Coinspeaker

SEC Stalls Decision on Franklin and Hashdex Bitcoin ETFs as Analysts Predict Wave of Approvals in January 2024

In a move that many may not have envisaged, the Securities and Exchange Commission (SEC) has provided an update on two Bitcoin ETF applications nearly a month before the scheduled deadline.

In a Tuesday filing, the Commission, via separate orders, initiated proceedings to allow for additional analysis into the proposals of Franklin Templeton and Hashdex. This is to determine that they are fully compliant with the Securities Exchange Act and investor protection rules, the SEC says.

Franklin seeks to list the Franklin Bitcoin ETF, which would track the price of Bitcoin. The Hashdex Bitcoin Futures ETF, on the other hand, seeks to invest in Bitcoin futures contracts and Bitcoin. However, both were not scheduled to receive word from the regulator until January 1, 2024.

Why Is the SEC Delaying?

The update from the SEC appears to suggest that it plans to approve all Bitcoin ETFs at once. That is considering that Franklin and Hashdex are the only two ETF applicants scheduled to receive their decision before the rest.

It might be understandable, what the Commission is trying to do. That is because, had it waited till January 1 to issue the latest update, it would generally need more than 9 days to revisit the applications and issue another decision.

Regarding Franklin and Hashdex, the SEC has asked for public comments on issues bordering on the potential for manipulation of the funds and underlying Bitcoin markets. So, interested parties have up to 21 days to submit their initial comments about the proposals to the SEC. However, rebuttals will only be due 35 days after publication in the Federal Register.

Interestingly, there are reasons to believe that the SEC is preparing to approve all spot Bitcoin ETF applications in a single day in early January. According to Bloomberg ETF Analyst James Seyffart, January 10 may just be the deal day.

So, it appears clear enough, what the SEC hopes to achieve with the mass approvals. That is to eliminate any unfair advantage that an ‘early-bird’ may have over other applicants if it does not give the go-ahead at the same time.

Spot Bitcoin ETF Approvals to Kickstart the Next Bull Run

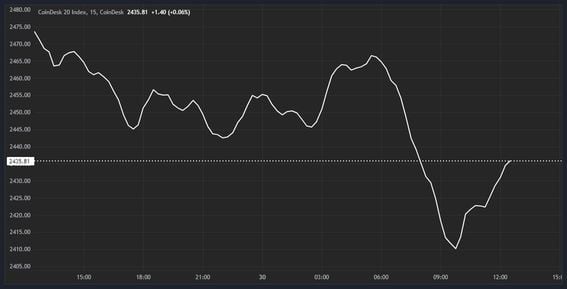

As it stands, there is a huge expectation that January 10 will mark a turning point for the crypto market. That is because, once the spot Bitcoin ETFs get approved, there will be a massive inflow of both institutional and retail money into the market, setting the tone for a potentially long bull run.

Based on these expectations, many analysts have even predicted very high strides for Bitcoin (BTC) price in 2024. As Coinspeaker earlier reported in August, Fundstrat foresees an almost 400% hike in the price of the flagship cryptocurrency. More recently, Matrixport also predicted an over 200% surge in BTC price to $125,000 by 2024 end.

Then there is also the issue of Bitcoin halving that will take place this coming April. Interestingly, Bitcoin halving has historically proven to usher in a bull run too. So, one way or the other, the coming conditions suggest a highly bullish season for Bitcoin. That is even as Bitcoin adoption is expected to see a massive surge as well.