Pump.fun continues to print fees, on a new inflow of meme creation. Token fatigue has not hurt the bottom line of the platform, despite the 99% failure rate.

Pump.fun continues to generate record revenues, by providing starting liquidity and an easy token launch. Briefly, Pump.fun surpassed all other apps and protocols, measuring peak 24-hour revenues. The meme token DEX and launchpad even surpassed Ethereum (ETH) and TRON (TRX), two of the biggest activity hubs in crypto.

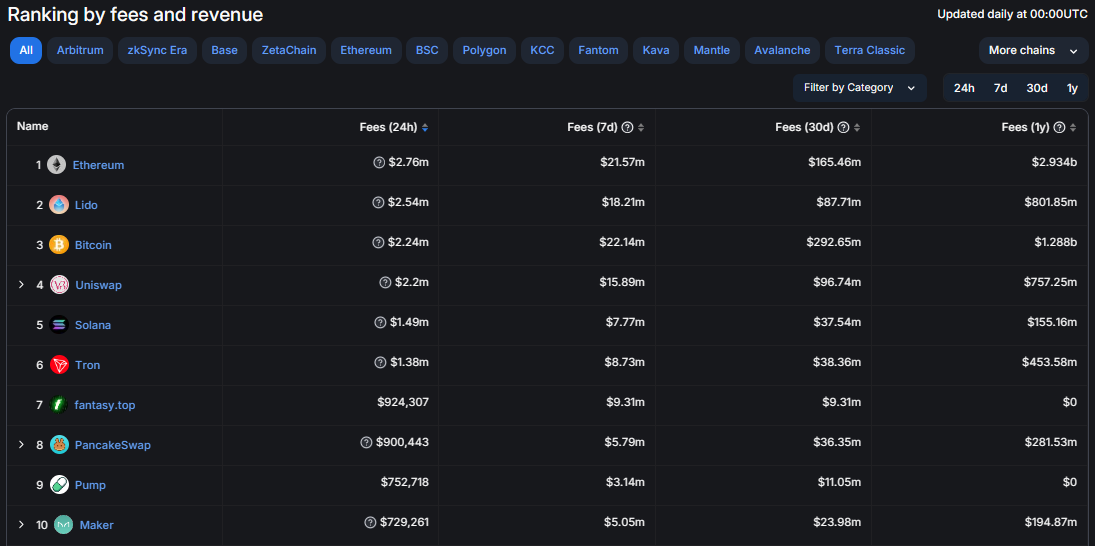

Pump.fun is also close to the top in terms of weekly and monthly fees, competing not only with Solana apps, but with the entire crypto ecosystem. The meme coin launcher achieved unified liquidity and a single entry point, while helping onboard new crypto users. Both new and returning users expanded in August, and were completely unaffected by the correction on centralized crypto markets.

The creation of tokens on Pump.fun also overcame other types of Solana launches, with a constant rate of growth in the past few months. As of August 14, more than 67% of Solana tokens were made through Pump.fun, for a total lifetime mints of 1.76M tokens.

BREAKING: @pumpdotfun 24H REVENUE IS HIGHER THAN THOSE OF THE REMAINING TOP 20 PROTOCOLS COMBINED pic.twitter.com/Ce12zu2GYP

— DEGEN NEWS (@DegenerateNews) August 14, 2024

Tracking fees among crypto protocols is inexact, as LidoDAO marks the biggest fee flows due to redistribution. However, Pump.fun is the only protocol that gets as close as possible to onboarding real users. On a monthly basis, Pump.fun generates close to $30M in launch and trading fees.

While Pump.fun remains an extremely risky bet, it is also seen as the fastest way to test new tokens and make up for the losses with one winner. The need for fast and competitive transactions, as well as the mint fees, turn Pump.fun into a source of income for other apps and validators in the Solana ecosystem.

The effects of Pump.fun also spill over into Raydium and Jupiter DEX aggregator, as well as into MEV bot fees for additional meme token trading.

Pump.fun decouples from the meme token narrative

Despite being the main launchpad for meme tokens, Pump.fun has decoupled from all previous successful token launches. Large-scale meme tokens that graduated to top centralized exchanges are also suffering as the market slides. At the same time, users on Pump.fun are aware that most of the assets will fail within 24 hours, but choose those assets precisely because of their risk profile.

During the peak days of Pump.fun, older meme tokens took a step back, losing $12B in market capitalization in the past two weeks. Older meme tokens also suffer from cannibalizing each other, as funds flow into the most active one, while causing rapid selling and crashes.

Pump.fun is extremely responsive to social media, especially X. The speed of launching new tokens accelerates with current events. The recent X Spaces talks with Elon Musk led to the creation of more than 157K new tokens, of which only two survived. The tokens are created with practically no hope of finding liquidity, except for the element of having fun.

The launches of new coins accelerated in the past week, after Pump.fun introduced a new way of interacting with the protocol. Launches are free, but the new asset is not created on the Solana chain until at least one buyer appears. This has allowed multiple creators to build tokens without even the smallest initial investment. Tokens that survive the initial trading also receive 0.5 SOL in liquidity to trade on Raydium.

Pump.fun competitors are slow to arrive

One of the high-profile competitors to Pump.fun was Moonshot, a protocol with more detailed information on the progress of tokens.

Moonshot was also promoted by Dextools and started to invite listings. However, the fees and activity on Moonshot are still lagging and even slowing down about a month after the platform’s launch.

Despite social media rumors and promotions of new projects, Pump.fun had no close competitors. Trading also concentrated on the new tokens, in hope of finding the winner or achieving short-term gains. Pump.fun is also seen as a liquidity drainer, as users move away from other crypto influencers with complex, slow token launches.

Cryptopolitan reporting by Hristina Vasileva