Sam Bankman-Fried sentenced to 25 years in prison, Fidelity files for Ether ETF with staking, and SEC case against Coinbase to proceed.

Former FTX CEO Sam SBF Bankman-Fried will serve 25 years in prison following a sentencing hearing in federal court. On March 28, Judge Lewis Kaplan of the United States District Court for the Southern District of New York sentenced Bankman-Fried to 240 months and 60 months for his conviction on seven felony charges. Judge Kaplan found that SBF also committed witness tampering based on the events that led him to revoke bail in August 2023 and perjury based on his testimony at trial over FTX user funds. SBF was the first person tied to FTX and Alameda Research to face prison time.

Fidelity filed an S-1 application with the United States Securities and Exchange Commission (SEC) on March 27 to create a spot Ether exchange-traded fund (ETF). As expected from an earlier filing, the ETF will give Fidelity the option to stake part of the ETH it holds. Fidelity Digital Asset Services, which is affiliated with sponsor FD Funds Management, would serve as custodian of the trusts ETH. The SEC has pushed back the approval deadline for other ETH ETFs to May 23. There are eight applicants for spot ETH EFTs awaiting an SEC decision.

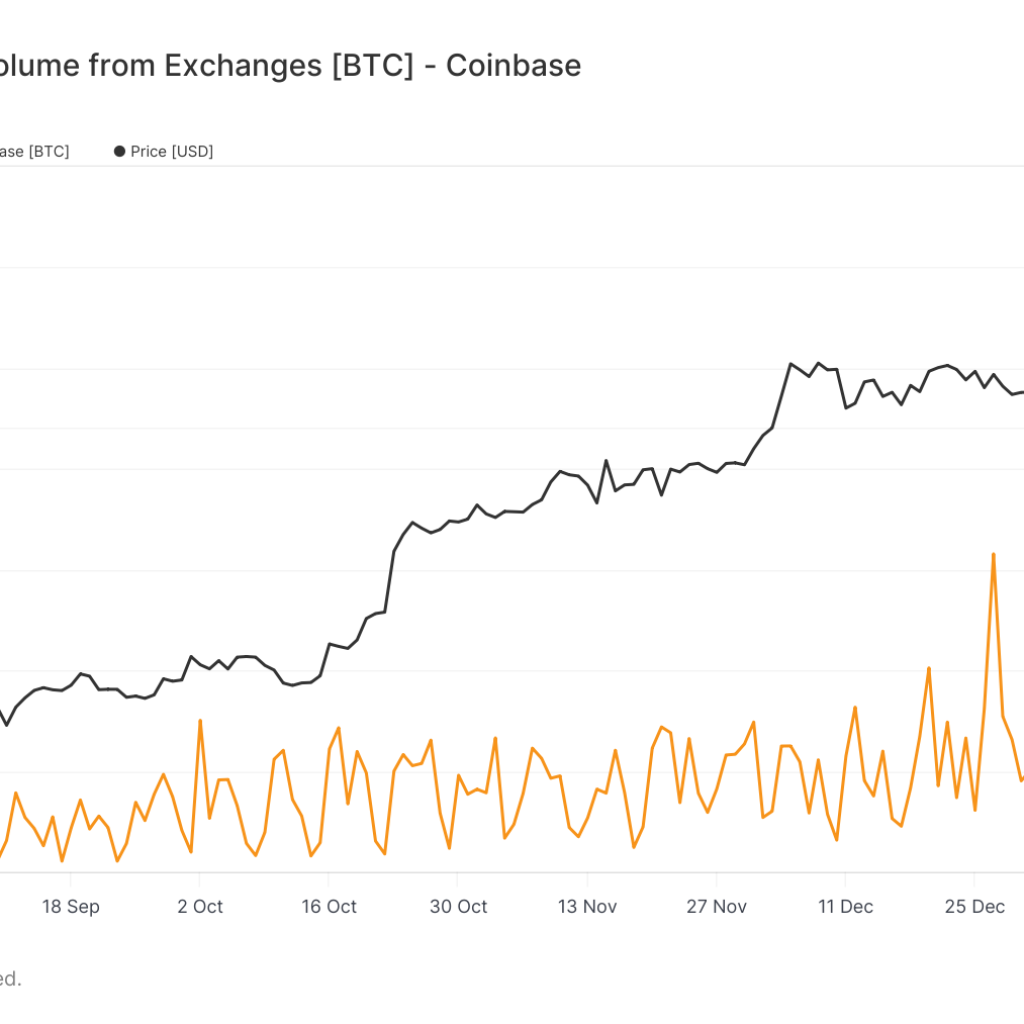

A United States court has denied Coinbases motion to dismiss the SECs case against the exchange. The decision, made by U.S. District Judge Katherine Failla, allows the commission to pursue its lawsuit against Coinbase. The SEC sued Coinbase in June 2023, saying the crypto exchange violated federal securities laws by listing 13 tokens it alleged were securities. The firm was seeking an order to drop the case, questioning the SECs authority over crypto exchanges.