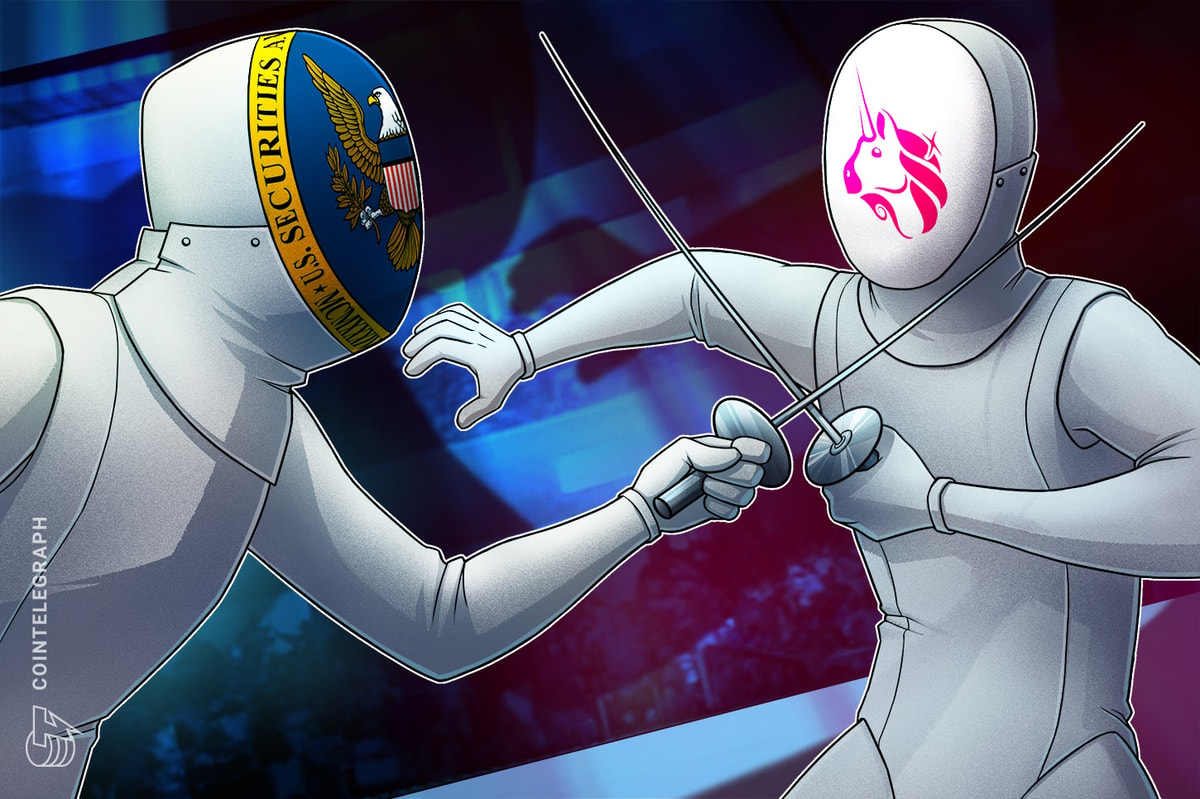

The Securities & Exchange Commission has chosen Uniswap — rather than a fraudulent actor — as its latest target. The commission is facing stiff odds of success.

Well, it happened. We’ve known for a year the Securities and Exchange Commission was conducting an investigation of Uniswap. Now the SEC is preparing to sue Uniswap after delivering a Wells notice to Uniswap Labs. Wells notices are the SEC’s required declaration of war before suing a company.

This is not happening because anyone building the Uniswap protocol committed fraud or stole money or manipulated markets. This is happening because the Uniswap model is a threat to the traditional centralized securities markets that the SEC regulates.

Uniswap is a decentralized protocol built on top of immutable code. Uniswap Labs does provide a portal for users to connect to the trading protocol. In that way it is more like the taxi cab driver that drives a user to a stock exchange or a broker and completely unlike the stock exchange or the broker themselves.