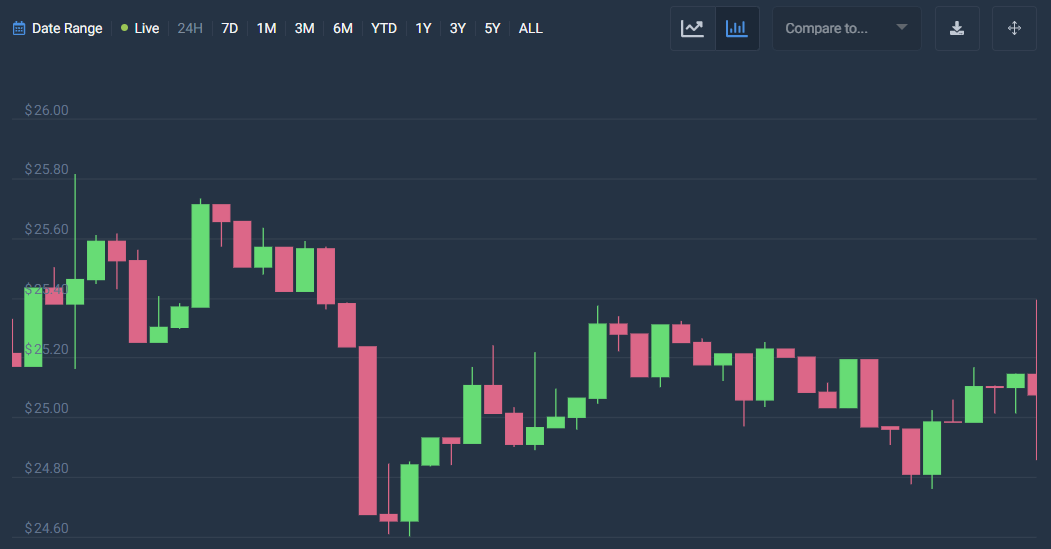

Solana price analysis for January 22, 2023, reveals the market following a complete bullish movement; moreover, Solana has obtained massive positive momentum, signifying a decline for the SOL market. The price of Solana has remained negative over the past few hours. Today, the price crashed and went from $26.18 to $24.75. However, the market started to increase further in value soon after, as the cryptocurrency had already gained most of its value. Moreover, Solana has increased and reached $25.04, just shying away from the $25.50 mark.

Solana’s price today is $24.98 with a 24-hour trading volume of $2.30B, a market cap of $9.07B, and a market dominance of 0.85%. The SOL price decreased by 0.73% in the last 24 hours.

Solana reached its highest price on Nov 6, 2021, when it was trading at its all-time high of $259.52, while Solana’s lowest price was recorded on n/a when it was trading at its all-time low of $0.00. The lowest price since its ATH was $8.09 (cycle low). The highest SOL price since the last cycle low was $26.33 (cycle high). The Solana price prediction sentiment is currently bullish, while the Fear & Greed Index is showing 53 (Neutral).

Solana’s current circulating supply is 362.91M SOL out of the max supply of 533.68M SOL. The current yearly supply inflation rate is 15.38% meaning 48.38M SOL was created in the last year. In terms of market cap, Solana is currently ranked #3 in the Proof-of-Stake Coins sector, ranked #2 in the Solana Network sector, and ranked #7 in the Layer 1 sector.

SOL/USD 1-day price analysis: Latest developments

Solana price analysis reveals the market’s volatility following an increasing movement. This means that the price of Solana is becoming more prone to the movement towards either extreme, showing further decreasing dynamics. The high price of the SOL cryptocurrency is $25.40, with an open price of $25.15. Conversely, the low price of SOL is present at $24.86, with a change of -0.86% and a closing price of $24.96.

The SOL/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to be dominated by bulls. The SOL/USD price appears to be moving upwards, illustrating an increasing market. The market appears to have broken the resistance band, which will trigger a reversal movement; this might prove fatal for the bulls.

Solana price analysis reveals that the Relative Strength Index (RSI) is 71, showing an extremely unstable cryptocurrency stock. This means that the SOL cryptocurrency falls in the inflation region. Furthermore, the RSI appears to move linearly, indicating a consistent market. The equivalence of selling activities and buying activities causes the RSI score to remain dormant.

Solana price analysis for 7-days

Solana price analysis reveals the market’s volatility following an increasing movement, which means that the price of Solana is becoming more prone to experience variable change on either extreme. The high value is present at $25.40, with an open price of $24.96. Conversely, the low price is $24.77, with a change of 0.14% and a closing value of $24.99.

The SOL/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. Moreover, the market’s trend seems to have shown bullish dynamics in the last few days. As a result, the market has decided on a positive approach.

Solana price analysis shows the Relative Strength Index (RSI) to be 46, signifying a stable cryptocurrency. This means that the cryptocurrency falls in the central-neutral region. Furthermore, the RSI path seems to have shifted to an upward movement. The increasing RSI score also means dominant buying activities.

Solana Price Analysis Conclusion

Solana price analysis reveals that the SOL cryptocurrency has an increasing trend with much room for further activity on the increasing extreme. Moreover, the market’s current condition appears to be following a negative approach. Therefore, we can assume that the bears will start making their moves soon to initiate their control over the market.