Decentralized Finance (DeFi) is rapidly expanding but leaves Bitcoin holders with limited options, high fees, and underutilized assets in ecosystems dominated by Ethereum. Segment Finance addresses this gap on the BOB network, offering BTC holders innovative solutions like Liquid Staking Tokens (LSTs) and Babylon yield opportunities. With Babylon Points providing additional incentives for engagement, Segment Finance empowers users to maximize their BTC’s potential in DeFi through competitive rewards and efficient asset utilization.

A New Era for Bitcoin in DeFi

Bitcoin’s role in the DeFi landscape has historically been limited, often overshadowed by the dominance of Ethereum-based applications. Segment Finance changes this narrative by offering BTC holders access to a new suite of opportunities through its innovative approach. By integrating Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) into its ecosystem, Segment Finance bridges the gap between Bitcoin and DeFi, creating a space where BTC holders can unlock liquidity, earn competitive yields and retain growth potential.

Segment Finance positions itself as more than just a platform—it’s a solution that empowers Bitcoin holders to make the most of their assets in a decentralized, efficient, and rewarding environment.

What Sets Segment Finance Apart?

1. LST Portfolio: A Game-Changer for BTC Holders

Segment Finance has emerged as the premier platform for Bitcoin Liquid Staking Tokens (LSTs), offering users a powerful combination of asset diversity and innovative tools. This comprehensive portfolio provides BTC holders with unparalleled opportunities to leverage their assets effectively without losing ownership or potential rewards.

Liquid Staking Tokens (LSTs): Unlocking Liquidity with Flexibility

One of Segment Finance’s flagship features is the ability to stake BTC and mint stablecoins like S1. This unique mechanism allows users to retain their BTC’s growth potential while unlocking liquidity for other financial needs. Here’s how it works:

- Seamless Staking: Users can stake their BTC and mint S1 stablecoins, ensuring they don’t need to sell their Bitcoin to access liquidity.

- Dual Benefits: While the staked BTC continues to earn rewards, the minted S1 stablecoins can be used for trading, lending, or other DeFi activities, providing financial flexibility without sacrificing long-term value.

- Risk Mitigation: By staking in isolated pools, users enjoy enhanced security, ensuring their assets are protected from broader market risks.

LST Payment Card: Spending Without Compromise

The LST Payment Card is a revolutionary tool that redefines how users interact with their staked BTC. It bridges the gap between traditional finance and DeFi, offering unparalleled utility:

- Effortless Collateral Usage: Users can use their BTC LSTs as collateral to spend directly through the card, removing the need for complex conversions or selling assets.

- Reward Retention: Even as users spend against their collateral, their staked BTC continues to earn rewards, ensuring they never lose out on growth opportunities.

- Versatile Applications: From online shopping to real-world purchases, the LST Payment Card turns staked BTC into a usable asset without sacrificing its earning potential.

Redefining BTC LST Opportunities on BOB

Segment Finance has carved out a unique space in the BOB network as the go-to platform for Bitcoin Liquid Staking Tokens (LSTs). The platform supports a diverse portfolio of BTC LSTs, including:

- Bedrock’s UniBTC: Offering a 63x Diamond Boost.

- Solv’s SolvBTC and SolvBTC.BBN: Enhanced with Solv Points for greater rewards.

- Lombard’s LBTC: The largest Bitcoin LST, marking its first pool deployment on BOB.

- PumpBTC: Also introduced as a first on the network.

To further incentivize participation, Segment Finance provides boosted rewards across all LST pools on the BOB network:

- 2x Spice Rewards: Subsidized by BOB and Segment.

- Increased Babylon Points: Subsidized by BOB and Babylon for higher engagement.

- 2x Segment Points: Users can anticipate a $USEF airdrop in Q1 2025.

- Enhanced Native Lending Yields: Maximizing returns for participants.

These features make Segment Finance the best destination for BTC holders seeking innovative ways to grow their assets while leveraging the BOB network’s robust infrastructure.

