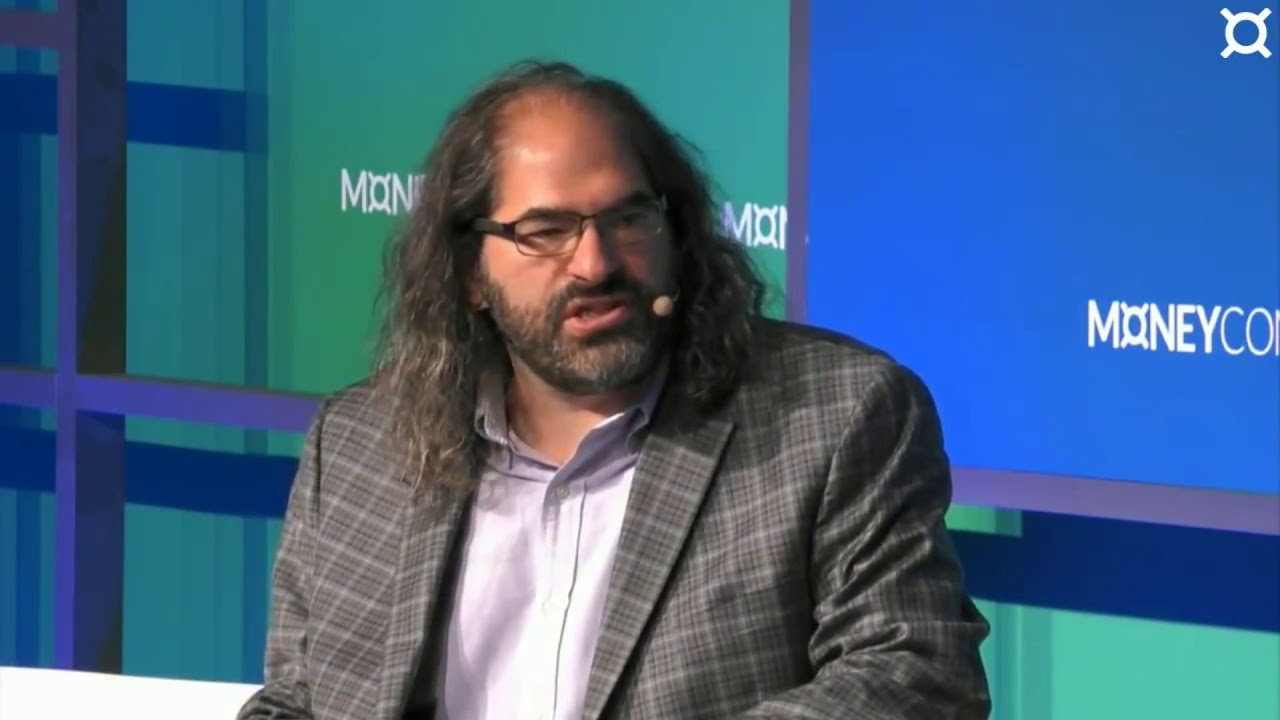

In a recent interview with Tony Edward of the Thinking Crypto Podcast, David Schwartz, the Chief Technology Officer of Ripple, shared his perspectives on the future of cryptocurrency in 2024. Schwartz outlined four key areas he eagerly anticipates developments in, including regulatory clarity, resolution of Ripple’s legal battle with the SEC, advancements in blockchain scalability, and increased institutional crypto adoption.

David Schwartz highlights blockchain scalability solutions

At the forefront of Schwartz’s list is achieving regulatory clarity for the cryptocurrency sector. The lack of clear regulations has been a longstanding issue, hindering the industry’s growth by fostering uncertainty and exposing investors to risks. Schwartz pointed out that definitive regulatory guidelines would mitigate these risks and establish a safer investment landscape by clearly delineating permitted activities.

Furthermore, he expressed optimism about the potential resolution of Ripple’s ongoing lawsuit with the Securities and Exchange Commission (SEC) within the year. The legal conflict began in December 2020 and has been a significant point of contention, with Ripple hoping for a favorable conclusion in the remedies stage by mid-2024.

Another area Schwartz is focusing on is the scalability of blockchain technology. He mentioned developers’ challenges in innovating at the blockchain layer and proposed solutions such as sidechains and zero-knowledge proofs to address these issues. These technologies, according to David Schwartz, have the potential to significantly enhance scalability and innovation directly at the blockchain’s foundational level. By improving scalability, Ripple aims to support more extensive and complex applications on its network, paving the way for broader adoption and utility of blockchain technology.

Fostering crypto ecosystem growth

David Schwartz also emphasized attracting more individuals and institutions into the crypto ecosystem. He suggested that creating compelling user experiences, such as offering access to tokenized securities and collateralized lending, could significantly increase public interest in cryptocurrency.

Furthermore, he highlighted the potential of Automated Market Makers (AMM) and decentralized identity solutions to make financial transactions more inclusive and less controversial. These initiatives are seen as crucial steps towards integrating a wider audience into the crypto market and expanding the use of digital assets beyond speculative trading.

Lastly, the Ripple CTO expressed his anticipation for a surge in institutional adoption of cryptocurrencies in 2024. Despite a recent downturn in trading volumes for Bitcoin exchange-traded funds (ETFs), David Schwartz remains optimistic about their role in attracting institutional investors. He believes these investment vehicles can play a pivotal role in mainstreaming cryptocurrency investments among larger financial entities, thereby injecting significant capital into the market and stabilizing it over the long term.