Sui Network, an L1 blockchain platform, has taken to Twitter to clear the air after speculations that they deliberately misrepresented the emission chart and that the team was dumping staking rewards in the company’s native token, SUI.

Sui sets the record straight on the ongoing controversy

Earlier, a DeFi expert made allegations against Sui Network for intentionally misrepresenting emissions and the team dumping rewards from staked SUI to Binance. In response, Sui has issued a statement explaining that it is gradually adding to the Sui token supply as planned and previously communicated. In addition, they clarified that they have never exceeded the market cap as they added liquidity to the ecosystem.

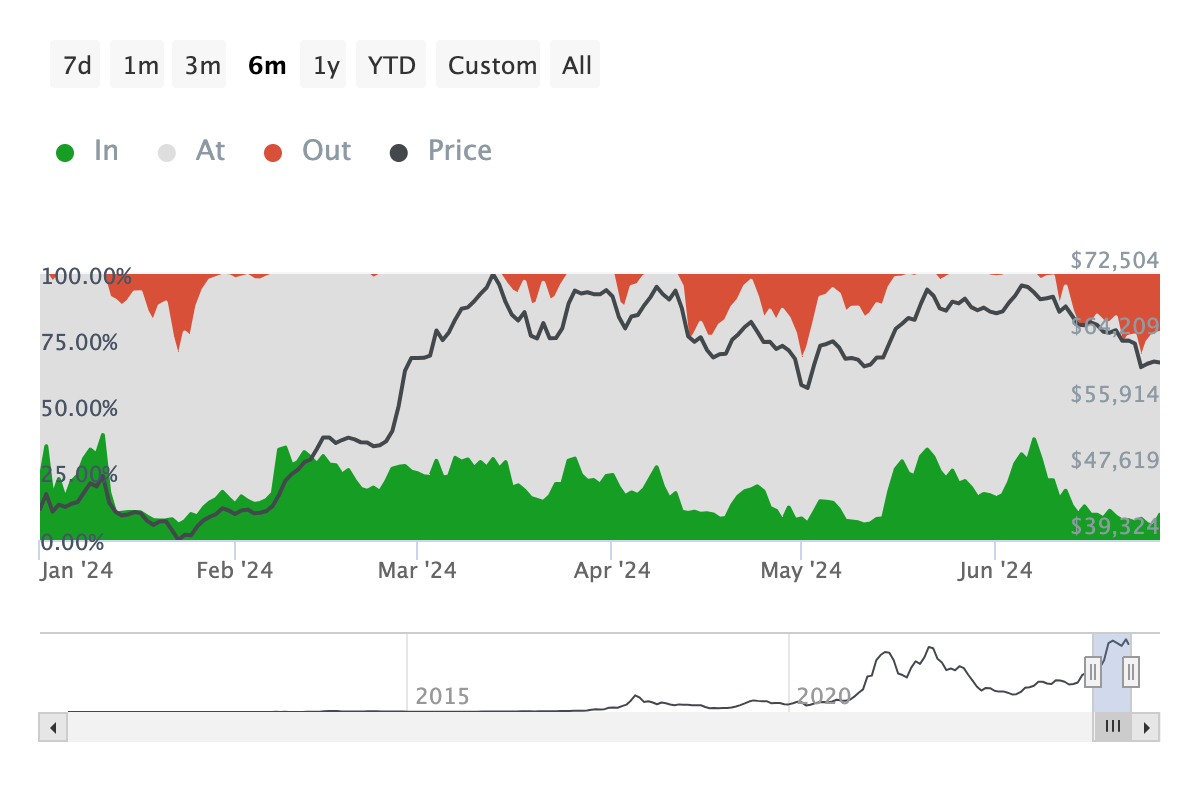

According to the Defi expert, Coinmarketcap only displayed exclusive emissions from its launchpad once each month. At the same time, Sui refused to publish an actual emissions chart which, according to the expert, appears to be a strange decision for such a respectable project. The expert continued saying that despite CoinMarketCap only receiving and disclosing data once, there was a significant increase in supply seen every day.

The analyst also explained that the corresponding emissions include emissions from SUI’s locked allocations, including VCs, and they were released without any restrictions.

In Sui’s statement, they denied this claim saying that they had not sold any staking rewards or tokens that were locked and non-circulating staked SUI on Binance. They also highlighted that the specific transaction the DeFi expert referenced was a contractual lockup payment as opposed to proof of the platform dumping the staking rewards on the open market.

On-chain data highlights Sui Network’s lack of transparency

In the case of circulating supply, nearly 250 million of the 600 million SUI is non-foundation. That means that the corresponding emissions increase the supply of non-foundation materials by 10% each month. In other words, if you own SUI, you are currently losing 20% of your investment every month, which is more expensive than the hyperinflationary Bolivar in Venezuela in 2022, according to the expert.

In response to the news, many critics disapproved of their operations, saying they were scammers and lacked transparency. One user, NFT Deity, even suggested that the team face prosecution for participating in illegal token sales.

Lastly, Sui Network confirmed that they would publish a detailed projection of the token release schedule and share the link with the users. Meanwhile, SUI, the network’s native token, is trading at $0.72, down 1% in the last day and 6.65 over the last week.