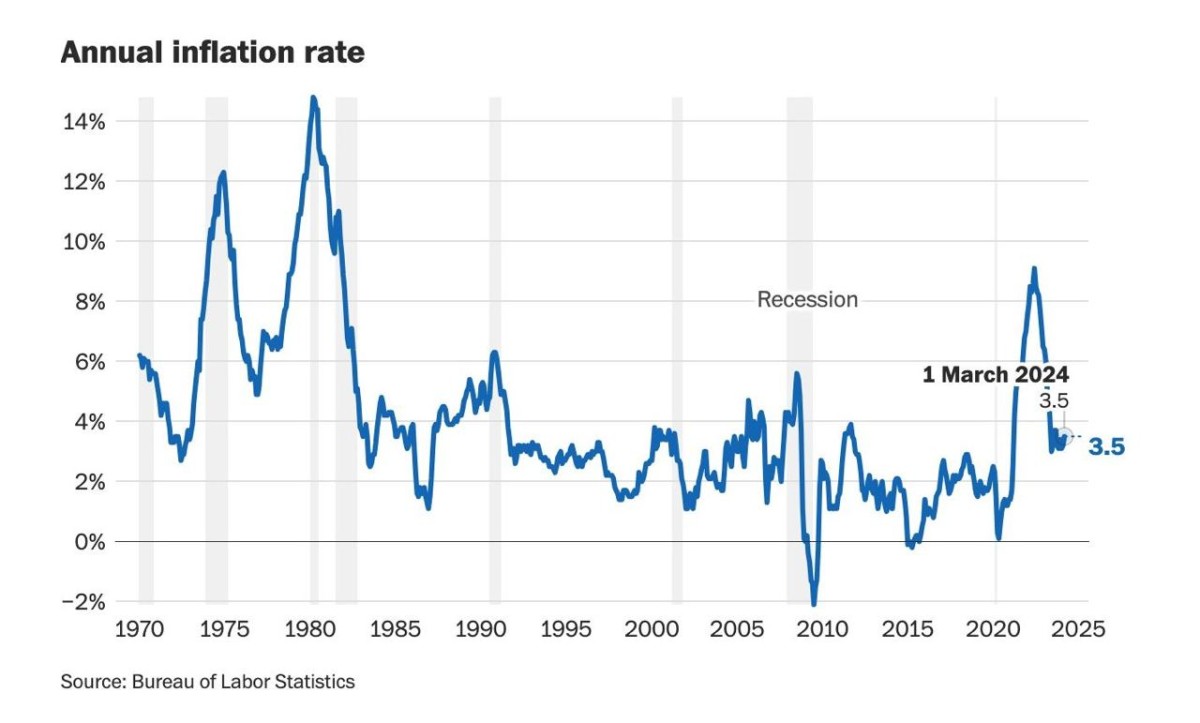

The U.S. economy just got a lot more interesting, and not in a good way for those hoping for a breather from high interest rates. President Joe Biden recently revealed to us that the unwelcome guest at our party—March’s inflation—decided to stick around a bit longer and, worse, put on some weight, climbing to 3.5%. This uptick is a signal that might just keep the Federal Reserve’s scissors away from the interest rate thread this year.

Now, getting straight into the chaos, Biden, although not privy to the Central Bank’s playbook, hinted at rate cuts down the line within the year.

BUT, Jerome Powell, the Fed Chair, had been more optimistic, teasing the possibility of three rate reductions before 2024 waves goodbye. The U.S. has been wrestling with inflation, attempting to pin it down to a comfy 2% with a strategy that now seems like trying to lasso a cloud.

High inflation has been haunting the U.S., threatening to derail plans for easing interest rates. Initially, there was a glimmer of hope with Powell’s suggestion. However, that hope is now uncertain as recent data shows inflation refusing to play nice and decline as it had started to in previous months.

This stubbornness has everyone on their toes, waiting for Powell’s direction in light of March’s figures.

The financial markets have already shown signs of seasickness. Traders, once buoyant about rate cuts as soon as June, have had to adjust their sails. The unexpected inflation rise has been like a storm, pushing the possibility of rate cuts further out into the horizon.

This was felt deeply in the bond market, with yields leaping up, and the stock market taking a dive in response to the inflation data and Biden’s acknowledgment that there’s still much to tackle in the inflation arena.

It seems like every piece of economic data lately is just adding fuel to the fire of uncertainty. With inflation running hotter than expected, the dreams of easing rates have kinda died. Even the once almost certain rate cut in July is now seen through a lens of 50/50 chance post-Wednesday’s revelations. Market bets have become more cautious, not expecting a clear cut until possibly after the November elections.

The reactions across the financial board reflect a concern that the Fed’s strategy might need a rethink. Economists and traders alike are adjusting their expectations, considering the possibility that the next move might not be a cut but a hike.

As we stand, the Fed’s dot plot, that little map of future rate expectations, shows a consensus on three cuts. Yet, voices from within the Fed express a growing unease with inflation’s stickiness. Despite their efforts, achieving that 2% target is proving more arduous than anticipated.