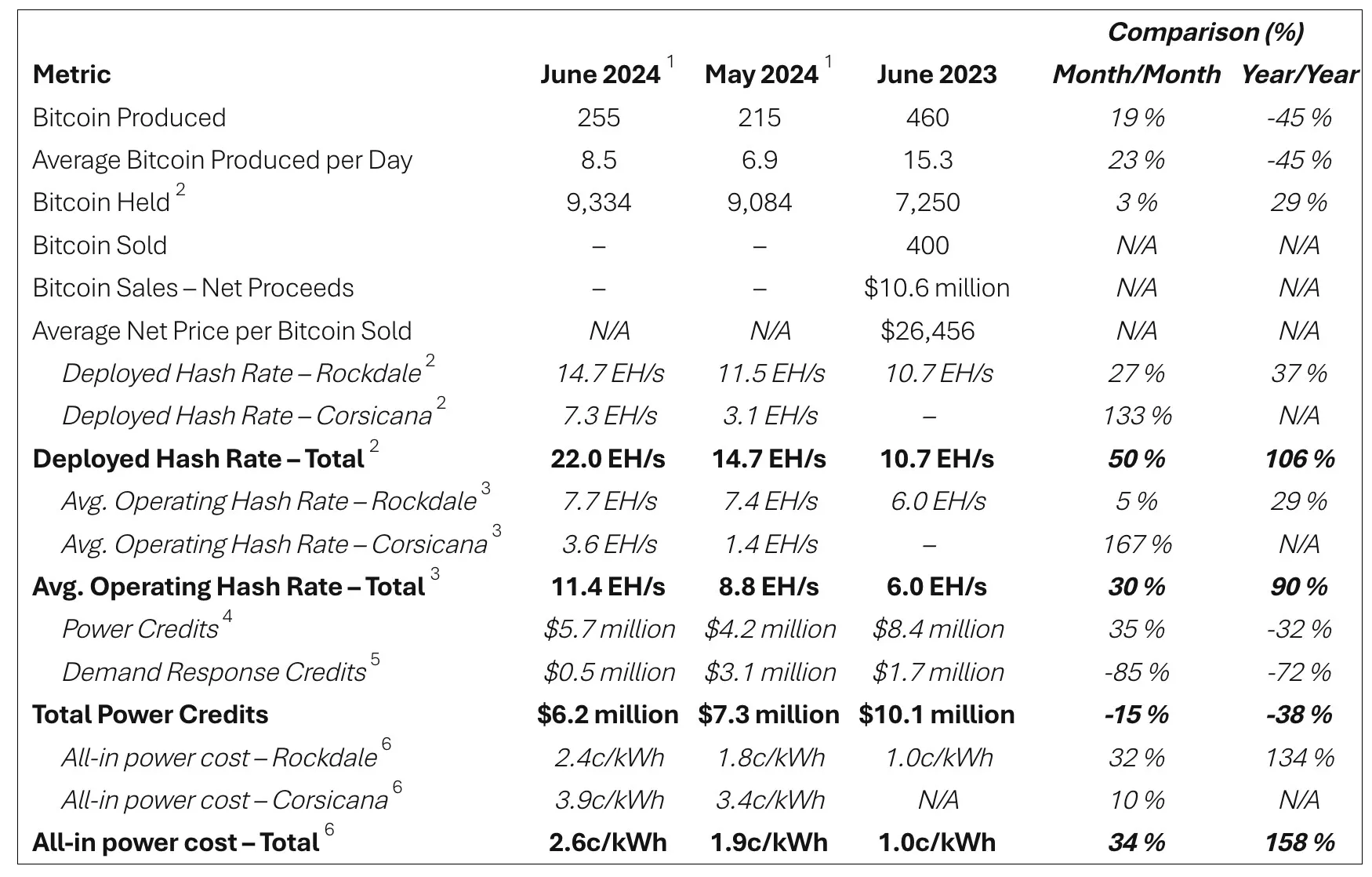

Riot Platforms, the biggest Bitcoin miner in the United States, has increased its hash rate by an astonishing 50% in one month. According to their Q2 report, Riot not only met but surpassed its hash rate target for the second quarter.

They achieved this by deploying 7.3 EH/s in June, marking the highest growth rate among all publicly traded miners in a single month. Riot’s ambitions don’t stop there. They aim to reach a total self-mining hash rate of 31 EH/s by the end of 2024.

Strategic equipment orders and deployment

In June 2023, Riot signed a long-term master purchase agreement with MicroBT. This deal included an initial order of 33,280 immersion miners for their Corsicana Facility.

By December 1st, Riot placed a second order under the same agreement for another 66,560 immersion miners, again primarily for the Corsicana Facility.

The buying spree continued in February 2024 with a third order for 31,500 air-cooled miners destined for the Rockdale Facility.

From the third order, around 17,000 miners will replace the underperforming machines currently in operation at Rockdale. The remaining 14,500 miners will boost Riot’s self-mining operations at the same facility.

Combined, these three purchase orders are expected to add an anticipated 28 EH/s to Riot’s self-mining capacity. Deployment of miners for the Corsicana Facility has already started and is projected to be completed by the second half of 2025.

Meanwhile, the deployment at the Rockdale Facility is underway and should wrap up by Q3 2024. Upon full deployment in 2025, Riot expects its self-mining hash rate to hit a whopping 41 EH/s. Jason Les, CEO of Riot, stated:-

“June was a historic month for Riot, during which we added an additional 7.3 EH/s to our hash rate capacity in Buildings A1 and A2 at our Corsicana Facility and by utilizing additional available capacity at our Rockdale Facility, bringing total capacity to 22.0 EH/s. This unprecedented achievement is a reflection of the incredible team and expertise at Riot.”

Les also announced that starting this month, Riot would provide greater visibility on the results of their unique power strategy by reporting the monthly cost of power by facility, net of power credits.

In June, Riot earned $6.2 million in power credits, lowering their net cost of power to an estimated 2.4c/kWh at the Rockdale Facility and 3.9c/kWh at the Corsicana Facility.

This combined cost of power, 2.6c/kWh across both facilities, is among the lowest in the industry. The miner’s power strategy focuses on being a flexible power consumer.

Unlike residential users who consume more power during peak periods, Riot uses power when it is cheap and abundant.

When prices spike or the grid operator needs to balance demand, Riot can either power down to cut costs or bid competitively to provide grid operators with control over their power usage.

Riot is currently developing Phase 1 of its second large-scale facility, the Corsicana Facility, which is set to total 400 megawatts (MW) of mining capacity upon completion.

When fully developed, this facility will boast 1 gigawatt (1,000 MWs) of total mining capacity.

Reporting by Jai Hamid