SOL price struggles to gain upward traction as DApp volumes plunge, spot ETF odds dwindle, and memecoins fail to rally.

Solana’s native token, SOL (SOL), has struggled to close above $150 since Aug. 11. Despite showing consistent buying activity each time it tests the $125 support, SOL remains largely flat compared to four months ago.

Even more troubling is the fact that the Solana network has experienced significant growth in deposits and activity during this period, but this expansion has yet to be reflected in SOL price. Let’s examine the factors keeping SOL’s price below $150 and what needs to occur for it to surpass this level.

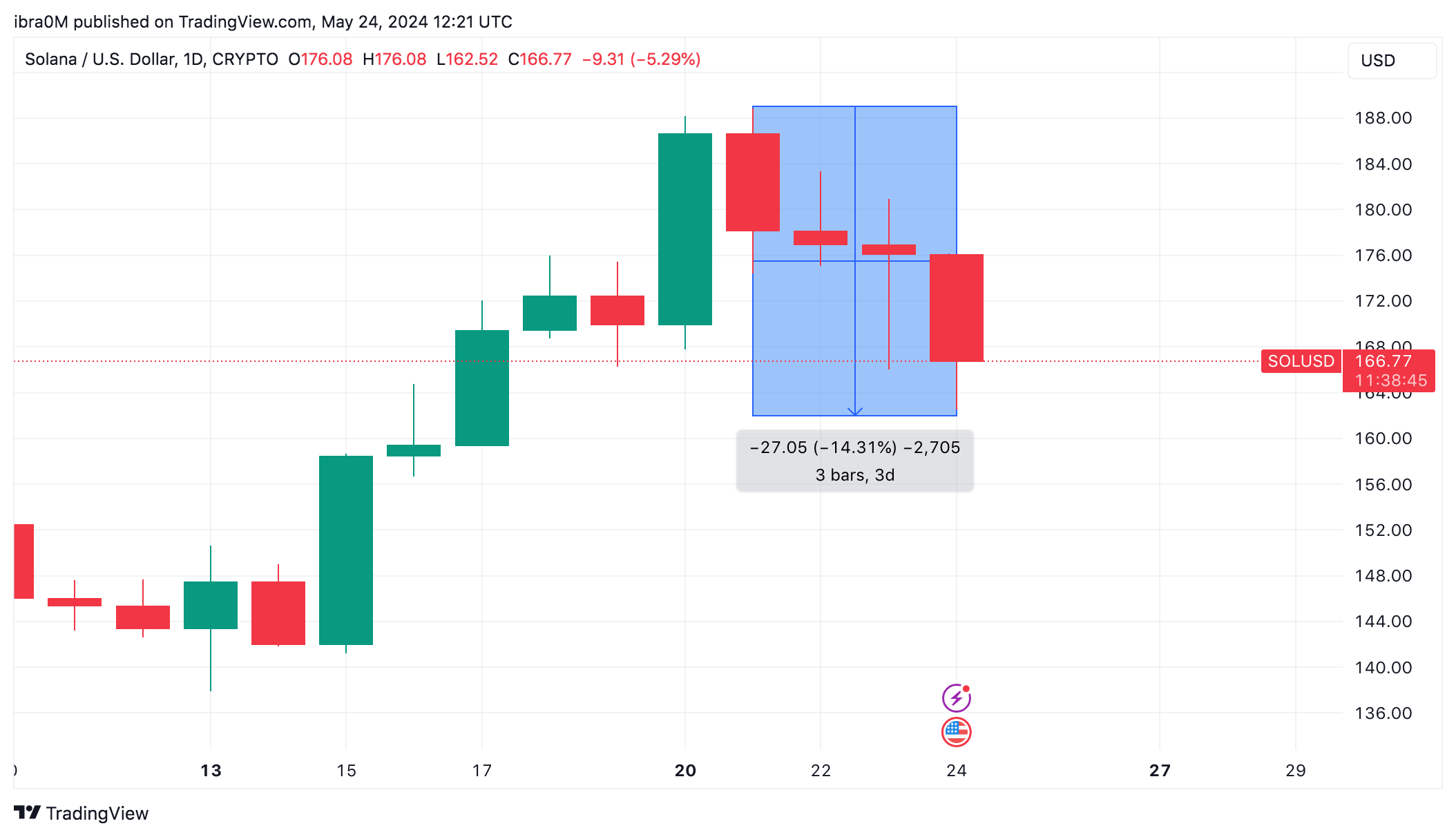

Some market participants argue that SOL’s recent hype was driven by a few airdrops, memecoins, and pump.tun activity, which proved unsustainable. Over the past thirty days, notable price corrections include Dogwifhat (WIF) with a 38% drop, BONK losing 39%, Lido (LDO) declining 43%, POPCAT falling 48%, and Wormhole (W) decreasing 31%. According to DappRadar, pump.fun volume has dropped 44% over the past week, now totaling $133.5 million.