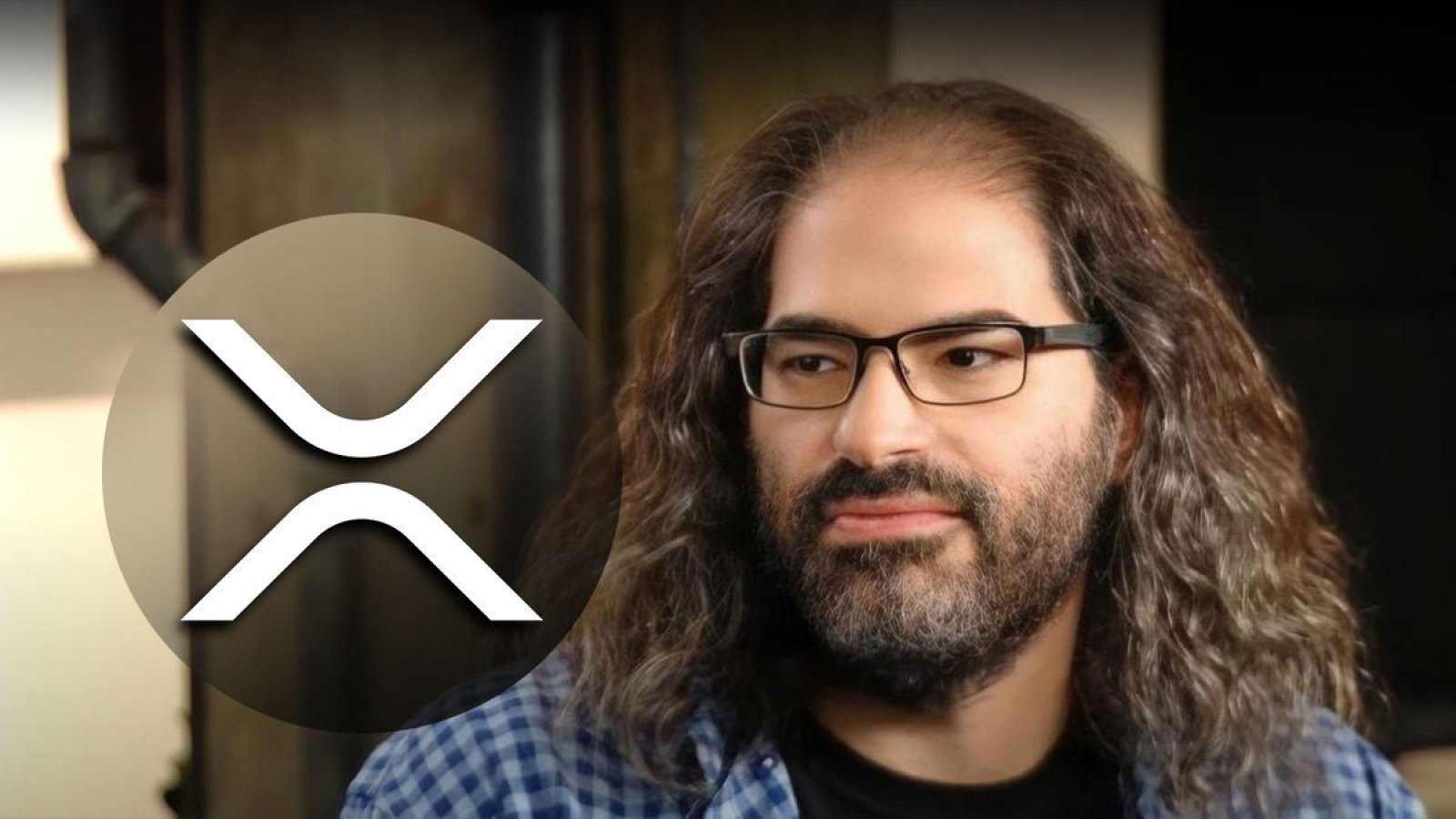

In a recent statement, Ripple’s Chief Technology Officer, David Schwartz, explained the potential burning of over 40.7 billion XRP currently held in escrow accounts. This move comes as a response to the growing inquiries and concerns from the XRP community regarding the management and influence of Ripple over the cryptocurrency’s market dynamics. Schwartz’s clarification sheds light on the technical possibilities for reducing the circulating supply of XRP, aiming to address the discontent among cryptocurrency enthusiasts.

Understanding the “blackholing” process

Schwartz introduced the concept of “blackholing” escrow accounts as a viable method for effectively removing a significant portion of XRP from potential circulation. This process involves making the escrow accounts inaccessible, thereby preventing the release of XRP into the market. The CTO’s explanation comes at a crucial time when the XRP community has been vocal about their concerns over Ripple’s periodic release of XRP from these escrows, which occurs on the first day of each month as part of the company’s market management strategy.

The mechanism of “blackholing” does not require the physical destruction of XRP tokens but rather restricts access to them, ensuring that they cannot be used or transacted with. This approach highlights Ripple’s unilateral capability to influence the supply of XRP without directly engaging in the burning of tokens. David Schwartz’s insights into this process aim to quell the unease within the community, emphasizing the company’s commitment to maintaining a balanced and stable market for XRP.

David Schwartz responds to XRP market fears

The discourse around the potential burning of XRP escrows has intensified amid broader controversies in the cryptocurrency market, including allegations of price manipulation by other entities through programmatic sales. Such developments have heightened the XRP community’s sensitivity to Ripple’s handling of the escrow accounts, with fears that these actions could adversely affect the cryptocurrency’s value and market position.

Ripple’s strategy for managing the release of XRP from escrow accounts has been a point of contention, with some community members arguing that it contributes to market saturation and potential devaluation of the cryptocurrency. However, David Schwartz’s recent statements aim to clarify the company’s intentions and operational mechanisms, providing a transparent view of Ripple’s efforts to stabilize and support the XRP market. By addressing these concerns directly, Ripple seeks to reinforce its commitment to the XRPL ecosystem’s health and the interests of XRP holders.

David Schwartz’s explanation regarding the potential for “blackholing” XRP escrow accounts marks a significant moment in Ripple’s ongoing dialogue with its community. By addressing the technical aspects and intentions behind Ripple’s escrow management, Schwartz aims to alleviate concerns and foster a deeper understanding among XRP enthusiasts. As the cryptocurrency market continues to evolve, Ripple’s proactive communication and management strategies will remain crucial in navigating the complex landscape of digital currencies.