Bitcoin bulls are trying to protect the $65,500 level, but if they fail, a drop to $62,000 is possible.

Crypto exchange Kraken said in a July 24 X post that it had distributed all the funds to the Mt. Gox creditors. However, that has not boosted Bitcoin’s (BTC) volatility, suggesting that the recipients of the repayments are not rushing to book profits as anticipated by a few analysts.

Similarly, the launch of spot Ether (ETH) exchange-traded funds (ETFs) failed to start any fireworks in Ether, suggesting that the markets are in a wait-and-watch mode. A minor positive is that the Ether ETFs witnessed net inflows of $106.6 million on the first day, even after $485 million in outflows from Grayscale’s freshly converted Ethereum Trust.

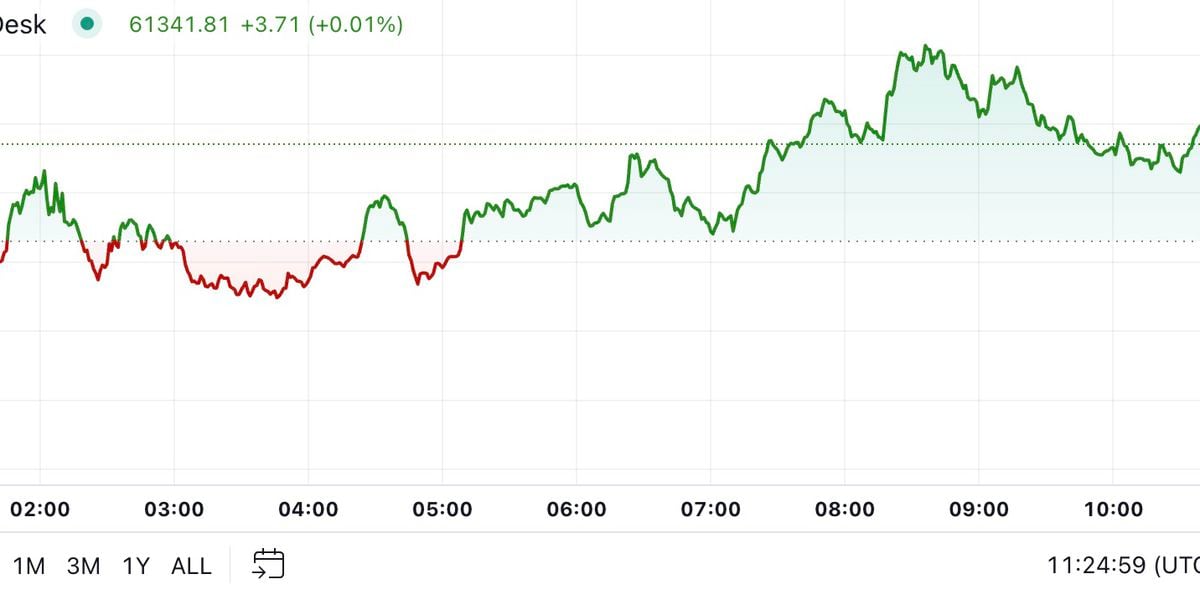

Bitcoin and select major altcoins have been consolidating for some time, indicating indecision between the bulls and the bears about the next directional move. The longer the range, the stronger the trigger needed for the price to break out from it.