The United States Securities and Exchange Commission (SEC) has joined the Commodity Futures Trading Commission (CFTC) and other regulatory bodies in bringing charges against a cryptocurrency user who allegedly orchestrated an illicit scam that cost Mango Markets millions of dollars.

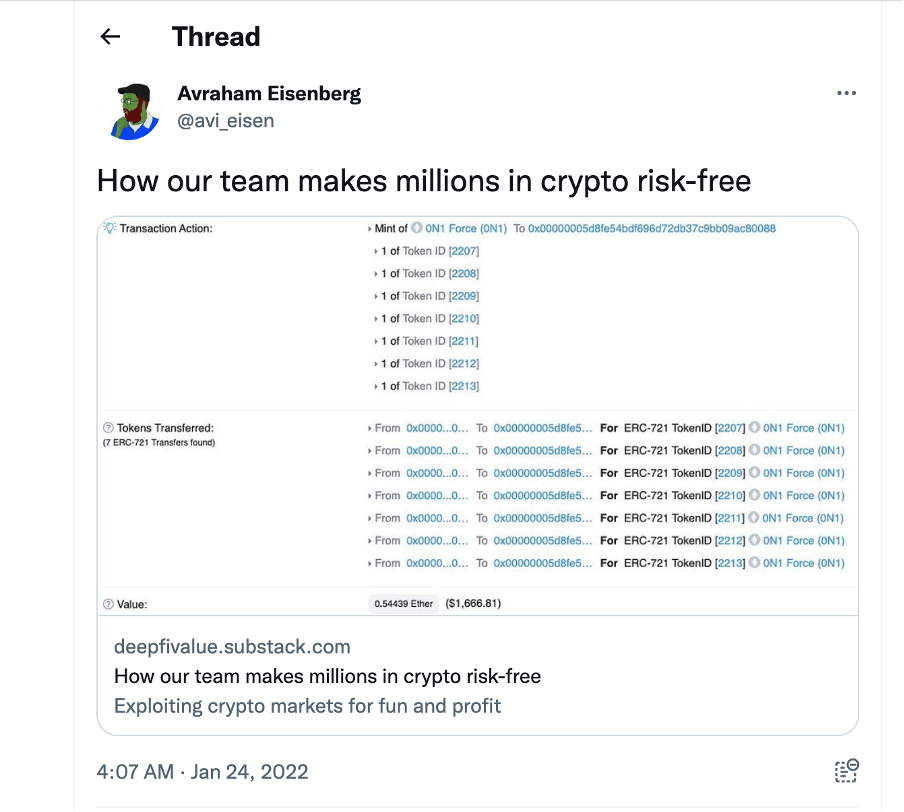

On Jan. 20, the SEC charged Avraham Eisenberg with manipulating Mango Markets’ MNGO governance token to embezzle a staggering $116 million worth of cryptocurrency from the platform. The accusation claims Eisenberg purchased large amounts of MNGO to inflate its rate relative to USD Coin USDC before cashing out and stealing the funds.

David Hirsch, the SEC’s Crypto Assets and Cyber Unit leader, accused Eisenberg of using a deceptive ploy to increase MNGO token prices so he could take out most available funds from Mango Markets when the security cost dropped back to its original price. This act left the platform with an unexpected deficit.

With the help of the U.S. Attorney’s Office for the Southern District of New York, FBI, and CFTC, the SEC has accused Eisenberg of violating anti-fraud and market manipulation laws governing securities markets. The financial regulator is insisting on a permanent injunction to prevent future frauds and disgorgement with prejudgment interest plus civil penalty payment to rectify any damages caused by these violations.

Eisenberg was accused of committing a major exploit on Mango Markets in October. He withdrew approximately $50 million USDC, $27 million mSOL in Marinade Staked SOL and another combined amount of around $39 million for both SOL and MNGO tokens. Later, he returned about two-thirds of the total sum – roughly $67 million – to the market. According to him, Eisenberg declared that his actions were part of a “lucrative trading strategy,” which made them legally justifiable.

In December of last year, law enforcement in Puerto Rico took Eisenberg into custody due to a complaint lodged by the FBI that he had engaged in an organized scheme to manipulate perpetual crypto futures prices on certain platforms. The CFTC later pressed charges against him for market manipulation and released their lawsuit on Jan. 9.

After a January hearing, the magistrate judge declared that Eisenberg should remain detained until trial to guarantee his presence.