Bitcoin and stocks continue to show resilience as BTC/USD surpasses $46,000 after the S&P 500 hits a historic milestone of 5,000 points.

The upward trajectory in both markets is fueled by positive sentiments and notable trends, marking a significant period for investors.

Bitcoin and S&P 500 synchronized surge

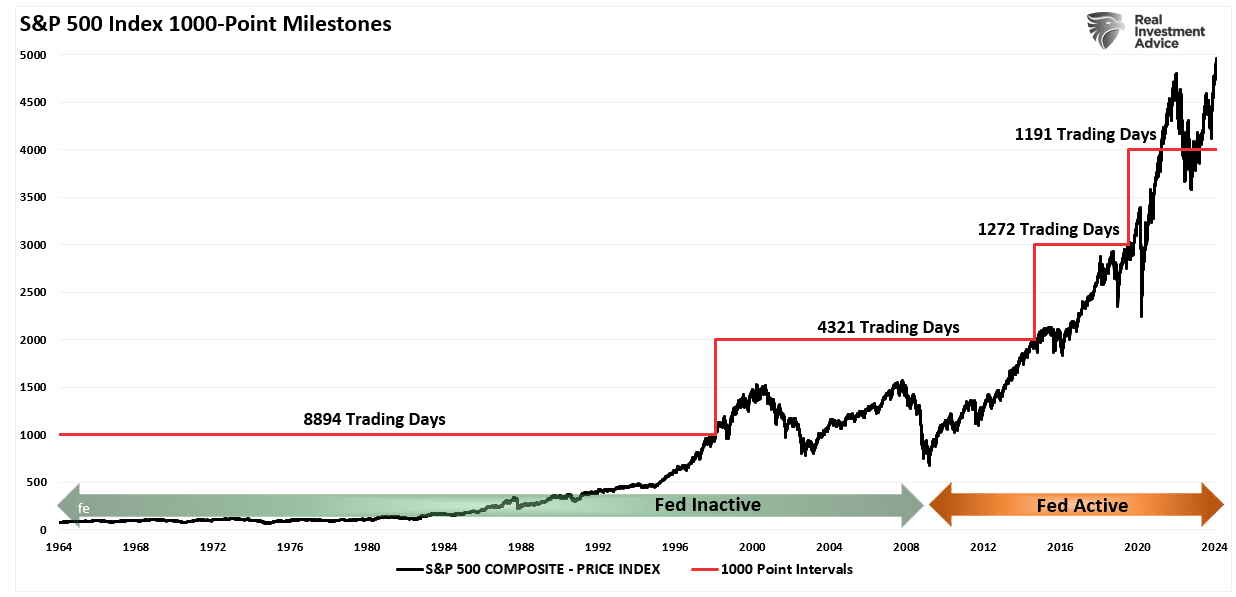

The recent surge in Bitcoin’s price, now over $46,000, coincides with a groundbreaking achievement in the U.S. stock market. The S&P 500 reached an unprecedented 5,000 points, a psychological milestone that underlines the robust performance of traditional financial markets.

BTC/USD has exhibited strength, showing a 2% increase since the recent daily close. Notably, Bitcoin navigated through rising sell-side liquidity, reaching levels not witnessed since the launch of the United States spot Bitcoin exchange-traded funds (ETFs).

Analysts point to key indicators, such as net inflows for nine consecutive days and lower outflows from the Grayscale Bitcoin Trust (GBTC), as supporting factors for the positive momentum.

Parallel historic run for U.S. stocks

The surge in Bitcoin is mirrored by a historic run in U.S. stocks, with the S&P 500 gaining approximately 900 points since its October 27th low. This translates to a staggering addition of nearly $8.5 trillion in market capitalization within just over three months.

The Kobeissi Letter, a prominent trading resource, acknowledged the significance of this achievement, terming it a truly historic run for stocks.

Continued uptrend expected

QCP Capital, in its market update on February 8, predicts a sustained uptrend for both stocks and cryptocurrencies. The firm suggests that any potential dip in equities will likely be met with buying activity as underallocated investors seek returns. This bullish sentiment is anticipated to spill over to Bitcoin and Ethereum (ETH), accentuated by narratives surrounding the Bitcoin halving and the potential launch of an ETH spot ETF.

Keith Alan, co-founder of trading platform Material Indicators, emphasizes the importance of avoiding wicks below the 50-day simple moving average, currently hovering just above $43,000. This cautionary stance reflects the need for Bitcoin to maintain key support levels to sustain its upward momentum.

Acknowledging weekly closing basis support

Trader Aksel Kibar highlights the resilience of BTCUSD’s horizontal support, emphasizing that the $40,000 mark is held on a weekly closing basis. This observation underscores the stability in Bitcoin’s price action and suggests a foundation for potential further upward movement.

With Bitcoin surpassing $46,000 and the S&P 500 hitting historic highs, traders and investors are now eyeing the potential for Bitcoin to approach the top of its price range. The synchronized surge in both markets indicates a broader market sentiment that favors risk assets.

Investors are advised to monitor Bitcoin’s adherence to key technical levels, particularly the 50-day simple moving average, as outlined by Keith Alan. Understanding the significance of weekly closing basis support, as emphasized by Aksel Kibar, provides valuable insights for investors navigating the cryptocurrency market.

Positive outlook for quities and crypto

As the market continues its bullish trajectory, the prevailing sentiment suggests that any market correction in equities is likely to be met with renewed buying interest. This positive outlook is expected to influence both Bitcoin and Ethereum positively, further solidifying their positions in the broader financial landscape.