Keith Gill, widely recognized as Roaring Kitty and DeepFuckingValue from the infamous GameStop trading saga, has made waves again. This time, he’s disclosed a 6.6% ownership in Chewy, the online retailer specializing in pet food and other pet-related products.

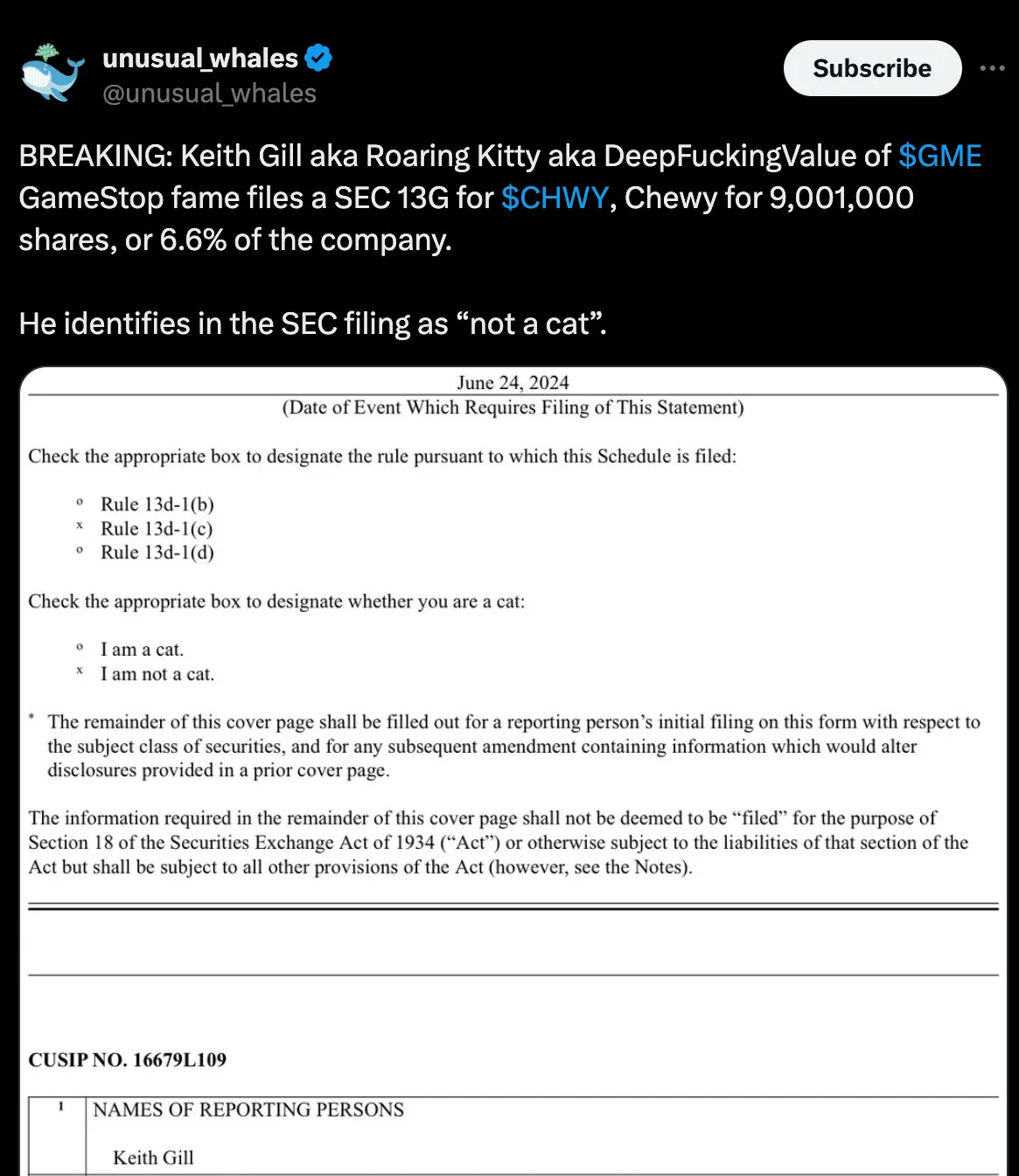

On June 24, the United States Securities and Exchange Commission (SEC) received a Schedule 13G filing from Keith. This document revealed that he, as an individual investor, holds 9,001,000 shares of Chewy’s Class A common stock.

To clear up any potential confusion, Keith humorously noted in the filing that he is “not a cat.” The SEC filing under Rule 13d-1(c) indicates Keith’s sole voting and dispositive power over the shares.

This type of filing is typical for investors who own more than 5% of a company’s shares but do not aim to control the company’s direction.

Roaring Kitty gets sued for stock manipulation

Despite this new venture, Keith’s past actions continue to haunt him. He has been served a class action securities fraud lawsuit related to his involvement with GameStop stock.

The lawsuit, filed on June 28th in the US District Court for the Eastern District of New York, claims that Keith manipulated markets for personal gain from May 12th to June 13th of this year.

The complaint asserts that Kitty could rally a massive following of retail investors through his social media posts, encouraging them to buy and hold GameStop securities.

It also accuses him of leveraging his social media prominence to boost his stock holdings. His return to Twitter (now X) in May spurred a renewed interest in GameStop stock, leading to this legal action.

Kieth was a key player in the 2021 surge of GameStop stock. However, he disappeared from public view for three years before making a comeback.

His cryptic posts on X caused a major spike in GME stock price, proving his influence over the market. His actions have even inspired a film from Netflix called “Dumb Money.”

US stock market headed for a crash

Amid the buzz around Roaring Kitty and Chewy, leading global investment bank JP Morgan has issued a dire forecast for the US stock market. The bank predicts a major market crash, with the S&P 500 index potentially facing a 20% downside.

This gloomy outlook comes as BRICS (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the UAE) seeks to challenge the dominance of the US dollar and weaken the US economy.

JP Morgan’s analysis suggests that the US economy will face its own downfall, with minimal impact from BRICS.

The bank highlighted that the largest 20 US stocks have surged over 27% year-to-date (YTD), outpacing the S&P 500 index’s nearly 16% rise and the Russell 2000’s mere 1.73% gain.

JP Morgan warns that a significant correction could hit the top 20 US stocks, potentially causing the markets to plummet. The S&P 500 index could fall to a low of 4,200, representing a drastic 23% decline.

If this scenario plays out, BRICS currencies are expected to strengthen in the forex markets.

Jai Hamid