SBI VC Trade, an affiliate of the Japanese banking conglomerate and long-term Ripple partner SBI Group, has entered into a strategic partnership with Metaplanet Inc., a Tokyo-based firm which recently gained recognition as ‘Japan’s MicroStrategy’ due to its extensive investment in Bitcoin. Announced on September 2, 2024, the partnership between SBI VC Trade and Metaplanet aims to optimize Bitcoin transactions, custody, and management with a focus on corporate clients.

SBI Supports Metaplanet With Its Bitcoin Strategy

The collaboration is part of our ongoing effort by Metaplanet to engage with leading industry stakeholders in Japan who support their corporate Bitcoin accumulation strategy. “A key element of this partnership is access to a compliant corporate custody service that prioritizes tax efficiency and offers the potential to utilize Bitcoin as collateral for financing,” the official press release by Metaplanet states.

Metaplanet has been at the forefront of using Bitcoin as a primary financial asset, especially as a hedge against the depreciating Japanese yen and the high levels of national debt. The company’s commitment to a Bitcoin-centric treasury is evident from its recent disclosure in August, where it reported holding approximately 360.368 BTC, highlighting its aggressive strategy to increase shareholder value through sustained BTC accumulation.

SBI VC Trade brings to the table a robust platform that facilitates not only the trading of cryptocurrencies but also advanced services geared towards corporate clients. These include leveraged trading, where crypto assets held by clients can be used as margins, and an innovative funding rate mechanism that aligns with market trends to replace the traditional leverage fee structures common in Japan.

One of the standout features of the partnership is the exemption service for the end-of-period mark-to-market tax on unrealized crypto gains. This feature is particularly advantageous for corporate clients as it allows them to leverage tax efficiencies while maintaining the liquidity and potential rewards from staking.

“The tax exemption service offered through our partnership is a testament to our commitment to providing a flexible and financially sound environment for managing crypto assets,” SBI remarked in their official press release.

Metaplanet added, “This aligns with our vision of a modern financial services provider and adds flexibility to our corporate strategy, complementing our ongoing efforts in equity and debt financing. As our treasury expands, we continue to evaluate various tools and strategies that could enhance our financial flexibility.”

The Ripple Link

The partnership addresses the demand for crypto management solutions that include custody and operational management, aspects that are crucial for large-scale corporate participants who are integrating digital assets into their financial portfolios.

The integration of these services underlines SBI’s broader commitment to the crypto sector which is also reflected in its long-standing collaboration with Ripple through SBI Ripple Asia. This consortium aims to harness Ripple’s blockchain technology for enhancing cross-border payment solutions across Asia, involving over 60 Japanese banks. Yoshitaka Kitao, CEO of SBI Holdings, has been a vocal advocate for the broader use of Ripple’s technology and XRP within their financial operations.

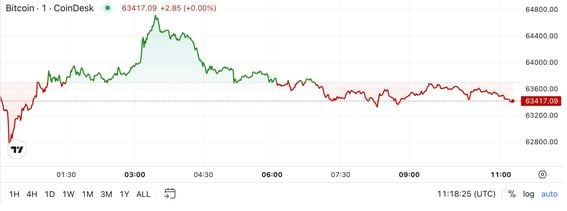

At press time, BTC traded at $58,290.