Coinspeaker

Spot Bitcoin ETFs See 3rd Consecutive Days of Inflow Streak, Reaching $216M Yesterday

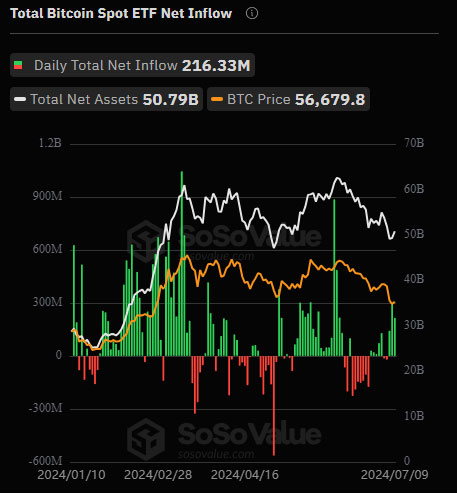

The US spot Bitcoin exchange-traded funds (ETFs) market is attracting renewed interest from institutional investors. On July 9, 2024, the market recorded a substantial $216.33 million in net inflows, marking the third straight day of positive inflows amid the potential shift in investor sentiment.

Photo: SoSoValue

According to data from SoSo Value, BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows with an impressive $121.03 million. Fidelity Digital Assets’ Wise Origin Bitcoin Fund (FBTC) followed closely, drawing $90.95 million in net inflows. Major financial institutions are becoming more comfortable with the evolving Bitcoin ETF market.

Adding to the interest, Ark Invest and 21Shares’ ARKB, an ETF focused on innovation with Bitcoin exposure, saw a significant $43.3 million in inflows. This suggests growing acceptance of Bitcoin as a potential asset within thematic portfolios, particularly by firms known for their disruptive investment strategies.

Bitcoin ETFs Mixed Outflows

While the overall trend leans positive, Grayscale’s Bitcoin Trust (GBTC), the second-largest Bitcoin ETF, bucked the trend with net outflows of $37.5 million. Grayscale’s outflow trend is driven by various factors, including the ongoing premium GBTC trades compared to its underlying Bitcoin value. Bitwise’s BITB also experienced minor outflows of $4.72 million.

The influx of capital into spot Bitcoin ETFs seemingly coincided with a positive price movement for the underlying asset. Bitcoin rose 2.70% in the past 24 hours, reaching $58,740, according to CoinMarketCap. BTC’s price action is a reaction to the increased institutional demand reflected in the ETF inflows.

The broader market context remains a key factor to consider. Investors are eagerly awaiting key US economic data scheduled for release later this week, including the initial jobless claims and consumer price index (CPI), both due on Thursday. These figures will provide further insights into the health of the US economy and potentially influence investor decisions across asset classes, including Bitcoin.

Bitcoin Sees Relief as Fed Backtracks

Federal Reserve Chair Jerome Powell spoke on Capitol Hill on July 9. He said the US economy is no longer “overheated” and believes the labor market is “back in balance”. This could create a better environment for riskier assets like Bitcoin, as fears of strict monetary policies may lessen.

The recent rise in net inflows for US spot Bitcoin ETFs shows a growing institutional interest in Bitcoin. Despite some challenges, the combination of major financial institutions adopting Bitcoin, its increasing price, and a possibly less restrictive Fed policy provides a cautiously optimistic view of Bitcoin investment.

Spot Bitcoin ETFs See 3rd Consecutive Days of Inflow Streak, Reaching $216M Yesterday