Coinspeaker

Spot Bitcoin ETFs Saw 4th Consecutive Day of Inflows, Totaling $257M Yesterday

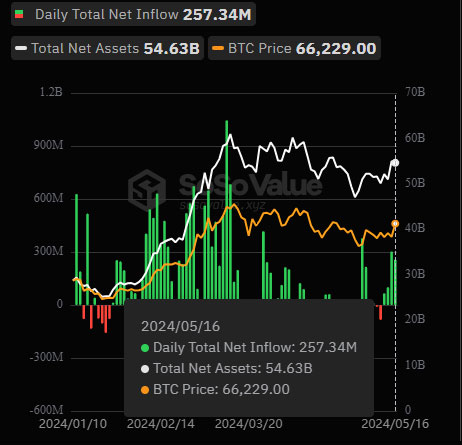

Spot Bitcoin exchange-traded funds (ETFs) saw a significant uptick in the last four days of inflow, recording the highest flow of about $257.34 million on May 16. This positive shift was partly logged by the first-quarter 13F reporting season of Wall Street, where major financial companies declared huge Bitcoin stakes that surpassed certain projections.

Photo: SoSoValue

BlackRock’s iShares Bitcoin Trust (IBIT) was the second-largest trust by net asset value and received the highest inflow of $94 million on Thursday. Over the last three weeks, IBIT had no positive inflow tendencies. Fidelity’s Bitcoin ETF (FBTC) was not far behind, as it gained $67 million. Additionally, Bitcoin ETF of Ark Invest and 21Shares saw $62 million in net inflows.

According to Thursday data, Grayscale’s Bitcoin Investment Trust (GBTC) witnessed the first net inflow of $4.64 million since its conversion in January after it had experienced huge net outflows. The new net flow indicated that it is likely changing in favor of the trust.

Growing Institutional Interest in Bitcoin ETFs

The positive trend extends beyond the top players. Valkyrie’s Bitcoin ETF raked in $18.5 million, while funds from Bitwise, Franklin Templeton, Invesco, and Galaxy Digital secured single-digit inflows. This broad-based participation indicates a growing interest in spot Bitcoin ETFs across the investment spectrum.

Major financial institutions like Morgan Stanley and the State of Wisconsin Investment Board disclosed holdings in spot Bitcoin ETFs, exceeding some initial expectations. Morgan Stanley held over $270 million, and Wisconsin held $163 million as of March 31st, 2024.

Adding further fuel to the fire, international hedge fund Millennium Management revealed a staggering $1.94 billion investment in shares across five spot Bitcoin ETFs as of March 31st. This significant allocation highlights the growing confidence of institutional investors in the Bitcoin market. Interestingly, BlackRock’s Bitcoin ETF represents Millennium’s largest holding, followed closely by Fidelity’s offering.

Mixed Views on Crypto ETFs

Despite the increasing interest, some major players are not very interested. Sticking to a point against launching a spot Bitcoin ETF, the new Vanguard CEO Salim Ramji asserts the company’s point of view reflecting the complexity and nuance of the market view concerning these investments.

On the other hand, the fact that the major institutional investors are more and more interested in it is undeniable. Banking firms such as JPMorgan and financial firms like Bracebridge Capital have made commitments to these ETFs.

Furthermore, Galaxy Digital, which saw a 40% increase in its net earnings recently, partly owing to the influence of these ETFs, suggests a possible correlation with Bitcoin’s price shock this week. These developments have the potential for Bitcoin to register significant gains in the coming months as major players join the arena.

Spot Bitcoin ETFs Saw 4th Consecutive Day of Inflows, Totaling $257M Yesterday