The Monetary Authority of Singapore (MAS) has upped the risk level for crypto exchanges from medium-low to medium-high. This change reflects updates to the country’s Countering the Financing of Terrorism (CFT) laws.

It’s a big move, and it is based on the 2024 Terrorism Financing (TF) National Risk Assessment (NRA). Moreover, it includes changes since the last assessment in 2020.

Key risk areas identified in 2024

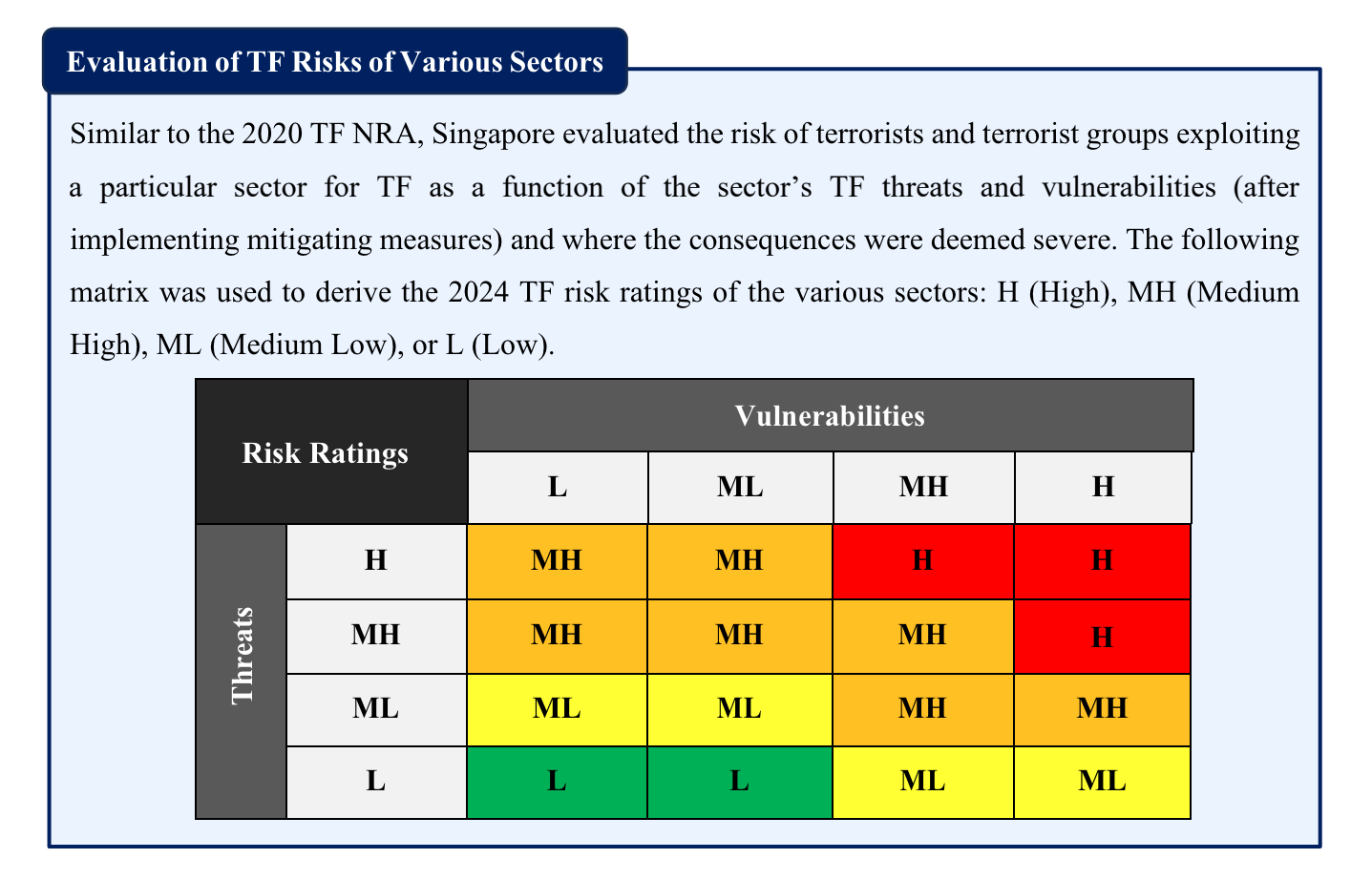

The 2024 TF NRA identifies key risk areas that look a lot like those from 2020. Money remittances and banks remain highly vulnerable to TF threats. Their services can be easily accessed for cross-border payments.

Digital Payment Token (DPT) service providers, however, have moved up from medium-low to medium-high risk. Non-profit organizations, cross-border cash movements, and precious stones, metals, and products remain at medium-low risk.

“As a result, TF risks associated with Digital Payment Token (DPT) service providers have been elevated from Medium-Low to Medium-High risk, necessitating increased industry vigilance against this evolving threat.”

MAS

The updated TF NRA backs the goals of Singapore’s National Strategy for CFT, launched in 2022. The strategy has three main aims: Prevent, Detect, and Disrupt.

First, it aims to deter terrorists, their organizations, and supporters from using Singapore for TF activities. Second, it seeks to detect and trace TF activities through robust monitoring and tracking, especially in high-risk sectors.

Third, it plans to disrupt and enforce against terrorists and their supporters who try to raise, move, and use funds for terrorism.

MAS states that it has thoroughly examined the terrorist groups posing the most significant threats to the region and identified how these groups are funded.

They’ve looked at international developments, like the Israel-Hamas conflict and tensions in the Middle East, and their potential impact on Singapore.

The TF threats to different sectors of the economy were analyzed, using data from TF investigations, financial intelligence, Suspicious Transaction Reports (STRs), Requests for Assistance (RFAs), and Mutual Legal Assistance (MLA) requests.

Regulators and supervisors reviewed vulnerability assessments of their sectors, considering key TF threats and how certain products, services, and activities might be exploited for TF purposes.

Industry feedback was also taken into account. They compared the latest threats with those identified in the 2020 TF NRA.

Reporting by Jai Hamid