2. Babylon Yields: Competitive Incentives for DeFi Enthusiasts

Segment Finance’s Babylon Yields redefine how users maximize their returns in the DeFi ecosystem. Designed to enhance engagement and profitability, this feature offers a range of lucrative opportunities for both novice and experienced users.

High Annual Percentage Rates (APRs): Maximizing Earnings

Babylon Yields stand out for their competitive APRs, ensuring users enjoy some of the best returns in the BOB ecosystem:

- Market-Responsive Rates: The platform dynamically adjusts APRs to remain competitive, ensuring users receive optimal returns based on current market conditions.

- Enhanced Yield Farming: By participating in liquidity mining programs, users can boost their earnings while supporting the platform’s liquidity needs.

- Scalable Rewards: Whether supplying assets or staking tokens, users benefit from scalable rewards that grow with their participation.

Segment Points: Loyalty That Pays

Segment Points form the backbone of the platform’s loyalty program, rewarding users for their activity and contributions:

- Activity-Based Earnings: Points are earned through a range of activities, including staking, supplying liquidity, and borrowing assets. These points reflect the user’s commitment to the platform.

- Exclusive Perks: Accumulated points increase eligibility for future rewards, such as airdrops, fee reductions, and premium platform features.

- Transparent Leaderboards: A real-time leaderboard fosters healthy competition among users, showcasing top contributors and encouraging consistent engagement.

Liquidity Mining: Making Every Token Count

Liquidity mining is a cornerstone of Babylon Yields, allowing users to put their assets to work:

- Dual Rewards: By providing liquidity to Segment’s pools, users earn rewards both in terms of interest and additional incentives.

- Low Risk, High Returns: Segment Finance’s isolated pools ensure that users can participate in liquidity mining with minimized exposure to broader market risks.

- Ecosystem Growth: Every liquidity contribution helps strengthen the Segment ecosystem, creating a win-win situation for both the platform and its users.

Why BOB Network Is the Perfect Base

Segment Finance’s integration with the BOB network is more than just a technical choice; it’s a strategic advantage that enhances the user experience and ecosystem capabilities. Here’s what makes the BOB network an outstanding foundation for Segment Finance:

- Low Gas Fees: Say goodbye to wallet-draining fees! BOB offers an incredibly cost-efficient environment for transactions, ensuring that every action you take on Segment maximizes your returns.

- Lightning-Fast Transactions: Time is of the essence in DeFi, and BOB doesn’t disappoint. With near-instant transaction speeds, users experience a seamless interface that keeps their operations smooth and frustration-free.

- Cross-Chain Compatibility: Segment Finance’s connectivity extends far beyond the BOB network. With seamless asset transfers across multiple networks, users enjoy a versatile and interoperable DeFi experience.

Built on Trust: Security and Reliability

When it comes to financial systems, trust and security are paramount. Segment Finance has taken robust steps to ensure user safety and confidence at every level of interaction.

1. Bug Bounty Program: Call in the Ethical Hackers

In collaboration with Immunefi, Segment Finance incentivizes security experts to find and report vulnerabilities. With rewards reaching up to $100,000 for critical discoveries, the platform ensures continuous improvement and rigorous protection against potential threats.

2. Audits That Inspire Confidence

Segment Finance leaves no room for doubt when it comes to transparency and reliability. Through regular audits conducted by industry leaders like Verichains and Mundus Security, the platform’s smart contracts and infrastructure are thoroughly vetted, providing users with peace of mind.

