- Bithumb listed Redstone (RED) and Nillion (NIL), sparking a 16% surge for RED and a 16% drop for NIL.

- RED hit $0.68 while NIL fell to $0.75.

- Trading volumes for both tokens have, however, soared—RED up 142% and NIL up 4,400%.

Bithumb has introduced KRW trading pairs for RedStone (RED) and Nillion (NIL), causing significant price fluctuations for both tokens as South Korea’s leading cryptocurrency exchange opened its market to these emerging assets.

New Listing

닐리온(#NIL) 원화 마켓 추가 안내

$NIL/KRW will be listed on #bithumb!

Details : https://t.co/FmkxXoDE1M #bithumb #NIL @nillionnetwork pic.twitter.com/wrugA2jFKo

— Bithumb (@BithumbOfficial) March 25, 2025

The listings sparked immediate reactions in the crypto sphere, with RedStone (RED) surging upward and Nillion (NIL) facing a sharp decline.

RedStone (RED) and Nillion (NIL) live on Bithumb

Trading for RED kicked off at 4:00 PM KST with a base price of 892 KRW (approximately $0.68), while NIL followed at 7:00 PM KST with a starting price of 1,044 KRW (around $0.75).

Within hours, RED climbed over 16%, reaching $0.68-$0.6851 according to various sources, buoyed by enthusiasm for its role in decentralized data solutions.

Meanwhile, NIL plummeted nearly 16%, settling around $0.7567-$0.75 after an initial dip, reflecting a more turbulent reception.

These opposing trajectories highlight the unpredictable nature of crypto markets when new trading avenues emerge.

RedStone rides the wave of optimism

RedStone, the native token of RedStone Oracles, has capitalized on its listing to cement its growing reputation. The platform provides cost-effective, customizable data feeds for decentralized applications (dApps) and Layer 2 scaling solutions compatible with both Ethereum Virtual Machine (EVM) and non-EVM blockchains.

Launched in February 2025, RED has already seen a 65% rise over the past month, further boosted by its inclusion as the 64th project on Binance’s Launchpool.

