The potential flip could further cement Solana’s status as an “Ethereum-killer,” which has been questioned due to the recent network outages.

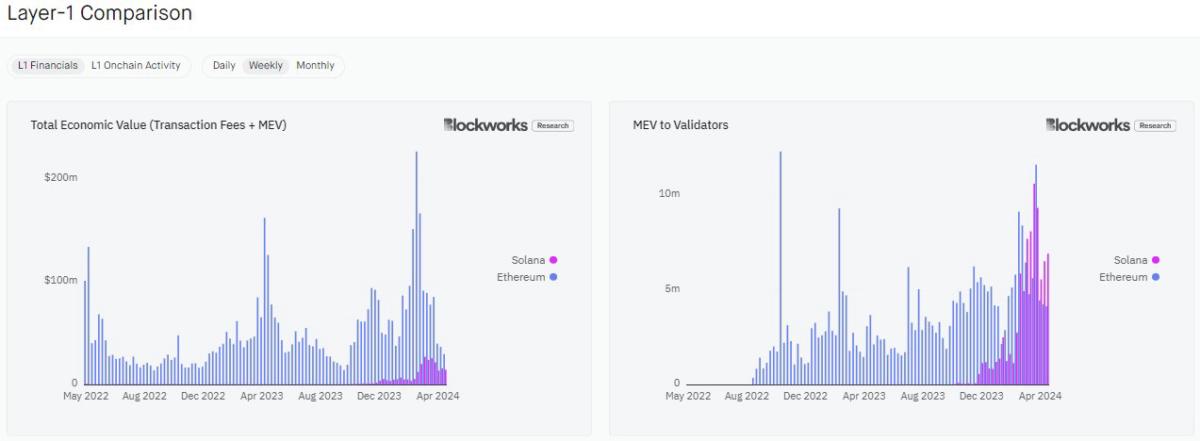

The Solana network could be on track to overtake the Ethereum network in transaction fees, a potentially significant development for Solana’s status as a so-called “Ethereum-killer.”

Solana could flip Ethereum’s transaction fees as soon as this week, according to Dan Smith, senior research analyst at Blockworks, who wrote in a May 7 X post:

Captured MEV, or Maximal Extractable Value, refers to profits that are mostly captured through arbitrage trading on the protocols. MEV measures the maximum amount of value that can be extracted from a blockchain by a user or a group of users.