Rich Dad Poor Dad author Robert Kiyosaki has expressed concerns about the rapid rise in the U.S. national debt, which ballooned by a trillion dollars over a short period. The famous author then urged investors to buy bitcoin alongside gold and silver. Kiyosaki recently doubled down on his own advice and increased his personal bitcoin holdings. Other critics of the U.S. government’s fiscal policies have also raised the alarm about the increasing national debt, citing its potential to weaken both the U.S. economy and the U.S. dollar.

Robert Kiyosaki Concerned About National Debt

The author of Rich Dad Poor Dad, Robert Kiyosaki, has again urged people to buy bitcoin, reiterating his bullish stance on the cryptocurrency and highlighting his ongoing concerns about the U.S. economy and the dollar. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

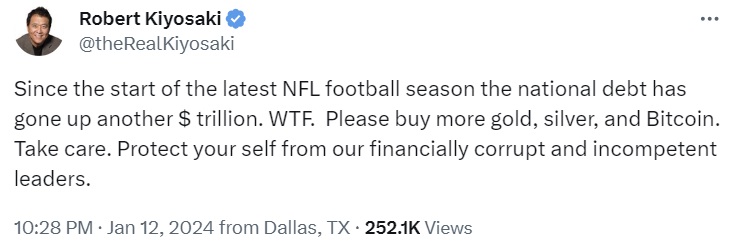

Kiyosaki expressed his frustration on social media platform X on Friday that the national debt has ballooned by another trillion dollars since the National Football League (NFL) season began. “Please buy gold, silver, and bitcoin,” he stressed, urging investors to shield themselves from the financial corruption and incompetence of our leaders. The national debt currently stands at $34.06 trillion, a $1.02 trillion increase since Sept. 18 last year, according to the Treasury Department.

Besides Kiyosaki, many others have sounded the alarm about the U.S. national debt. Economist and gold bug Peter Schiff explained on Jan. 2 on X: “It’s only the 2nd day of Jan. and the national debt already blew past $34 trillion. I think 2024 will set a record for the largest one-year increase in the U.S. national debt in history. The only question is will there be a sovereign debt or dollar crisis before the year ends.” Schiff added:

It took less than three months and two weeks to add the last trillion to the national debt. I think the U.S. will add the next trillion in less than three months. At that pace, the national debt will be growing at over $1 trillion per quarter. Just imagine if there’s a recession!

In November last year, Moody’s downgraded the U.S. credit rating to “negative,” citing growing deficits and debt burdens. Echoing these concerns, U.S. Senator Rand Paul warned that out-of-control government spending jeopardizes the very existence of the dollar, stating: “The greatest threat to [our national security] is the national debt. We borrowed a trillion dollars in the last three months.” Renowned billionaire “Bond King” Jeffrey Gundlach also sounded the alarm in October last year, cautioning: “The massive budget deficit and increasing interest rates on the national debt should scare every American … The future of the U.S. dollar, and possibly out-of-control inflation, depends on getting the budget and spending under control.”

Do you share Robert Kiyosaki’s concerns regarding the rapid rise of the U.S. national debt? Let us know in the comments section below.