Solana price analysis reveals that the cryptocurrency has been following a slight downward trend, with the price of SOL/USD in decline. Over the past week, SOL/USD has dropped from a high of $12.40 to a low of $11.27, However, the bulls showed some signs a few days, pushing the price up to $11.49. But the current trend for SOL/USD is bearish and traders should watch for a break of support at $11.27.

The SOL/USD is currently trading at $11.31, but in order for the bulls to take control of the market, they must break above the $11.49 resistance and establish a new higher low. The 24-hour trading volume currently stands at $111 million, and a market cap of $4.153 billion.

SOL/USD 4-hour price analysis: Market tightens as trend shifts

The hourly Solana price analysis shows a bearish trend, with the price of SOL/USD in decline. Over the past 4 hours, SOL/USD has dropped from a high of $11.31 to a low of $11.27. The market has been trading in a tight range and the bulls have failed to push the price higher, with the bears in control of the market.

The MACD indicator is crossing the signal line and is in the process of moving into the bearish zone. The RSI is also trading in the bearish zone and is indicating that there could be further downside pressure in the near term. The 50-day moving average is currently trading at $11.31 and is providing support for the price, while the 200-day moving average is at $11.49 and is providing resistance.

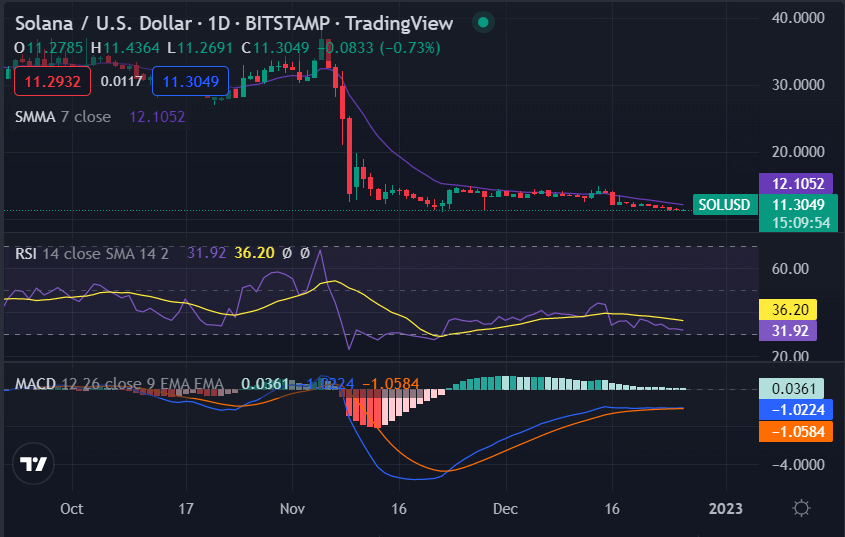

Solana price analysis for 1 day: The market indicates strong bearish dynamics

On the 1-day Solana price analysis, we can see that prices have been mostly trading sideways with a bearish bias in the last few days. Prices are currently facing resistance at $11.49, which is preventing prices from breaking out to the upside. The market for SOL started the week with bearish dynamics, with prices dropping to $11.27, its lowest point in the past week.

The Moving average convergence/divergence indicator (MACD) is turning bearish, signaling further downside pressure. The Relative Strength Index (RSI) has also dropped into the bearish zone and is indicating bearish momentum. The 50-day moving average and 200-day moving average lines are both trending downward, indicating a bearish market.

Solana price analysis conclusion

In conclusion, the Solana price analysis shows that the SOL/USD is currently in a bearish trend, with the bulls failing to break out of the range. The market is currently facing resistance at $11.49 and could continue to decline if this level is not broken, but could rally if it is. The bulls need to regain control of the market and break out of the range in order to push prices higher.