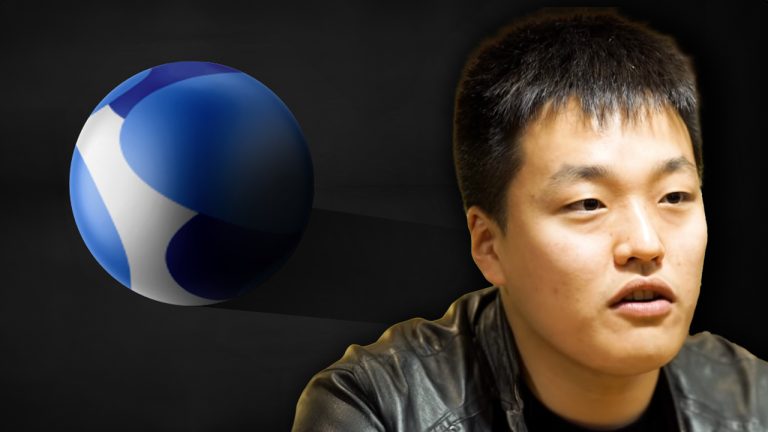

Last week, lawyers representing Terraform Labs and its ex-CEO Do Hyeong Kwon (Do Kwon) moved to dismiss the lawsuit brought against them by the U.S. Securities and Exchange Commission (SEC). In response, the SEC has countered with a motion of its own, asserting the accountability of both the company and Kwon. The commission maintains that the evidence amassed by the prosecution is “clear, undisputed and overwhelming.”

SEC Files Motion for Summary Judgment Against Terraform Labs and Do Kwon

On November 2, 2023, the U.S. Securities and Exchange Commission (SEC) advanced its case in the ongoing Terra litigation by filing a motion for summary judgment. The regulatory body claims to hold “undisputed” proof of the purported infractions committed by former Terraform Labs CEO Do Kwon and the company itself.

The SEC’s filing alleges that “Terraform and Kwon orchestrated a fraudulent scheme that ultimately led to $45 billion in market loss, including devastating losses for U.S. investors.”

The SEC motion for summary judgment further states:

Defendants fabricated Terra blockchain activity to create the appearance of real-world transactions on the blockchain that did not exist. And they lied to investors about the stability of Terraform’s so-called stablecoin, while concealing the secret deal defendants had entered into with a third party to save the asset from collapse.

The U.S. regulator believes the case is stacked against Terraform Labs and the former CEO. “No rational jury could conclude that Kwon was not liable for Terraform’s violations,” the SEC filing insists.

The SEC’s motion for summary judgment follows a jury of 12 finding the former FTX CEO Sam Bankman-Fried guilty on all counts in his fraud trial. It also follows Terraform Labs and Kwon’s lawyers submitting a motion for summary judgment in an attempt to get the case quickly dismissed.

The motion filed by the defense attorney claims that despite a two-year investigation, which encompassed extensive discovery, the SEC allegedly made no progress in demonstrating any misconduct by Kwon and the defendants. The defendants’ lawyers argued that even after a thorough probe, the evidence presented by the SEC against the accused remained static.

The SEC’s lawyers are not buying the argument and said, “Kwon and Terraform then engaged in a scheme to defraud the public about [the] use and stability of these crypto asset securities.”

The SEC insists that the Terraform Labs startup and Kwon sold unregistered securities and performed unregistered and fraudulent spoofed blockchain transactions in order to commit fraud. Prosecutors argue that the defendants, meanwhile, “cashed out” a large sum of fiat currency.

What do you think about the SEC’s latest court filing against Terraform Labs and Do Kwon? Share your thoughts and opinions about this subject in the comments section below.