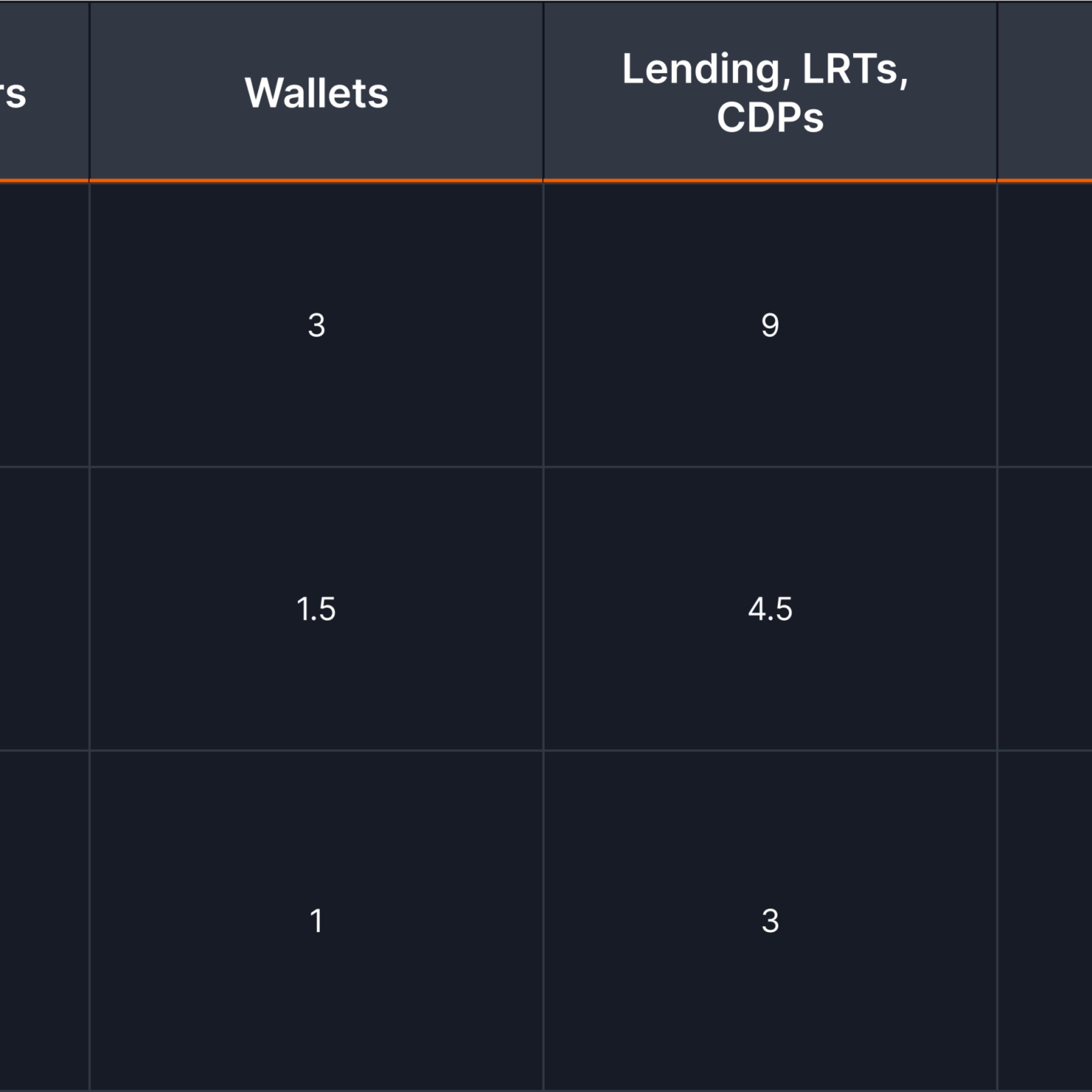

3. Multi-Signature Wallets and Timelocks

Multi-signature wallets and 48-hour timelocks are part of Segment’s robust security protocol. These measures ensure that funds and protocol changes are secure, transparent, and resistant to unauthorized access.

Community Vibes and Ecosystem Growth

1. Segment Spice Campaign

Forget mundane referral programs. Segment’s Spice Campaign brings a twist to community engagement by rewarding users not just for referrals but for bringing in high-quality participants who actively contribute to the ecosystem. It’s a win-win for everyone involved.

