitalcoinprice

Digitalcoinprice forecasts a steadily ascending trajectory for the Polymath (POLY) token from 2023 to 2032. Initial growth is anticipated between 2023 and 2025, with the token’s price expected to rise from a minimum of $0.11 to a maximum of $0.44. The market appears to stabilize during 2026-2028, with both 2026 and 2027 showing consistent prices ranging from $0.47 to $0.56. Following this stabilization, accelerated growth is expected from 2029 to 2031, reaching a maximum price of $1.76 by 2031. By 2032, the token is forecasted to hit a minimum of $2.31, signaling substantial long-term growth.

POLY Price Prediction by Coincodex

According to Coincodex’s price predictions for Polymath (POLY), the token is expected to experience varying trends in both the short and long term. In the short-term, POLY is anticipated to appreciate, reaching $0.132183 in a 5-day prediction, $0.210921 in a one-month outlook, and peaking at $0.270976 over a three-month period. Interestingly, a dip is expected in the 6-month forecast, with the price falling to $0.148618. The 1-year prediction suggests a significant rebound to $0.413947. However, the long-term predictions for 2025 and 2030 suggest a bearish outlook, with prices decreasing to $0.150363 and $0.112322, respectively.

POLY Overview

The “Ethereum of security tokens” is Polymath. It is a platform for issuing tokens that offer the technical foundation and the resources needed to generate tokenized equities. On the blockchain, businesses may distribute security tokens to investors.

But not everybody should use it. Before using the platform, investors must successfully pass all legal compliance requirements, including identity verification and anti-money laundering procedures.

The ST-20 token standard is used by Polymath, a platform for security tokens, to guarantee that issuing digital assets complies with legal requirements. Similar to Ethereum, Polymath offers equity in businesses, a model with a well-established regulatory framework, as opposed to utility tokens like an ICO platform. In order to maintain regulatory compliance with securities laws, Polymath works on KYC, AML, and other legalities.

In 2017 and 2018, ICOs were criticized by government authorities all around the world.

The ensuing ownership share in the firm is what distinguishes an ICO (initial coin offering) from an STO (securities token offering). As their networks, foundations, and tokens are used interchangeably and the real distinctions between them are muddled, early blockchain initiatives face risks that are well illustrated by Ripple Labs’ attempt to distance itself from the XRP token and the legal issues surrounding Tezos.

POLY Price History

Proof of Stake is how POLY is generated (PorS). The ST-20 token standard was developed by Polymath, however, it is staked using POLY, an ERC-20 token on the Ethereum network. As a result, even while Polymath facilitates the sale of securities, its own native token is only a utility token. The Securities and Exchange Commission actually registered The Polymath ICO, making it the first ICO to properly adhere to SEC regulations. During a private token sale to approved investors, more than $59 million was raised. Polymath paved the way for everyone else in crypto to follow after it gained entry.

Token airdrops of 240,000,000 POLY were distributed to Polymath users who signed up by January 10, 2018. The initial group kept the remaining supplies. You cannot mine for POLY. Similar to how ETH powers Ethereum transactions, POLY powers Polymath network transactions.

Every day, POLY is exchanged for more than $4 million. Numerous cryptocurrency exchanges, including as CoinZest, Upbit, Binance, Bittrex, Huobi, and LATOKEN, support it. Trading pairings for POLY include those for ETH, BTC, and fiat money like KRW. POLY is supported by all ERC-20 compliant wallets, including MyEtherWallet and the hardware wallets from Ledger because it is an ERC-20 utility coin.

Since the outset of 2023, Polymath (POLY) has showcased a volatile price trajectory. Starting the year at $0.141, the token experienced bullish momentum, reaching peaks of $0.204 in late February and $0.228 in April. However, a bearish phase followed, causing a significant dip to $0.0996 by June 15. A subsequent rebound saw POLY surge to $0.196 on August 1, although this was short-lived, with the price receding to $0.177 by August 23. As of now, POLY is trading within a range of $0.12 to $0.13.

More on Polymath Network

Who created Polymath?

Trevor Koverko and Chris Housser, two Canadians, are the creators of Polymath. Before making the switch to bitcoin in 2015, Koverko had previously worked for a number of fintech startups. Housser worked as an associate in financial and employment law in Toronto for four years.

Koverko was a talented hockey player long before Polymath. He even participated in international events after being selected by the New York Rangers hockey team. Housser had served as a military instructor in Canada.

