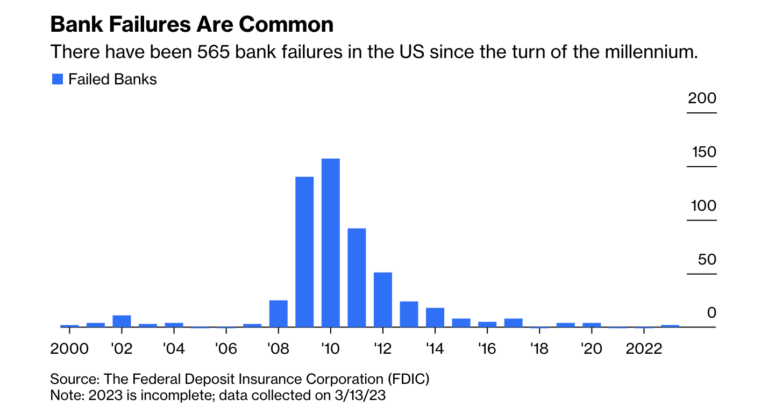

Since the turn of the millennium, more than 550 central banks have failed. This raises the question of who bails out the “too big to fail” banks? The answer is taxpayers, who bear the brunt of the cost of these bailouts. This is not capitalism, but rather a form of fascism, where the government is given the power to intervene in the economy, regardless of the wishes of individuals and free markets. This is a form of central banking, which is a type of communism. It is time for humans to reevaluate our economic system and understand the consequences of central banking.

Protect Your Savings Like Joe Montana

Invest In Bitcoin With Your IRA

Central Banks: Too Big To Fail, Too Big To Bail?

Central banks have become too big to fail, and too big to bail out. This has caused some to question their role and influence on the global financial system. Central banks are responsible for the stability of the banking system, the health of the economy, and the security of financial markets. They are a critical part of the infrastructure of the global financial system. As such, they have become increasingly interconnected and influential. When one central bank fails, it can have a ripple effect on the entire system. This interconnectedness has caused central banks to become too big to fail. In other words, it is impossible to let a major central bank fail, since this could cause a domino effect that could destabilize the entire financial system. At the same time, bailing out a central bank is not an option, since this could create a moral hazard in which other central banks become too reliant on government bailouts. The result is a system in which central banks are too big to fail and too big to bail out. This has led to some calling for more oversight and regulation of central banks to ensure that they are held accountable for their actions. However, it is also important for central banks to remain independent, since their primary role is to maintain the stability of the financial system. Ultimately, the challenge is to find a balance between providing the necessary oversight and regulation of central banks while also allowing them to remain independent and secure. This is a difficult task, but it is one that must be addressed if the global financial system is to remain stable and secure.

Central Banks: The End of Capitalism or The Rise of Fascism?

The issue of central banks and their potential effects on capitalism and fascism is a complicated one that has been the subject of much debate. Central banks are powerful entities that control the money supply and the interest rate, which in turn affects the economy. This power can be used to influence the economy in a variety of ways, and some have argued that it could lead to the end of capitalism or the rise of fascism. To understand the potential implications of central banks, it is helpful to first consider the history of capitalism and fascism. Capitalism is an economic system based on private ownership of the means of production and free markets. It is widely credited with helping to create the modern world, and it is largely responsible for the incredible economic advancements of the past two centuries. On the other hand, fascism is a system of government that emphasizes total control of the economy and society by a centralized authority. It has been associated with authoritarianism and extreme nationalism, and it has been used as a tool for political repression in many countries. It is important to note that central banks are not inherently either capitalist or fascist; they are simply financial institutions that are meant to serve the public by providing stability and liquidity in the financial system. However, their power and influence can be used to support either capitalist or fascist goals. For example, the Federal Reserve in the United States has been used to support capitalist policies such as low inflation and low interest rates, while other central banks have been used to support more nationalist and authoritarian policies. Ultimately, the answer to the question of whether central banks will lead to the end of capitalism or the rise of fascism depends on how they are used. If they are used responsibly and in accordance with the principles of capitalism, they can help to promote economic growth and individual freedom. However, if they are used irresponsibly and in support of fascist policies, they could lead to the erosion of economic and political freedoms. Therefore, it is important for citizens to remain vigilant and ensure that their central banks are used for the benefit of all.

Central Banking: The Benefits and Burdens of Abolishing Communism?