2. Educational Initiatives

Knowledge is power, and Segment Finance ensures its community is empowered. From engaging AMAs to detailed user guides, the platform makes DeFi accessible, understandable, and exciting for newcomers and veterans alike.

3. Airdrops That Make an Impact

Loyalty pays off. Segment Finance rewards early supporters and active users with well-structured airdrops, reinforcing its commitment to community building and long-term engagement.

Metrics and Vision

Strong Market Performance

Since its inception, Segment Finance has achieved impressive milestones, including:

- Market Size: Surpassing $10 million.

- Total Value Locked (TVL): Exceeding $8 million.

- User Base: Over 350,000 unique wallets actively using the platform.

- Protocol Ranking: Currently the sixth-largest protocol on the BOB network.

BOB Network Integration

The BOB network’s hybrid Layer-2 design combines Bitcoin’s security with Ethereum’s versatility. With its transition into a Bitcoin-Secured Network (BSN) through Babylon integration, BOB delivers enhanced security and finality for transactions. Segment Finance plays a pivotal role in this ecosystem, contributing significantly to its adoption and success.

The Vision for the Future

Segment Finance aims to build the largest market portfolio across every chain it operates on, offering a full spectrum of assets, including:

- Blue-Chip Cryptocurrencies: Catering to the most sought-after assets in the market.

- Stablecoins: Providing liquidity and stability to users.

- Major LSTs and Liquid Restaking Tokens (LRTs): Expanding its offerings to cover all essentials.

This ambitious vision positions Segment Finance as a leader in DeFi innovation, continually evolving to meet the needs of its users while staying ahead in a competitive landscape.

What’s Next for Segment Finance?

Segment Finance isn’t resting on its laurels. The platform is constantly evolving to redefine possibilities in the DeFi space. Here’s a glimpse of what’s on the horizon:

1. Real-World Asset (RWA) Lending

Imagine a world where real-world assets are tokenized and seamlessly integrated into DeFi. Segment Finance is bringing this vision to life with its upcoming RWA lending feature, offering users a bridge between tangible assets and decentralized finance.

2. $USEF: A Universal Token

Segment Finance is introducing $USEF, a governance token designed to unify its networks. This token will streamline decision-making processes, enable efficient revenue-sharing, and create a cohesive ecosystem across all its platforms.

3. Enhanced Cross-Chain Features

The future is interconnected, and Segment Finance is leading the charge. With plans to enhance cross-network compatibility, users can look forward to even more seamless asset transfers and expanded ecosystem opportunities.

Final Thoughts: Why Segment Finance Leads the Pack

Segment Finance is more than just another DeFi protocol—it’s a game-changer for Bitcoin Liquid Staking Tokens (LSTs) and yield farming. In a market where BTC often struggles to find its place in DeFi, Segment Finance bridges the gap with innovative features like LSTs, Babylon yield programs, and robust security measures. Backed by a vibrant community and operating at the heart of the BOB network, Segment empowers Bitcoin holders to unlock liquidity, earn competitive yields, and retain the growth potential of their assets.

For those ready to take their Bitcoin to the next level, Segment Finance offers a seamless blend of rewards, security, and innovation. Whether you’re a seasoned DeFi participant or new to decentralized finance, Segment provides the tools to maximize your BTC’s value. Step into the future of DeFi today with Segment Finance—the ultimate destination for Bitcoin holders.

Official Links

- Website: https://segment.finance/

- Segment Finance App: https://app.segment.finance

- Medium: https://medium.com/@segment.finance

- Docs: https://docs.segment.finance/

- ImmuneFi Bug Bounty Program: https://immunefi.com/bug-bounty/segmentfinance/information/

- Verichains Audit Report: https://verichains.io/?search=segment+finance

- Mundus Security Audit Report: https://github.com/mundus-sec/public-reports/tree/main/Segment%20Finance%20Oracle%20Provider%20Security%20Audit

- Twitter: https://twitter.com/segment_fi

- Discord: https://discord.gg/SegmentFinance

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.