Rising inflows into the spot Bitcoin ETFs have improved investors' sentiment toward the crypto market and could a factor in BTC price and altcoins moving higher.

Bitcoin (BTC) is on the move, and the exchange-traded funds (ETFs) investors are cheering the rise by buying more. The spot Bitcoin ETFs witnessed their third largest inflows on Feb. 8, totaling $403 million. This brings the total inflows into the ETFs to more than $2.1 billion since the launch on Jan. 11.

BlackRock and Fidelity’s spot Bitcoin ETFs have each amassed more than $3 billion in assets under management. Comparing the first-month performance of all ETF launches in the past 30 years, Bloomberg ETF analyst Eric Balchunas said in a Feb. 8 post on X (formerly Twitter) that BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) are in “league of own,” occupying the top two spots by a wide margin.

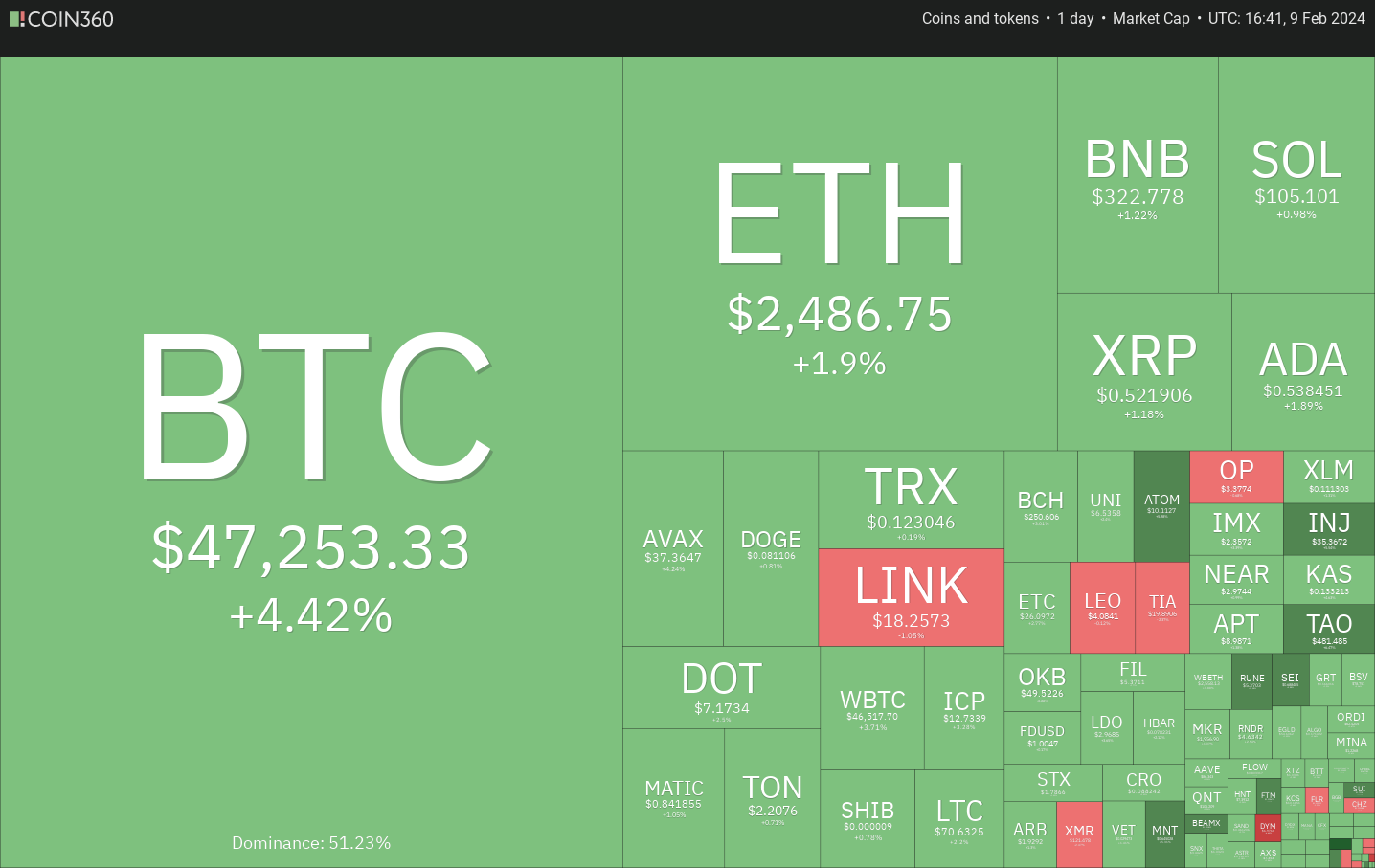

The bullish move is not limited to Bitcoin alone, as select altcoins have also started to move up, breaking above their respective overhead resistance levels. This indicates that the sentiment is improving in the entire crypto space.