Earlier, Ripple filed a motion to have the court redact evidence related to the remedies briefing that the SEC filed on March 22. Now, the US Securities and Exchange Commission (SEC) has opposed, in part, Ripple’s motion to seal evidence from the public.

The ongoing dispute between Ripple and the US Securities and Exchange Commission (SEC) continues to escalate, devoid of any tangible progress toward a definitive resolution. Recent regulatory action involved the submission of the regulator’s reply to the company’s motion to redact and seal specific evidence about the parties’ briefing on remedies.

SEC Files Opposition to Sealing XRP Details

Ripple had previously sought that the court seal and redact the financial reports, details on post-complaint XRP institutional sales, and other proprietary information due to the substantial dangers to Ripple Labs.

According to the most recent court filing, the United States SEC has filed a response to Ripple’s application to seal and redact, opposing the move in part. The regulatory commission claims that Ripple’s request to “conceal financial and securities sales information” from the public is improper, and the material at issue, such as financial numbers and other facts, is critical to the desired remedies.

#XRPCommunity #SECGov v. #Ripple #XRP The @SECGov has filed its response to @Ripple’s Motion to Seal. pic.twitter.com/zH9XYWbSsh

— James K. Filan(@FilanLaw) May 21, 2024

It is worth noting that the Commission does not question the sealing of Ripple’s recent financial statements “as a whole.” It is not against the company’s request to seal the five exhibits in question in their entirety and several of its suggested redactions for remedy briefings.

However, it strongly opposes the company’s proposal to “redact information about its revenues and expenses” going back to 2014. According to the SEC, this data could shed more light on Ripple’s XRP sales and play an important part in the legal process.

Ripple wants to hide the extent to which it offered XRP at discriminatory prices. However, the period when Ripple was offering discounts goes back to 2014 and ended in December 2020. Ripple has not shown how the discounts it offered four years ago and more would matter, particularly since Ripple seeks to avoid remedies by claiming it “has changed the way it sells XRP and changed its contracts.”

SEC

XRP Whale Moves 29M Coins

In the midst of this attention-grabbing development, a well-known XRP investor, Rzn, sold approximately 29 million XRP to a centralized exchange based in Luxembourg City. Rzn’s transaction fueled speculation about XRP’s future price movements and implications for the future of XRP’s cryptographic journey.

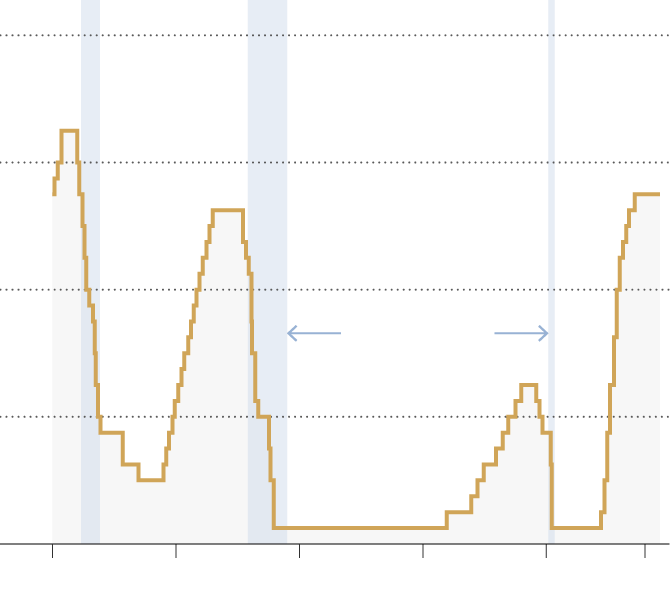

Currently, the price of XRP (XRP) is $0.5438, reflecting a 5.8% increase in the past 24 hours. In addition, XRP witnessed a significant surge in trading volume over the past 24 hours, suggesting a growing interest among traders.

The recent rally began due to the increased likelihood of spot Ethereum ETF approval, with the SEC requesting exchanges to update 19b-4 filings.

Also Read: Bitcoin Surges Over $71K and Short Traders Take Ls

The legal dispute began in December 2020 when the SEC brought charges against Ripple and several of its executives, alleging that they unlawfully acquired more than $1.3 billion through an unregistered securities offering through the sale of XRP.

The case underwent several revisions over the years until it entered its trial phase on April 23, 2024.

Cryptopolitan Reporting by Florence Muchai