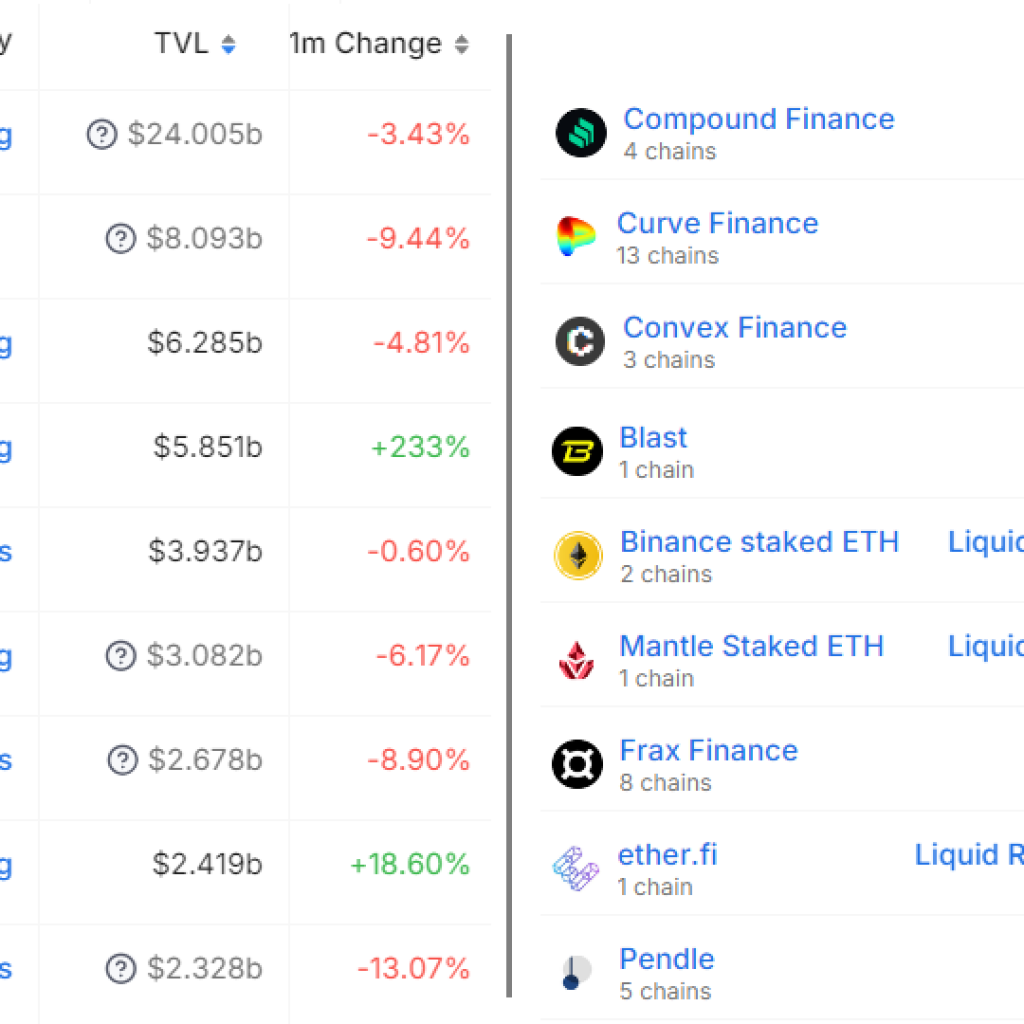

On Bithumb, the token’s market cap hovers between $177.56 million and $192.29 million, with 24-hour trading volume soaring by 142% ($63.89 million) to a hefty $139.95 million.

With a circulating supply of 280 million out of a total of 1 billion tokens, RED’s upward momentum reflects strong community and investor support.

The listing specifics on Bithumb add another layer to RED’s appeal. Deposits and withdrawals, supported solely on the Ethereum network, require 33 confirmations, ensuring security for traders.

To curb manipulation, Bithumb has imposed a five-minute ban on new buy orders at launch and capped sell orders within ±10% and ±100% of the base price.

These measures didn’t stifle RED’s ascent, as its price oscillated between a 24-hour range of $0.5847 and $0.703, still shy of its all-time high of $0.9325 from March 6 but well above its low of $0.4243 on March 11.

The token’s resilience suggests it’s riding a wave of optimism tied to its utility and exchange backing.

Nillion faces a rocky debut

In contrast, NIL’s debut on Bithumb has been a rollercoaster of a different kind.

Notably, NIL’s native blockchain, Nillion Network, which is a Layer 1 blockchain leveraging Multi-Party Computation (MPC) for enhanced security and privacy-preserving data processing promised innovation when it launched earlier in March 2025.

Backed by notable figures like BitMEX co-founder Arthur Hayes, the Nillion initially garnered attention for its focus on secure, parallelized data handling.

However, its Bithumb listing triggered a stark 16% drop, with prices dipping to $0.75-$0.7567 from its base of 1,044 KRW.

Currently, its market cap sits around $147.7 million, ranking it at position 269 among cryptocurrencies, a far cry from RED’s 199 spot.

NIL’s trading volume tells a dramatic story of its own, skyrocketing by 4,400% to $589.22 million in 24 hours, though this figure contrasts with its more subdued price performance.

Supported exclusively on the Nillion Network with 15 deposit confirmations required, NIL faced the same Bithumb safeguards as RED, yet these couldn’t prevent its downward spiral.

The token’s launch timing, just days before the listing, may have left it vulnerable to profit-taking or scepticism about liquidity, which Bithumb noted could delay its 7:00 PM KST trading start.

However, despite the setback, NIL’s underlying technology hints at the potential for recovery if market sentiment shifts.

The post Redstone (RED) and Nillion (NIL) experience wild swings following Bithumb listing appeared first on CoinJournal.