The 2022 bear market is characterized by plummeting crypto prices buffeted by rising inflation and volatile markets that resulted in falling consumer confidence.

The situation led to a liquidity crunch throughout the industry, pushing multiple firms to insolvency and revealing the rot in others.

Axie Infinity

In March, hackers hacked the play-to-earn game for over $625 million from their Ronin bridge.

Investigators traced the attack to Lazarus, a North Korean cybercrime group. The platform later managed to raise $150 million to reimburse its users. Assistance from Binance and Chainalysis enabled them to freeze $5.8 million of crypto-related crime.

The hack marked the first significant instance when investor confidence began to wane.

Celsius Network

Celsius showed its first sign of distress in April when they began limiting the Celcius Earn product. Later in May, the collapse of Terra Luna resulted in a ‘domino’ effect that sent the firm to insolvency.

By July, the firm had laid off 23% of its staff and faced multiple lawsuits from its lenders. According to DeFi aggregator KeyFi, Celsius engaged in market manipulation and failed to implement basic accounting measures to protect user deposits.

Celsius acknowledged losses of over $1.3 billion, the firm filed for bankruptcy protection, and its investors paid a hefty price.

Terra ecosystem

The Terra ecosystem lives on with their native tokens still trading on multiple exchanges. The same, however, cannot be said for its decentralized applications (dApps).

Terra Luna was a decentralized stable coin protocol for UST, pegged to the US Dollar. The protocol crashed into a death spiral resulting in a loss of $45 billion in 72 hours.

The May occurrence marked a significant inflection point in the 2022 bear market.

Applications that succumbed to the Terra Luna collapse include Alice, Terra name service, Terra Nova, LoTerra, and Stake. These were all third-party apps that worked alongside the Terra protocol.

Many users cry foul from losing their investments, with reports of several contemplating suicide.

Three Arrows Capital

Three Arrows Capital was a Singapore-based crypto hedge fund that a court in the British Virgin Islands ordered to liquidate on June 2022.

At its peak, analysts valued the firm at over $560 million; it, however, had significant exposure to troubled firms like Axie Infinity, Terra Luna, and BlockFi. Shattered investor confidence resulted in a wave of margin calls from lenders that the firm failed to honor.

Liquidators are working on winding down the failed firm; Judge Martin Glenn, a US bankruptcy judge, subpoenaed the company founders.

Voyager Digital

Voyager Digital filed for bankruptcy protection after three arrows capital defaulted on a $650 million loan. The event forced the firm to freeze deposits and withdrawals.

In June, Sam Bankman Fried (SBF) offered the troubled firm a $500 million line of credit to help them weather the storm. Current events indicate that the SBF handouts were customer funds from his exchange.

The firm owes over 100,000 debtors between $1 billion to $10 billion. In filings made in September, the firm indicated that they would be auctioning their assets.

FTX/ Alameda

The FTX/ Alameda debacle broke news headlines. The FTX exchange was revered as a top three exchange by trading volume before its collapse.

The exchange fizzled out in November following an acute liquidity crunch and allegations of user funds misappropriation. Its collapse reverberated throughout the crypto industry, with some of its close allies filing for bankruptcy protection or reporting liquidity crunches.

Reports indicate at least $1 billion of investor funds lost in the exchange. The exchange’s former CEO, Sam Bankman-Fried (SBF), could face up to 100 years in jail if found guilty.

With investors still crying foul, analysts suggest it could take up to 10 years before the court can complete bankruptcy proceedings and compensate the investors.

The collapse of FTX happened in November, and its effects will continue to be felt in 2023 as the market plays out.

Troubled industry from bear market

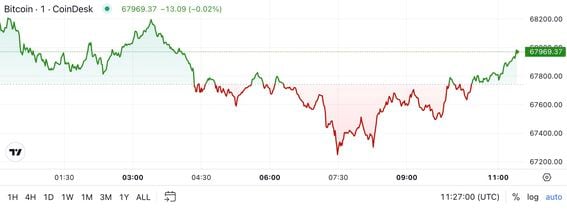

BTC/ USD chart 2022, Bitcoin lost 60% in the 2022 bear market.

The number of firms that contributed to the 2022 bear market is enormous. Some other firms not discussed include BlockFi, Serum, Mirror Protocol, Nuri, Symbiont, Unify, FTX US, Skynet Labs, and MistX.

Liquidity crunches, misappropriation of funds, hacks, and project rug pulls have all played out in the 2022 bear market, with them a painful lesson as we cross into 2023.