Coinspeaker

Robinhood Lists All 11 New Spot Bitcoin ETFs

Robinhood has stayed true to its word by listing all new spot Bitcoin exchange-traded funds (ETFs) on its platform. The US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs on Wednesday, including funds from BlackRock, Grayscale, Fidelity, Invesco, Valkyrie, Bitwise, Hashdex, BZX, VanEck, WisdomTree, and Franklin Templeton.

Shortly after the landmark decision by the SEC to approve those spot Bitcoin ETFs, Robinhood CEO Vlad Tenev revealed the company’s next line of action.

Exciting update from Washington today! As a pioneer in offering spot crypto trading, Robinhood is thrilled about the @SECGov's decision to approve spot Bitcoin ETFs. We've been ahead of the curve in crypto access, and we plan to list these ETFs on @Robinhoodapp as soon as…

— Vlad Tenev (@vladtenev) January 10, 2024

So, on January 11, the platform began offering the new class of spot Bitcoin ETFs. This means that US-based customers may now access all 11 ETFs in both retirement and brokerage accounts through Robinhood Financial. Additionally, the company said that users may also trade – buy or sell – Bitcoin ETFs, the same way they would when they are interested in any other ETF or stock.

Robinhood Seeks to Improve Access to Financial Markets

According to Robinhood, listing the new spot Bitcoin ETFs aligns perfectly with the core mission of the firm. That mission, as Chief Brokerage Officer Steve Quirk puts it, focuses on offering increased access to the financial markets to customers. Thereby, giving them a wider depth of choice.

This is exactly Robinhood’s aim for adding support for the newly-approved Bitcoin ETFs. Johann Kerbrat, GM of Robinhood Crypto also shares the same sentiment. Kerbrat said in a part statement:

“We believe crypto is the financial framework of the future and that increased access to Bitcoin via ETFs is a good thing for the industry.”

Meanwhile, it might be worth mentioning that the addition of spot Bitcoin ETFs has not stopped customers from purchasing Bitcoin directly. For that choice, the firm assures that they may do so through Robinhood Crypto, which offers the lowest cost to trade crypto on average.

SEC’s Decision to Boost Many Firms

Meanwhile, analysts have tipped the recent spot Bitcoin ETF approvals to be a huge boost for many companies. That includes Robinhood, whose major source of revenue is stock trading.

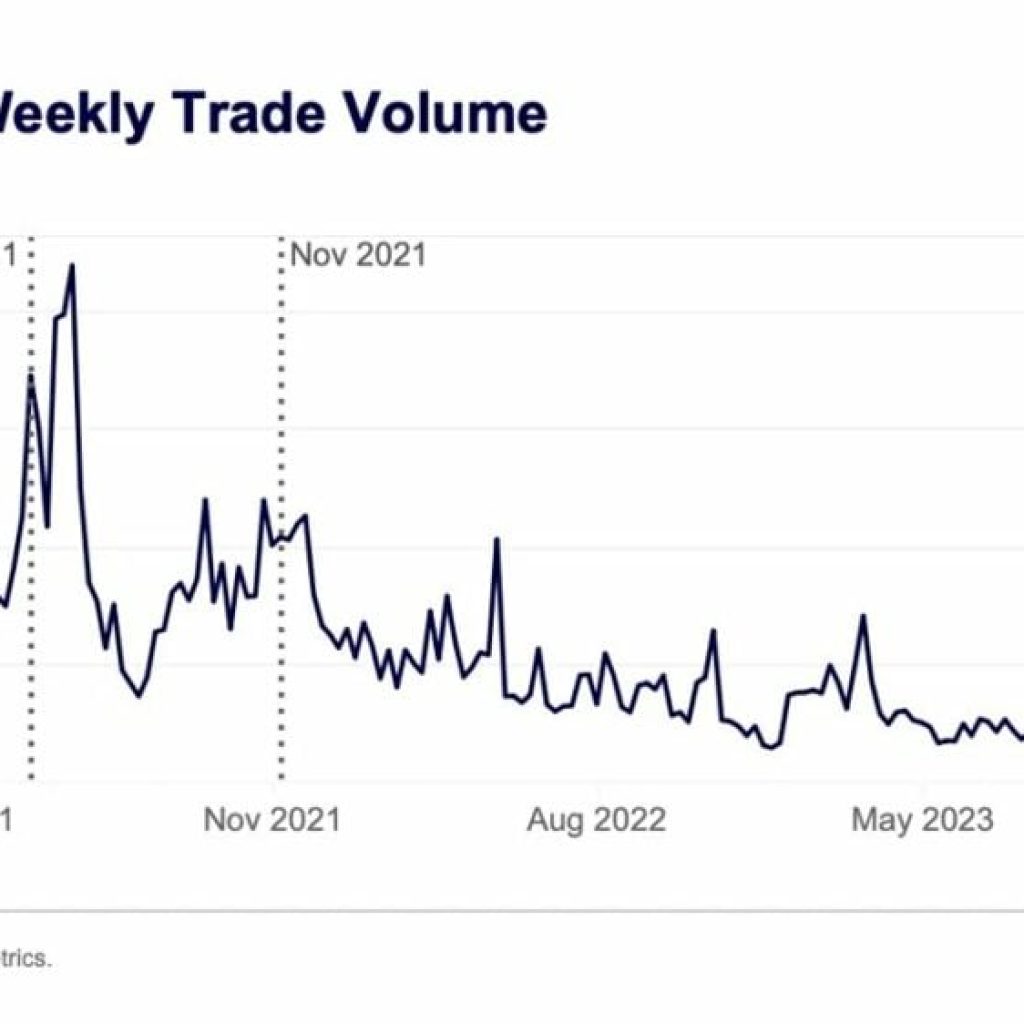

According to Dan Dolev, a senior analyst at Mizuho Securities, it is likely that exchanges that have been quick to add support for the new ETFs will experience increased trading volumes. That is because users are expected to migrate to platforms like Robinhood, where they can transact Bitcoin directly.

Without a doubt, the situation gives the likes of Robinhood an edge over competing exchanges as they are expected to see substantially higher mainstream engagement with digital assets.