Solana, the blockchain network known for its speed and scalability, has witnessed an unprecedented surge in decentralized finance (DeFi) activity, propelling its native token, SOL, to new heights.

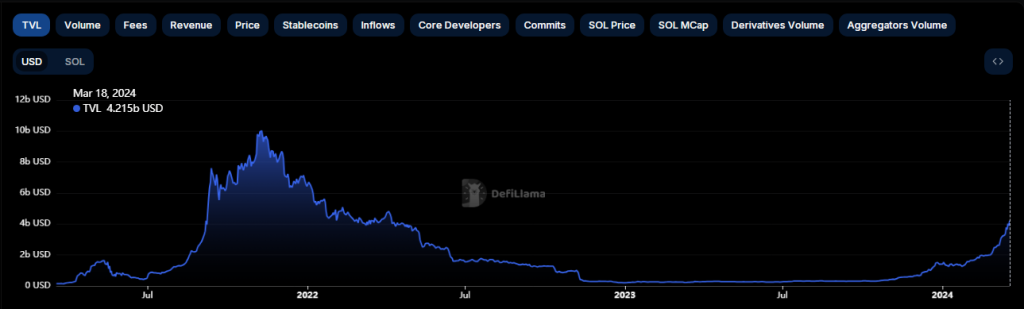

Not only has Solana’s DeFi total value locked (TVL) soared by over 80% in the past month, but its network activity has also surpassed that of Ethereum, further solidifying its position as a leading player in the cryptocurrency market.

Solana Shines With Soaring DeFi TVL

On the back of impressive growth, Solana’s DeFi TVL has reached its highest level in the last two years, currently standing at an impressive $3.8 billion, according to data from DefiLlama.

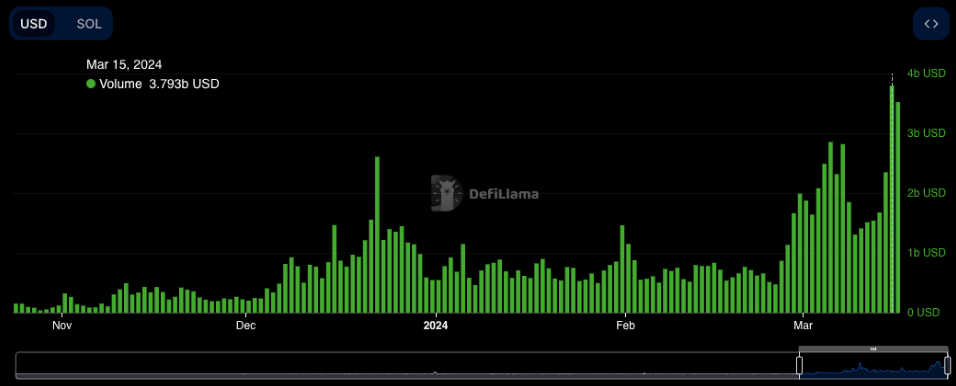

This surge in TVL can be attributed to a substantial uptick in trading volume on the DeFi protocols built on the altcoin’s Layer 1 network (L1). Since the beginning of the month, the daily trading volume on these protocols has experienced an astonishing 125% increase.

Altcoin’s Network Activity Up As Well

However, it is not just the DeFi metrics that showcase Solana’s remarkable performance. The network’s activity has recently surpassed that of Ethereum, the world’s leading blockchain platform.

Solana’s solid infrastructure and low transaction fees have attracted traders and investors seeking opportunities amidst a turbulent market. As a result, Solana’s total trading volume on March 16 exceeded Ethereum’s daily volume by more than $1.1 billion, reaching an impressive $3.52 billion, as reported by DefiLlama.

The combination of Solana’s explosive DeFi growth and network activity has had a profound impact on the value of the SOL token. Trading at $207 at the time of writing, SOL has experienced a remarkable 70% increase in value over the past month, defying the market’s downward trend.

While other cryptocurrencies grapple with price reversals, SOL continues to surge, buoyed by bullish sentiment and growing demand.

Analysts have pointed to key indicators, such as the On-Balance-Volume (OBV) and Chaikin Money Flow (CMF), which further validate SOL’s upward trajectory. The OBV, which tracks buying and selling pressure, has witnessed a steady uptrend, signaling a growth in buying momentum.

The CMF, measuring the flow of money in and out of an asset, confirms the increase in liquidity inflow into the SOL market. These indicators suggest a sustained positive sentiment surrounding SOL.

The remarkable growth of Solana’s DeFi ecosystem, coupled with its surge in network activity, has positioned the blockchain as a formidable player in the cryptocurrency market.

As the industry continues to evolve, Solana’s ability to attract DeFi participants, generate substantial revenue through network fees, and defy market trends bodes well for its future prospects.

Featured image from Pexels, chart from TradingView