A pro-XRP lawyer has disclosed the final dates of the Ripple and SEC case, sharing insights into the upcoming dates and what could transpire during the hearing.

Ripple And SEC Case Final Dates Disclosed

Pro-XRP lawyer, John E. Deaton has revealed the dates of the final case between Ripple, the technology company behind XRP, and the United States Securities and Exchange Commission (SEC).

In a live video posted on his official YouTube Channel, Crypto Law TV, Deaton gave detailed insights on the Ripple and US SEC case. He revealed the next dates of the final case ordered by US District Judge, Analisa Torres.

According to the remedies and discoveries filing, the court has ordered both parties, namely the US SEC and Ripple, to conclude all remedies-related discovery by February 12, 2024.

By March 13, 2024, the plaintiff, which is the US SEC, is mandated to file its brief regarding the remedies. In response to the SEC’s brief, Ripple, who is the defendant, would be allowed to file its opposition by April 12, 2024. And finally, by April 29, 2024, the plaintiff is expected to file its response to the defendant’s opposition.

Deaton has stated that the culmination of the Ripple and SEC lawsuit would most likely be in July, during the summer.

Deaton Predicts Lower Fees In Damages Than Demanded

In his recent live YouTube video, Deaton made some interesting predictions about the Ripple and US SEC lawsuit. According to the pro-XRP lawyer, Ripple may end up paying less in damages than its attorney expenses.

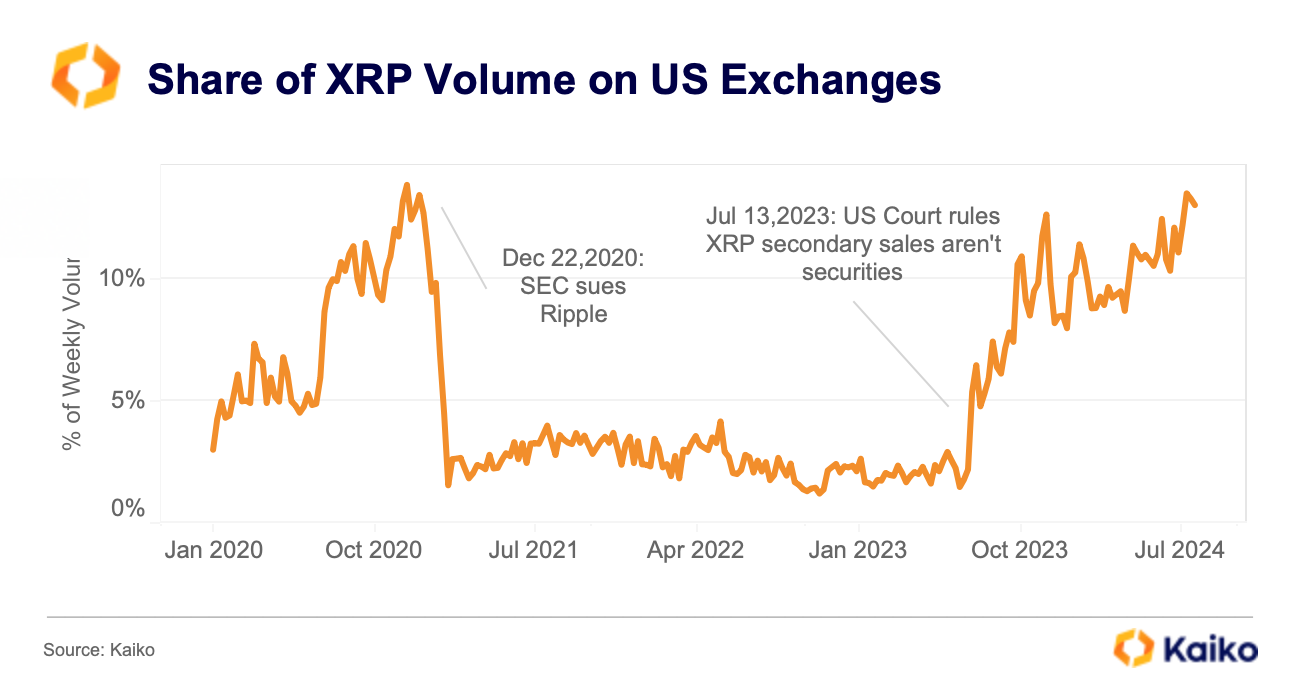

At present, the company has spent over $200 million in its lawsuit with the SEC as the crypto payments company has been in a legal battle with the regulatory body since 2020.

Deaton has based his predictions on his insights and deductions of the $770 million disgorgement fine issued by the US SEC to Ripple. The lawyer mentioned several elements in the case that could greatly reduce the initial charge.

He stated that factoring in ODL sales and XRP sales made outside the US where XRP is not considered a security, in the deductions of the charges, could potentially result in a significant reduction of the $770 million fine.

He also mentioned that the case between the US SEC and Ripple was not a fraud case and as such, the regulatory agency would be mandated to provide documents related to the victims allegedly harmed by XRP sales.

Deaton has stated that the majority of institutional investors have not suffered any harm as they presumably purchased XRP tokens at a price lower than the present value. Many XRP holders have stated that they did not experience harm from XRP sales. However, they did incur losses due to the SEC’s attempted enforcement actions against the crypto firm.