According to a Bloomberg report citing persons with knowledge of the situation, Singapore’s central bank and police officials have been assisting banks to develop universal guidelines for enhancing their vetting strategy when opening crypto accounts.

According to the article, the research has been continuing for about six months. The sources told Bloomberg that a different industry study, which is anticipated to define best practices in areas including due diligence and risk management, might be released in the next two months. The stablecoins, NFTs, and gaming credits would be covered in the study that focuses on businesses that offer payment services.

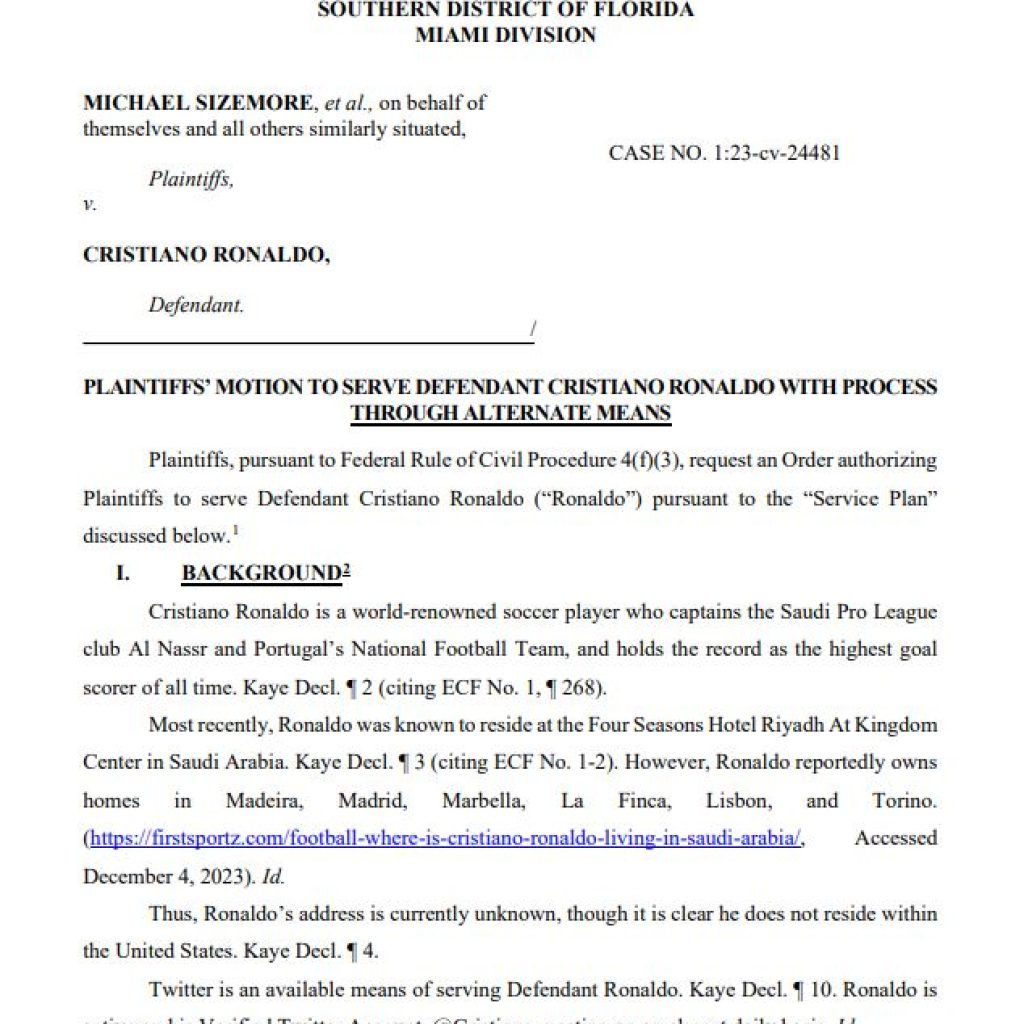

Monetary Authority of Singapore(MAS)

According to the Monetary Authority of Singapore (MAS), the central bank of Singapore, banks operating there are not prohibited from doing business with companies that deal with cryptocurrencies or other types of digital assets. Bloomberg’s sources state that this project, which focuses on businesses providing services in payments, trading, and transfers of these assets, will also cover stablecoin, non-fungible tokens, as well as transferable gaming or streaming credits. In addition, even with such standards, the banks will determine whether to accept these clients based on their willingness for risks.

“As with any other current or prospective customer, banks are required to conduct customer due diligence measures to understand and manage the risk(s) posed by them.”

Singapore has experienced its fair share of cryptocurrency scandals involving local companies like Terraform Labs and the cryptocurrency hedge fund Three Arrows Capital. It is one of the major jurisdictions that has created a licensing system for the sector and has suggested additional restrictions on cryptocurrency trading by retail investors.

U.S. officials have cracked down on banks that provided services to cryptocurrency users during the past several weeks in an effort to cut off the industry’s access to financial services.

Since the collapse of crypto-friendly banks Signature Bank, Silicon Valley Bank (SVB), and Silvergate Bank, crypto firms have been frantically searching for banking partners and legal frameworks in which to operate. Similar “shadow ban” actions have already been taken by other jurisdictions, including India.