Bloomberg ETF analyst Eric Balchunas said the $625 million in trading volume excluding Grayscale’s ETHE was “healthy” and expects a “sizeable chunk” of that sum will convert to inflows.

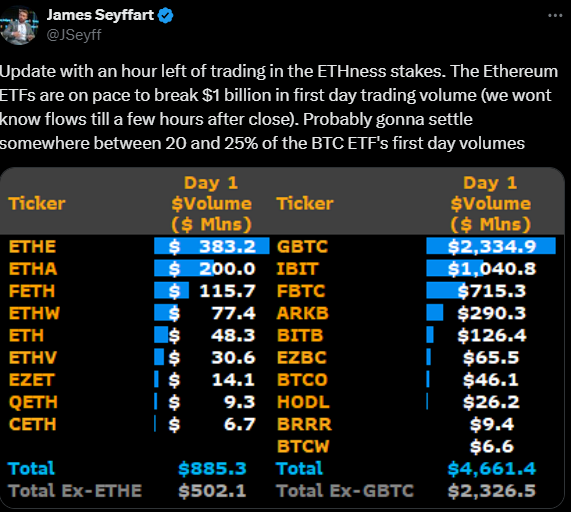

United States listed spot Ether exchange-traded funds generated around $1.08 billion in cumulative trading volume on its first day of trading — roughly 23% of what the spot Bitcoin ETFs saw on their opening day.

The converted Grayscale Ethereum Trust (ETHE) and BlackRock’s iShares Ethereum Trust (ETHA) saw the most volume on July 23 at $458 million and $248.7 million, respectively, according to preliminary data from Bloomberg ETF analyst Eric Balchunas.

The Fidelity Ethereum Fund (FETH), Bitwise Ethereum ETF (ETHW) rounded out the top four with $94.3 million and $63.8 million, while the 21Shares-issued spot Ether ETF came in last, failing to crack the $10 million mark.