Samsung Electronics revealed its earnings report for the first quarter of fiscal year 2024 on Tuesday, reporting a tenfold increase in operating profit mainly because of a memory chip price spike from AI expansion.

Samsung reports a 932% increase in operating profit

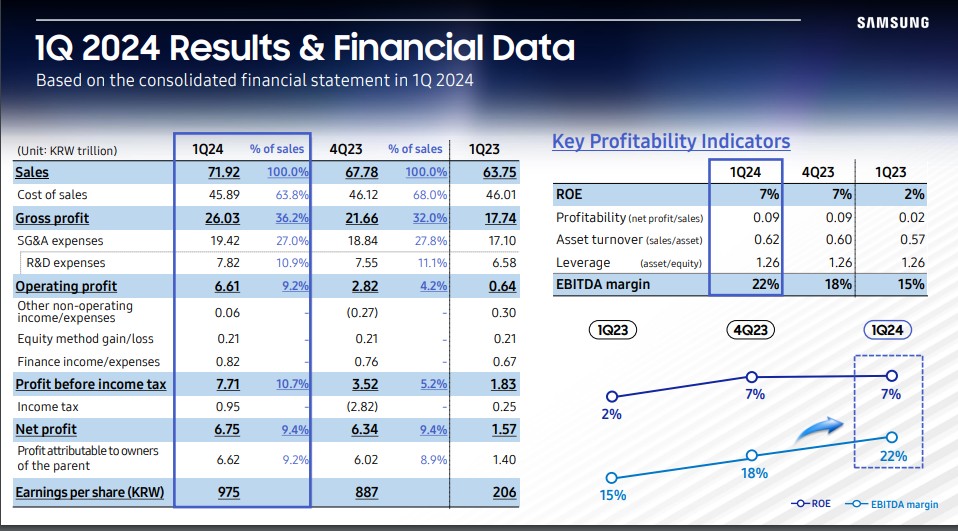

The staggering profits also sent the share price of the smartphone maker up by 1.8 percent after the release of the report. The tenfold operating profit equals 6.6 trillion South Korean won ($4.8 billion), which is outlandishly higher if compared to the first quarter of 2023 when the profit was 640 billion won.

At the start of the month, Samsung predicted almost the same numbers as the memory chip maker, saying that the weakness of the Korean currency against major currencies also had a positive impact on the operating profit.

Mentioning the Galaxy S24 smartphone, which is its flagship model, the company said,

“The company posted KRW 71.92 trillion in consolidated revenue on the back of strong sales of flagship Galaxy S24 smartphones and higher prices for memory semiconductors. Operating profit increased to KRW 6.61 trillion as the Memory Business returned to profit by addressing demand for high-value-added products.”

Source: Samsung.

The tech giant also noted that the Mobile Experience (MX) business also performed better, and the digital appliances and visual display businesses also proved profitable, reporting higher earnings.

DRAM and display businesses are Also revenue generators

Capital expenditure was KRW 11.3 for the first quarter, which also included KRW 9.7 trillion for the Device Solution (DS) Division and also 1.1 trillion for Samsung Display Corporation (SDC).

Samsung is the largest manufacturer of DRAM (dynamic random-access memory) chips, and in line with that, it noted that the spending in memory manufacturing was focused on facilities and packaging technologies to meet the growing demand for HBM (high-bandwidth memory), DDR5, and other latest chips.

Mentioning the foundry investments, it noted that the funds were allocated to establishing infrastructure to address the medium- and long-term demand for chips, while speaking of display investments, it said that they were mainly in IT OLED products and in flexible displays.

Samsung’s memory business also revived, and mentioning the semiconductor side, the company reported KRW 1.91 trillion in operating profit and KRW 23.14 trillion in total consolidated revenue for it. According to the company, the reason for this is the demand for servers, storage, mobile, and PC sectors, and it focused on high-value-added solutions such as SSDs, DDR5, HBM, and also UFS 4.0.

Samsung expects a positive business environment as it expects the demand for its products to increase despite geopolitical issues and uncertainties. It was also said that it will incorporate Galaxy AI into other phone models, as the Galaxy S24 played a pivotal role in improving revenues. For the second quarter, Samsung expects smartphone demand to remain stable and TV demand to recover gradually.