Rumors are swirling in the financial world as social media chatter fuels hopes for the approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC) on Friday. Despite the excitement, experts and analysts offer divergent opinions on the likelihood of such swift approval.

Social media buzz over SEC’s Bitcoin ETF approval speculation

The cryptocurrency community was set abuzz when several tweets on Crypto X sparked optimism about the SEC’s imminent approval of a spot Bitcoin ETF. The prospect of this milestone has driven a surge of enthusiasm on social media platforms.

One tweet that ignited the frenzy came from Grayscale’s legal chief, who cryptically mentioned that he was “just filling out some forms.” Another widely shared tweet from a reporter further stoked the speculation, suggesting that approval could be just around the corner.

While the cryptocurrency world anticipates a Friday decision, several analysts remain cautious, expecting potential approvals to materialize in the coming week.

TechCrunch reporter Jacquelyn Melinek added fuel to the fire with a post on X (formerly Twitter), citing sources “extremely close to the matter.” Melinek indicated that multiple ETFs might receive approval, fostering anticipation of significant developments in the cryptocurrency market.

Crypto community’s social media frenzy and analyst skepticism

One tweet garnered significant attention from Grayscale’s chief legal officer, who merely stated, “Just filling out some forms.” This cryptic message drew 1.9 million views and 6,700 likes, intensifying speculation.

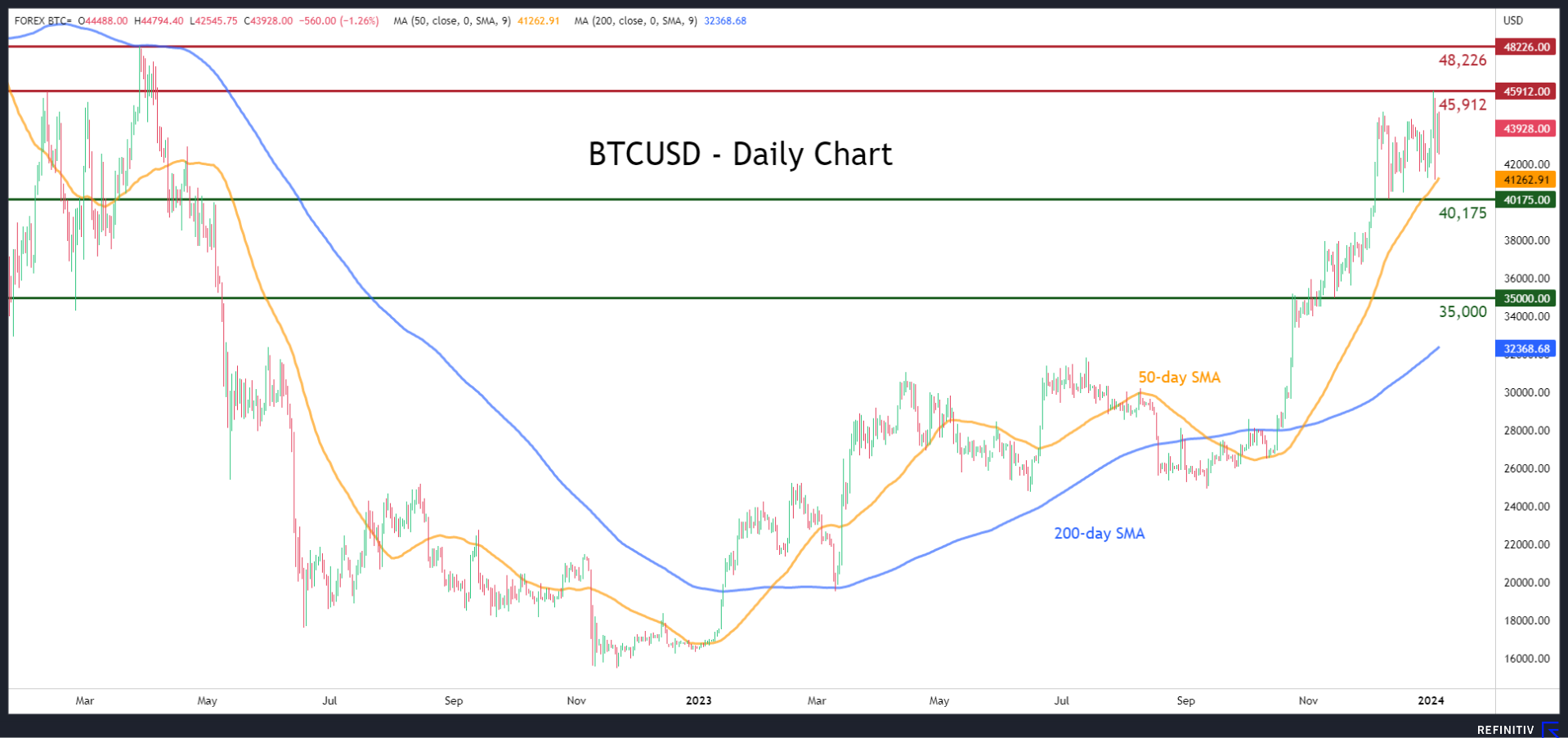

Furthermore, the trending hashtag #BTCETF and discussions about “Bitcoin ETFs” on Twitter indicate the keen interest of the cryptocurrency community. The price of Bitcoin itself has experienced a 3.4% surge in the last 24 hours, following a sharp decline on January 3rd.

Trader Scott Melkor summed up the prevailing sentiment, stating, “The rumor mill is going full steam” in response to the lively back-and-forth discussions on social media.

Expert insights on Bitcoin ETF approval timing

amid the excitement, seasoned analysts have offered a dose of skepticism. Bloomberg ETF analyst James Seyffart dismissed much of the speculation around a January 5th approval as “noise.” Seyffart maintains his expectation that approval will be granted between January 8th and 10th, emphasizing the uncertainty surrounding the decision.

Attorney and commercial litigator Joe Carlasare highlighted a crucial aspect. He pointed out that the public comment period for several ETF applications doesn’t close until midnight on January 5th. Carlasare’s view is that this timeline makes it “very unlikely” for approval to occur before the start of the next week.

A senior Bloomberg ETF analyst, Eric Balchunas shed light on the SEC’s ongoing process. Balchunas explained that the SEC is currently in the phase of providing final comments. Subsequently, issuers will submit their final 19b-4 and S-1 forms, which require SEC approval before an ETF can commence trading. Notably, an approved 19b-4 form is vital for the spot Bitcoin ETF’s effective approval.

Scott Johnsson, the general partner at VB Capital, voiced his skepticism about an ETF approval before the next week. He questioned whether all 19b-4 applications were cleared and if the SEC would entertain simultaneous approvals.