How does POLY work?

Smart contracts

Investors wishing to purchase stock escrow their cash. Before tokens and money are delivered via the auto-fulfilling contract, both the issuer and the investor must meet all conditions.

Identification

Before investing in STOs, investors must verify their identity and place of residence. Additionally, they must be accredited, investors. For each token sale, participants will need to be whitelisted. Access to one sale’s whitelist does not guarantee access to another.

Significant Features of POLY

Regulatory assurance

Sales of security tokens must adhere to US financial regulations, which are among the tightest in the world. Issuers can utilize the platform to submit the necessary legal paperwork and register the sale with the SEC. Before investing in sales, investors must first pass AML/KYC checks.

The platform was intended to be easily accessible. It doesn’t call for any expertise in blockchain technology. As a result, businesses may concentrate on selling equity. Even issuers can utilize the “wizard” program, which can quickly construct working security.

No middleman

Traditional security sales include a long and intricate supply chain. Companies that use Polymath are able to offer equity to investors directly. This expedites the procedure and lowers overhead expenses.

A standard

Polymath created the ST-20 token standard, which is a standard. It implies that securities that are launched on the platform are technologically comparable to one another and may communicate with one another, much like the ERC-20 standard.

What Problems Does Polymath (POLY) Attempt to Fix?

The network’s designers at Polymath focused on a number of issues when building it. One benefit of the platform is that it aids in addressing the flaws in the ERC-20 token standard. For cryptocurrencies and utility tokens, ERC-20 tokens are the best choice. They don’t, however, have the regulatory requirements for carrying out security token transactions.

These issues are resolved by Polymath with the advent of the ERC1400 standard. Notably, Polymath spearheaded and fought for the adoption of this standard. The fundamental mechanisms of this new token standard incorporate regulatory compliance.

With the help of Polymath’s modular design and token standard, users may create unique services to satisfy regional regulatory needs. The management of securities may have additional obligations. You may, for instance, incorporate transfer specifications or the capacity to protect UBO rights for assets held in custody.

New Business Onboarding/Integration

Roadblocks to blockchain adoption and integration are one of the main issues that Polymath intends to address. The network achieves this goal by introducing a patented technology-and-unique infrastructure mix that boosts productivity.

Benefits of POLY

With so many advantages available to consumers, Polymath is the best option for anyone looking for security token protocols. Polymath is safe, for starters. The network has never been compromised, and its open-source code has been examined and approved by several organizations.

White Label Solutions

Users of Polymath have the opportunity to offer their customers the network’s services under a white label. With this strategy, brokers and other service providers may supply the market with an all-inclusive security token solution. Users don’t need to engage expensive engineers or learn new coding to generate, issue, and manage their tokens.

A significant competitive advantage is the process’s capacity to be branded and personalized. It makes it simple for brokers and dealers to include Polymath’s solutions in their list of services. Additionally, it enhances the complexity of the Polymath ecosystem.

Automation

For several reasons, Polymath is the best platform for issuing security tokens. Users can bring up regulatory requirements using the system throughout the token generation process. Then, these conditions are automatically followed. You may, for instance, provide regional legal specifications like location-based authorization or KYC authorization.

These requirements must be satisfied before any Polymath tokens may be transferred. The best part is that the tokens maintain regulatory compliance over their entire life cycle since these criteria are built into the network’s basic smart contracts. By doing away with the requirement for third-party monitoring services, this tactic lowers costs and increases effectiveness.

Conclusion

For several reasons, Polymath is gaining ground steadily. The protocol continues to be a market innovator, for starters. The system has become well-known as a result of its prior work organizing and promoting the adoption of the ERC1400 token standard as well as its general push to enhance the security token market.

The Polymesh mainnet’s recent deployment also alters the rules of the game. Users of Polymath now benefit from decreased prices and a more responsive user interface. It is simple to understand why more investors keep moving to the Polymath ecosystem when you consider these qualities along with the network’s established track record and development potential.

Polymath has shown it still has some life in it despite having lain inactive for a while. In September 2021, it succeeded in crossing the $1 threshold for the first time since 2018. Currently trading above $0.1, there might something in there for investors should the general market rebound. A cryptocurrency’s price prediction, however, does not always predict its future value, so always conduct your own research before investing. Whether or not Polymath is a good investment is totally subjective, we advise you to seek professional investment advice.