Russia is looking at crypto to mitigate the effect of sanctions and bolster its international payments ability, according to a new report from Chainalysis.

Chainalysis says that Russia is positioning itself in an attempt to overtake the US as the global leader in crypto mining, passing a new bill allowing legal entities and registered entrepreneurs to mine digital assets.

“This regulatory move raises important questions about the classification of crypto mining outside Russia as well, particularly in light of broad U.S. sectoral and European sanctions against Russia’s energy sector. Russia’s authorization and oversight of crypto mining suggests a strategic alignment with national interests, despite the ongoing international sanctions targeting Russia’s energy resources.”

While large-scale on-chain sanctions avoidance is unlikely – mainly due to a lack of liquidity – Chainalysis says Russia’s integration of crypto into its financial system could still have implications for US national security.

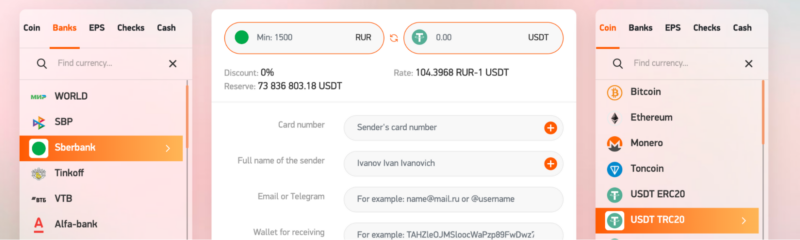

The firm shares a glimpse of a Russian “instant exchanger” that allows users to transfer funds from their accounts at sanctioned banks without any KYC (know your customer) and then receive cryptocurrency to a wallet in exchange.

“Government-affiliated actors who might seek to leverage the new developments include fundraisers supporting pro-Russian militants in Ukraine, facilitators helping oligarchs and other politically exposed persons engage in capital flight, or Russian-language instant exchangers with no KYC requirements, servicing on- and off-ramping activities for sanctioned Russian banks. These smaller-scale activities can have major repercussions, highlighting the broader security and compliance risks associated with such transactions.

Below, we can see the interface of a Russian instant exchanger.”

Last month, Bloomberg reported that the Russian government wants to use digital tokens for cross-border transactions to help ease payment difficulties for its companies affected by international sanctions.

According to people “with knowledge of the matter who asked not to be named discussing private information,” Russia will attempt to use the National Payment Card System (NSPK) to trade rubles and crypto assets when testing payments and the exchange platform.

The NSPK was created in 2014 and is wholly owned by the Central Bank of Russia, but was placed under sanctions in February 2024 by the United States Department of the Treasury.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Russia Setting Sights on Alternative Financial System Independent of US Dollar Using Crypto: Chainalysis appeared first on The Daily Hodl.