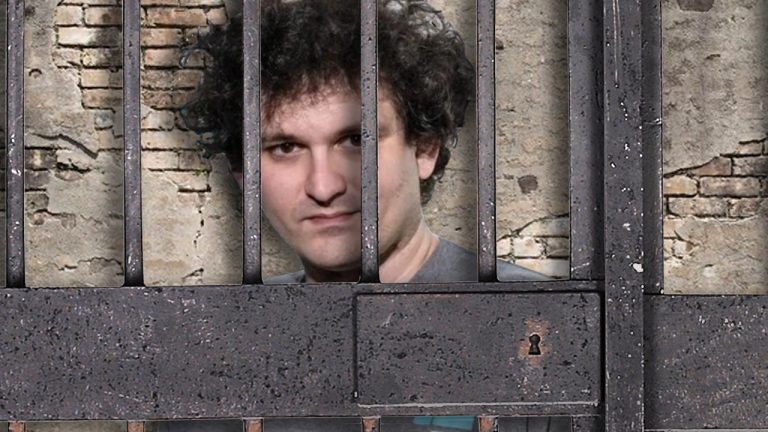

Galaxy Digital’s CEO Mike Novogratz talked to Andrew Ross Sorkin on CNBC’s Squawk Box and gave his reaction to Sam Bankman-Fried’s (SBF) recent New York Times (NYT) Dealbook Summit interview. Novogratz said that SBF was “delusional” and insisted that the former FTX CEO needs to be prosecuted and further said, “he will spend time in jail.”

Mike Novogratz: ‘Sam Was Delusional’

The billionaire and CEO of Galaxy Digital, Mike Novogratz, was very candid about what he thought about Sam Bankman-Fried’s (SBF) most recent interview held virtually at the NYT Dealbook Summit. Novogratz explained that SBF needs to take responsibility for his actions and stressed that the comments he made during the interview were “delusional.”

“Let’s be really clear. Sam was delusional about what happened and his culpability in it,” Novogratz told the CNBC Squawk Box host Andrew Ross Sorkin on Thursday. “He needs to be prosecuted. He will spend time in jail. They perpetuated a large fraud. And it wasn’t just Sam. You don’t pull this off with one person,” Novogratz added. The Galaxy CEO added:

I’m not saying he even planned this all like a criminal mastermind. What they did was criminal and they need to be prosecuted for it.

Novogratz said that prosecuting specific people for the wrongdoings that happened at FTX would not only be good for the crypto industry, but for the entire financial industry as a whole. “I’m hoping that the authorities get to the bottom of this faster,” Novogratz remarked. “Not just for the sanctity of the crypto markets, but for all markets. Markets are based on trust and when you have trust broken like this, it questions everyone else.” Novogratz continued:

People start looking for black swans everywhere. So in some ways this is the story of the moment because it’s such a giant story. But your seeing someone who is just spewing more lies. Listen, Sam has always been kind to me and he has a kind demeanor … but that was part of the schtick.

Novogratz’s Galaxy Digital was also one of the crypto companies exposed to the FTX fallout. On Nov. 9, 2022, Galaxy disclosed publicly that the company’s ties to FTX led to approximately $76.8 million in exposure. Novogratz also talked to Sorkin about the FTX situation last Wednesday on Squawk Box, and he said that the FTX collapse created a “deficit of trust” within the crypto industry.

“I think coins should be segregated in your account, and they shouldn’t be lent unless you give them permission to lend,” Novogratz explained. “This is always about building trust with your clients. And right now we’re in a deficit of trust. People think there’s a black swan around every corner, that everyone else is a sociopath, saying one thing and doing something else,” the Galaxy Digital CEO added.

Speaking with Sorkin again during his interview on Thursday, Novogratz said crypto companies need regulation. “I think the money side of crypto, companies like ours that buy and sell and lend and do derivatives, are going to get regulated and should be,” the investor said.

Customer funds should never be co-mingled without the customer’s permission Novagratz insisted, and he further argued that all crypto platforms should explain this in their terms and conditions concisely. As far as the crypto industry, in general, and as far as crypto assets like bitcoin and ethereum, Novogratz said he still believes the digital currency ecosystem has a bright future.

What do you think about Galaxy Digital’s Mike Novogratz and his opinion about the former FTX CEO? Let us know what you think about this subject in the comments section below.