The total value locked on Solana surged but is this enough to send SOL price to a new all-time high?

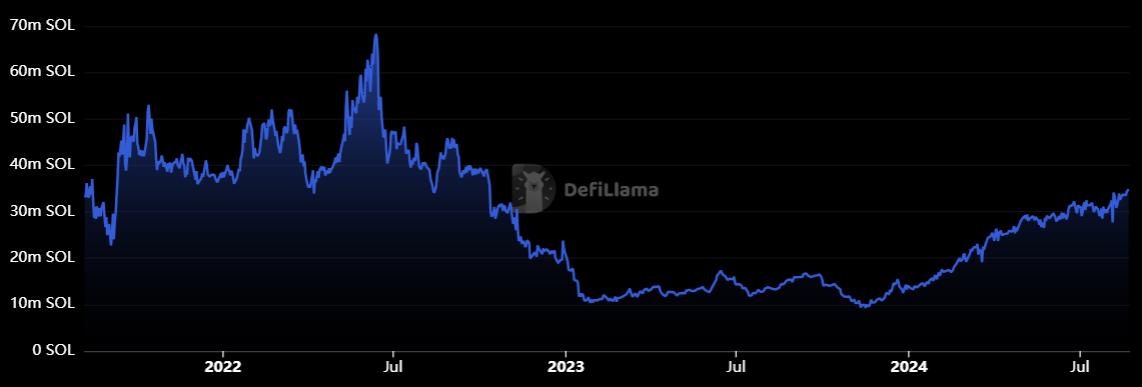

Solana’s native token, SOL (SOL), has been unable to break above the $150 resistance level since Aug. 12. However, some network metrics have shown strength, including the total deposits in its decentralized applications, which have surged to their highest level since October 2022. Traders are now questioning whether these improvements in network fundamentals are sufficient to drive SOL’s price back to $190 and what factors may be hindering its performance.

One reason for the lack of enthusiasm among investors stems from Cboe Global Markets' recent decision to remove the 19b-4 forms for Solana spot exchange-traded funds (ETFs) from its website on Aug. 16. Some market participants, including finance lawyer Scott Johnsson, suggest that the United States Securities and Exchange Commission has informally rejected the Solana ETF, consistent with Chair Gary Gensler’s earlier stance.

Eric Balchunas, a senior ETF analyst at Bloomberg, shares a similar view, noting that while the S-1 filings from the ETF issuers remain active, the chances of approval are slim, with the only hope being a change in the current SEC administration should Donald Trump win the US presidential election. As a result, investor optimism regarding the potential launch of a spot Solana ETF has diminished, reducing the immediate impact of Solana’s network metrics.