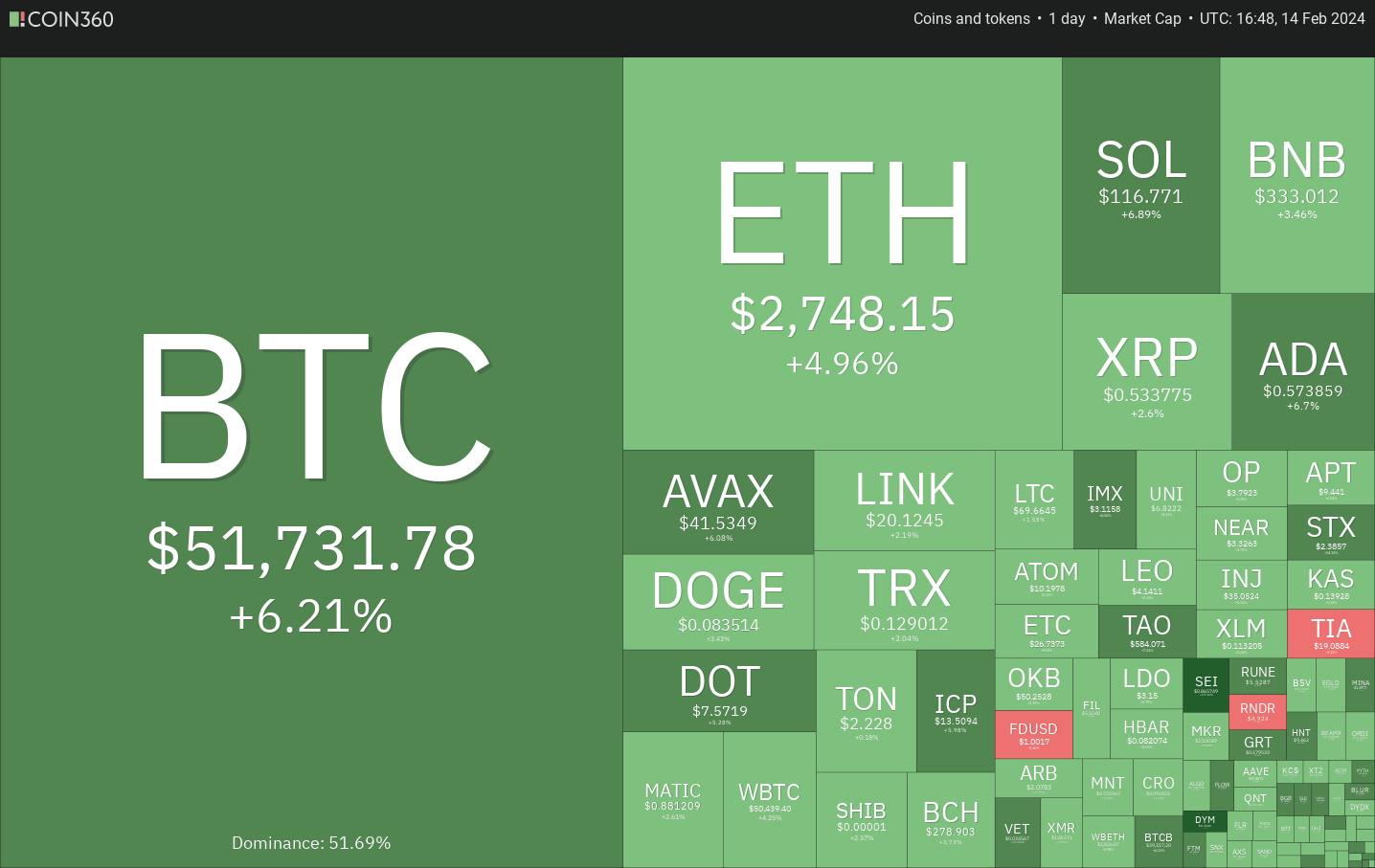

Bitcoin price continues to march higher, fueled by robust demand from the spot Bitcoin ETFs. Which altcoins could follow BTC's bullish price action?

Bitcoin’s (BTC) market capitalization reached $1 trillion on Feb. 14, buoyed by the strong demand from the newly launched spot Bitcoin exchange-traded funds. Data shows the ETFs recorded more than $600 million in inflows on Feb. 13 alone.

Bitcoin ETFs bought 10 times more Bitcoin than what miners produced on Feb. 12. Pomp Investments founder Anthony Pompliano said in an interview with CNBC that roughly $200 billion in Bitcoin is tradable as 80% of the total supply has been dormant. Pomp added that the Bitcoin ETFs have devoured 5% of Bitcoin’s entire tradeable supply within 30 days of their launch.

The sharp rally in Bitcoin sent the Crypto Fear and Greed Index score to 79 on Feb. 13, showing “extreme greed.” The last time the index entered the “extreme greed” zone was in mid-November 2021 when Bitcoin reached the all-time high of $69,000. During strong bull phases, the sentiment may remain in the extreme greed zone for an extended period, but the higher the price goes, the greater the risk of a correction.