Coinspeaker

Spot Bitcoin ETFs Outflows Surge to $742M in Three Days, GBTC Bleeds

After seeing massive inflows during the first half of March 2014, the spot Bitcoin ETFs have been bleeding badly since the start of this week. On Wednesday, March 20, the nine spot Bitcoin ETFs recorded total net outflows of $261 million.

According to data from Farside Investors, the three-day net outflows amounted to $742 million, with March 18 and 19 witnessing respective net outflows of $154.3 million and $326.2 million. The Grayscale Bitcoin ETF (GBTC) turns out to be the major show spoiler recording $386 million in outflows on Wednesday.

This week, the Grayscale Bitcoin fund has already lost over $1.5 billion in net outflows. With this, the total outflows from GBTC ever since the Bitcoin ETF launch has crossed $13.2 billion. Along with GBTC, even the Invesco Galaxy Bitcoin ETF (BTCO) recorded a net outflow of $10.2 million.

On a recent trading day, BlackRock’s iShares Bitcoin Trust (IBIT) experienced its second-lowest net inflow at $49.3 million, trailing just $4 million above its previous daily low recorded on February 6. Likewise, the Fidelity Wise Origin Bitcoin Fund (FBTC) also saw a comparably low inflow day, registering $12.9 million. while all other funds, witnessed either negative or zero inflows.

Bitcoin maximalist Max Keiser expressed his views on investors in Bitcoin ETFs, referring to them as the epitome of ‘dumb money.’ He observed that they often engage in buying and selling Bitcoin ETFs, frequently without achieving substantial gains and mostly incurring losses. However, this trading activity does generate significant commissions for brokers. Keiser highlighted the challenges these investors face in navigating Bitcoin’s volatility effectively, which can result in potential financial setbacks.

As predicted,

ETF buyers are the quintessential ‘dumb money’ who will buy and sell the #Bitcoin ETF’s and realize no gains (and mostly losses) but will generate lots of commissions for brokers.

They can’t surf #Bitcoin’s volatility, and they’ll drown. https://t.co/sUwNMxWIdb

— Max Keiser (@maxkeiser) March 20, 2024

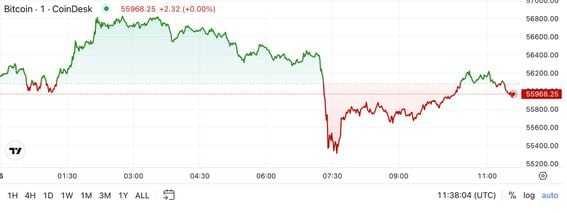

Bitcoin Price Action

The Bitcoin price has bounced back significantly following the dovish stand of the Fed as it plans to continue on its stand of three rate cuts by the year-end. QCP Capital has observed a significant response in the cryptocurrency market, marked by a complete reversal with Bitcoin (BTC) rising back above $67,000. The demand appears to be primarily driven by spot trading, with funding rates showing minimal changes.

In a recent statement, crypto analyst Michael van de Poppe discussed the significant rebound observed in Bitcoin’s price, suggesting a continuation of the upward trend. Van de Poppe expressed his belief that Bitcoin is likely to undergo a consolidation phase following the bounce, followed by another surge towards its all-time high prior to the halving event.

Massive bounce on #Bitcoin initiating continuation here.

I think we'll be consolidating, and, given the strong bounce, have another run to the all-time high pre-halving. pic.twitter.com/CfPbnNOJTS

— Michaël van de Poppe (@CryptoMichNL) March 21, 2024

However, if the Bitcoin price declines below the $60,000 mark, there is a possibility that the cryptocurrency might experience further weakness, potentially testing the $50,000 to $52,000 range.

Spot Bitcoin ETFs Outflows Surge to $742M in Three Days, GBTC Bleeds