Solana price analysis shows rising signs as the market shows downside risk. As a result, the bears have obtained control of the Solana market, which might change the course of the market for the worse as bears gather to decline the price, and SOL now expects a positive period to take over in the next few days. As a result, the bears will do everything they can to maintain control. Moreover, the SOL price has experienced decreasing dynamics in the last few hours.

The market shows the price of Solana crashed yesterday to the $11.50 mark and further increased to $12.11. Solana continues a positive movement. Moreover, the next day, Solana prices crashed and reached $11.88. SOL currently trades at $11.88; SOL has been down 8.39% in the last 24 hours with a trading volume of $488,181,774 and a live market cap of $4,325,061,850. SOL currently ranks at #15 in the cryptocurrency rankings.

SOL/USD 4-hour price analysis: Latest developments

Solana price analysis illustrates that the present condition of the market demonstrates bearish potential as the price moves downwards. Moreover, the market’s volatility follows a decreasing movement, making the cryptocurrency less susceptible to volatile change on either extreme. As a result, the upper limit of Bollinger’s band rests at $13.7, serving as the strongest resistance point for SOL. Conversely, the lower limit of Bollinger’s band is present at $11.62, serving as a support point for SOL.

The SOL/USD price travels under the Moving Average curve, indicating the market is following a bearish movement. However, as the market experiences increasing volatility today, the Solana price has more room to shift to a positive trend; however, that also means that the cryptocurrency has more room to move to the positive side. In addition, the SOL/USD price seems to move upward, signifying am increasing market with further increasing dynamics.

Solana price analysis reveals that the Relative Strength Index (RSI) score is 32 making the cryptocurrency lie in the devalued region. Furthermore, the RSI score moves upwards, indicating that the buying activity exceeds the selling activity while moving toward stability.

Solana price analysis for 24-hours

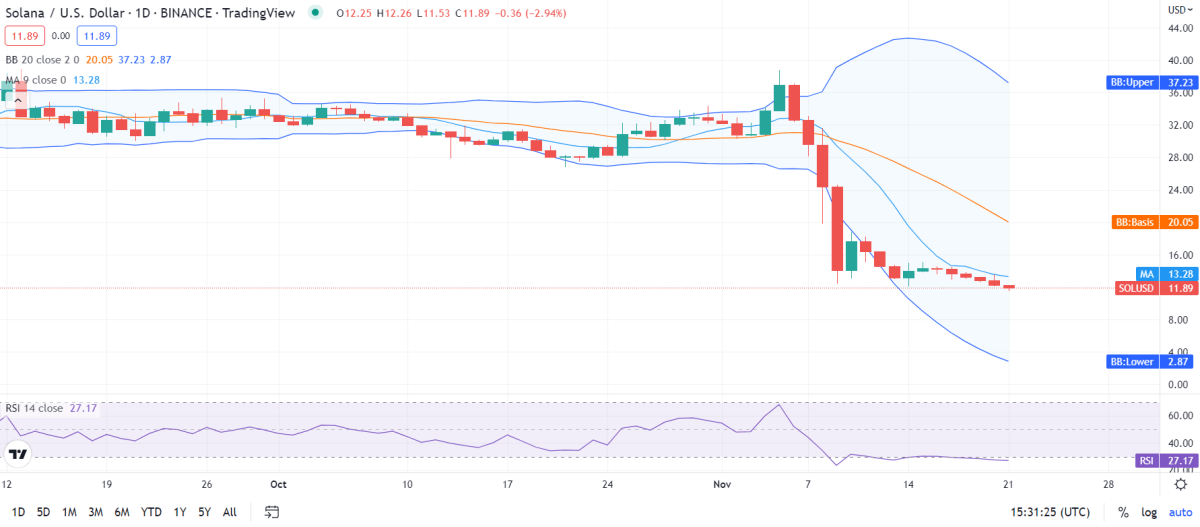

Solana price analysis has experienced a fluctuating movement in the last few days. However, with the volatility decreasing. Moreover, as the volatility closes, it makes the value of the cryptocurrency less vulnerable to change. As a result, the upper limit of Bollinger’s band rests at $37.23, serving as the most substantial resistance for SOL. Contrariwise, the lower limit of Bollinger’s band rests at $2.8, serving as another resistance point for SOL.

The SOL/USD price appears to be crossing under the Moving Average curve, displaying bearish momentum. However, the support and resistance are closing in, indicating decreasing volatility with massive chances of a trend reversal. However, the price moves downwards towards decreasing characteristics.

The Relative Strength Index (RSI) score appears to be 27, showing the cryptocurrency’s low value. It falls in the undervalued region. However, the RSI score follows a linear movement signifying a consistent market and gestures toward decreasing dynamics. The increasing RSI score indicates buying activity exceeds the selling activity.

Solana Price Analysis Conclusion

Solana price analysis shows bearish momentum and further constant potential. Moreover, the bears have shown their deterrence and might take control of the market soon for the long term as the market shows massive signs of change. Therefore, according to this analysis, Solana is expected to have a bright future, with the bulls taking the bears completely out of the picture, provided the price breaks the market.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.