Central banking is a system of government regulation and supervision of a country’s financial institutions and markets. It often includes the regulation of monetary policy, the issuance of currency, and the supervision of private banks. Central banking has been a major factor in the success of modern economies, but it has also been a source of debate and controversy. The debate over central banking has been particularly intense in countries that have recently abolished communism, such as the former Soviet Union and its satellite states. The benefits of central banking in a post-communist economy include increased economic stability and the ability to manage economic growth. Central banks can provide a more stable economic environment by controlling inflation, setting interest rates, and providing a secure environment in which to conduct financial transactions. This is especially important in a post-communist economy, where investment and growth can be disrupted by political and economic uncertainty. Central banks also play an important role in providing financial intermediation between lenders and borrowers. By providing access to credit and encouraging the flow of capital, central banks can facilitate investment and economic growth. This can help to create jobs, reduce poverty, and increase economic security. However, there are also some drawbacks to central banking in a post-communist economy. Central banks often have a monopoly on the issuance of currency and the setting of interest rates, which can lead to inefficient allocation of resources. Furthermore, central banks can be vulnerable to political interference, which can lead to corruption and mismanagement. In conclusion, central banking can be a beneficial tool for a post-communist economy, but it also presents some potential drawbacks. The benefits of central banking include increased stability, access to credit, and the ability to manage economic growth. However, central banks can also be vulnerable to political interference, leading to corruption and inefficiency. For these reasons, it is important that any reforms of central banking be implemented with caution and a clear understanding of the potential benefits and risks.

Central Banking: The Impact of Failed Banks on Taxpayers?

The failure of a bank can have a wide-ranging impact on taxpayers, depending on the size of the bank, its financial position, and the severity of the failure. In some cases, taxpayers can face significant costs associated with the failure of a bank. When a bank fails, it often has a large number of unpaid debts and other obligations. In some cases, these obligations may include deposits that were insured by the federal government. In these cases, the Federal Deposit Insurance Corporation (FDIC) will step in to pay out the insured deposits, but may require the government to reimburse it for the insurance payments. In addition, in some cases, taxpayers may be required to bear the costs associated with the liquidation of a failed bank’s assets. This can include costs associated with the sale of the bank’s assets, as well as costs associated with resolving any legal disputes that may arise in the liquidation process. Finally, taxpayers may also be required to bear the costs associated with any compensation or restitution payments that may be required in the aftermath of a bank failure. This could include payments to customers of the failed bank, as well as payments to investors or creditors of the failed bank. Overall, the impact of a failed bank on taxpayers can vary widely depending on the size and severity of the failure, as well as the specific circumstances surrounding the failure. In some cases, taxpayers may be required to bear significant costs associated with the failure of a bank, while in other cases the costs may be minimal.

Central Banking: The People vs. The Banking System?

The debate between central banking and the people versus the banking system is one that has been ongoing for many years. Central banking is a system in which a central bank is responsible for the control of money supply and interest rates, as well as other aspects of the economy. This system is used by many countries around the world and is seen by some as a necessary part of economic stability. However, it is also seen by some as a system that gives the banking system too much power and control over the people. On one side of the debate, proponents of central banking argue that it is necessary in order to maintain economic stability. The central bank is able to use its control of money supply and interest rates to manage the amount of money in circulation and to ensure that the money is being used in an efficient manner. This helps to reduce inflation, maintain a consistent level of economic growth, and can even provide some protection against economic crises. On the other side of the debate, opponents of central banking argue that it gives too much power and control to the banking system. They argue that the banking system is able to use its control of money supply and interest rates to manipulate the economy for its own benefit, rather than for the benefit of the people. This can lead to increased inequality and a lack of economic opportunity for many people. Ultimately, the debate between central banking and the people versus the banking system is one that will likely continue for many years to come. While both sides have valid points, it is important to remember that the needs of the people should always come first. Central banking can be a powerful tool for economic stability, but it must be used in a way that is fair and equitable for all citizens.

The conclusion that can be drawn from the fact that over 550 central banks have failed since 2000 is that centralized banking is not a viable economic system. It is not capitalism, but rather a form of socialism or communism, as evidenced by the fact that it is taxpayers who bail out the ones that are “too big to fail.” It is time to recognize and understand the shortcomings of centralized banking, and to move towards more equitable, market-driven economic systems.