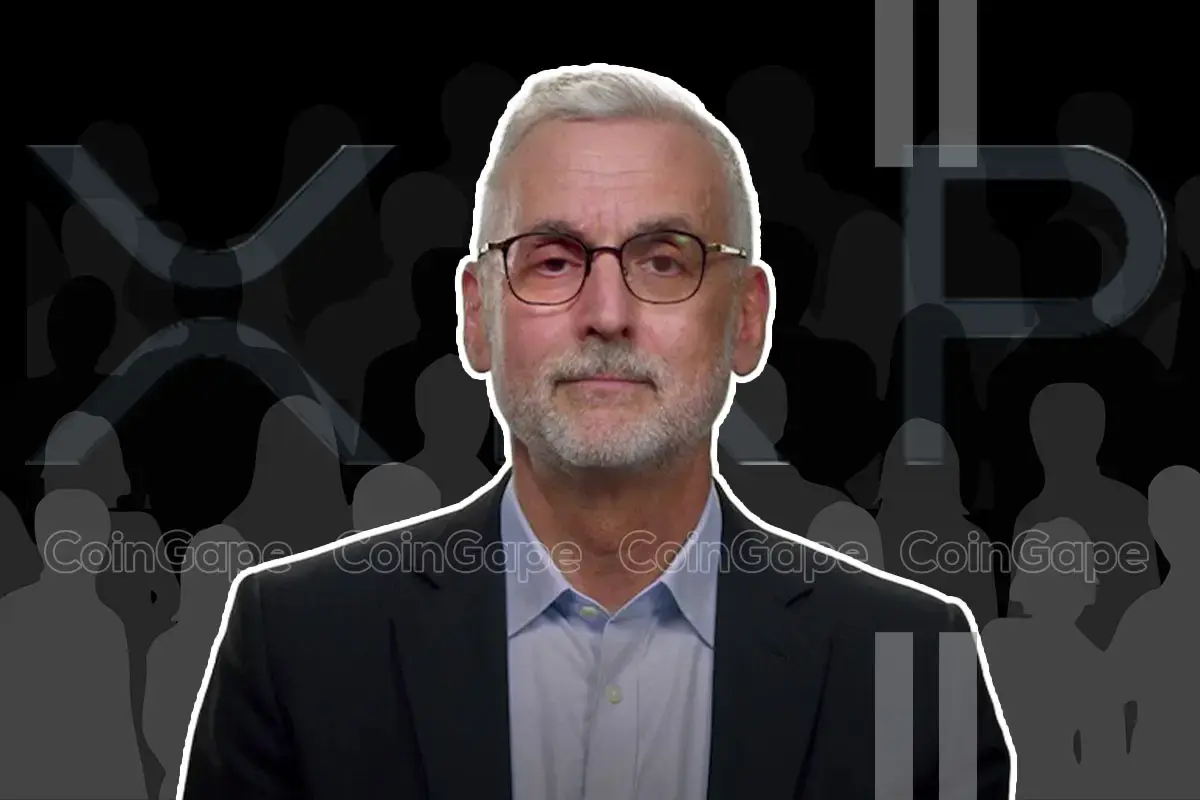

U.S. Securities and Exchange Commission Chair Gary Gensler discussed crypto exchanges and digital currencies at the Piper Sandler Global Exchange & Fintech Conference. He insisted that there is “nothing about the crypto securities markets that suggests that investors and issuers are less deserving of the protections of our securities laws.” Gensler reasserted his belief that “the vast majority of crypto tokens meet the investment contract test.”

Gensler Dismisses Claim of Exchanges and Crypto Token Issuers Lacking Fair Notice — ‘Don’t Believe It’

Gary Gensler, the current chair of the U.S. Securities and Exchange Commission (SEC), discussed digital currencies at the Piper Sandler Global Exchange & Fintech Conference in New York. Gensler pointed out that some promoters of crypto asset securities claim that their token’s utility exempts it from being classified as an investment contract. However, the SEC chair rejects this argument and insists that “crypto security issuers need to register the offer and sale of their investment contracts with the SEC or meet the requirements for an exemption.”

Gensler stated:

Some additional utility does not remove a crypto asset security from the definition of an investment contract.

Gensler’s speech follows court documents alleging that the current SEC chairman had once sought to advise for Binance in 2019 and reportedly had lunch with Binance’s founder Changpeng Zhao (CZ) in Japan. When discussing crypto exchanges and alleged crypto securities, Gensler emphasized that the SEC “provided years of guidance to market participants on what does or does not constitute a crypto asset security.” He also highlighted that the SEC’s enforcement actions against LBRY, Telegram, and Kik have further clarified the matter.

“In fact, we alleged just this week that Binance’s chief financial officer and chief compliance officer were aware of the Kik case’s relevance to their own business,” Gensler told the attendees. “According to our complaint against Binance, as a result of the SEC’s action against Kik, Binance insiders realized that they would need to ‘start prepping everything’ for a subpoena and Wells notice relating to their exchange token, BNB, including a ‘War chest.’”

Gensler Stresses SEC Has ‘Consistently Alleged That Lending and Staking-as-a-Service Offerings Need to Register’

Gensler believes that there are “flexible rules for the disclosures required in registration statements.” He dismissed claims of “lacked ‘fair notice'” by participants on Twitter, urging people not to believe it. Following regulatory actions against Binance and Coinbase, Gensler stated during an interview with CNBC earlier this week that there is no necessity for numerous digital currencies. “We already have digital currency. It’s called the U.S. dollar. It’s called the euro or it’s called the yen, they’re all digital right now,” Gensler conveyed to the show host.

Regarding staking-as-a-service and the actions taken against Coinbase in relation to this issue, Gensler emphasized that the SEC had provided prior notice through their crackdown on Bitconnect and Blockfi. Gensler asserts that the SEC has “consistently alleged that these lending and staking-as-a-service offerings need to register and provide the investing public with proper disclosures.”

What are your thoughts on SEC Chair Gensler’s response to claims of exchanges and crypto token issuers lacking fair notice? Share your thoughts and opinions about this subject in the comments section below.