While the stablecoin market has seen significant redemptions in the past three months, the supply of tether, the largest stablecoin by market capitalization, has increased by 2.46 billion since mid-November 2022. Tether is the only one of the top five stablecoins by market valuation that has seen a supply increase in the past three months.

Tether Supply Rises While Competitor Stablecoins See Declines

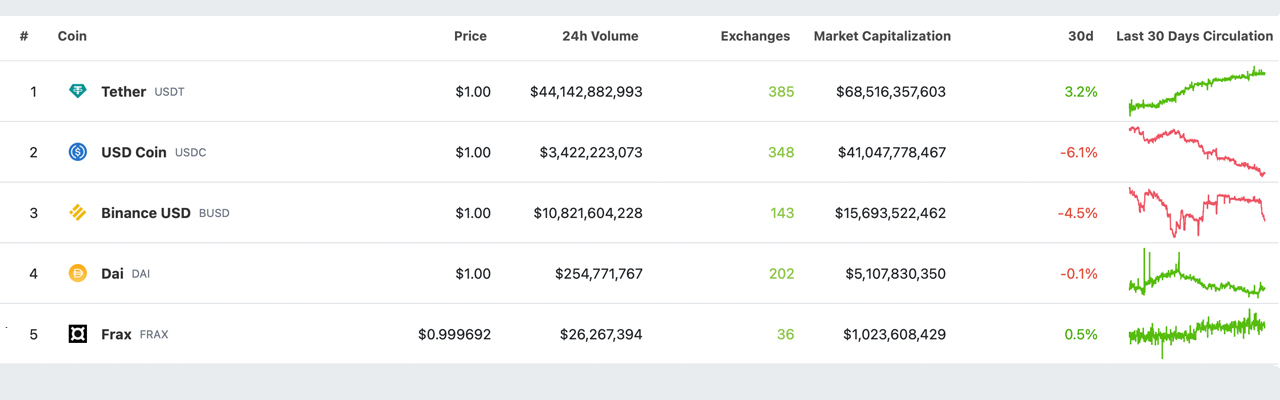

Much has changed in the past three months following the collapse of FTX and its aftermath. The stablecoin economy has experienced significant redemptions, and 30-day statistics from February 14, 2023, show that three of the top five stablecoins have seen a decline in their market capitalizations. The affected stablecoins are usd coin (USDC), binance usd (BUSD), and DAI. While BUSD experienced significant redemptions after the announcement that Paxos would no longer mint the stablecoin, USDC saw the largest decline, losing 6.2% in the last month. BUSD decreased by 4.5% in the last 30 days, and DAI had a slight decrease of 0.1%.

Tether (USDT), on the other hand, has seen a 3.2% increase in supply over the last 30 days. In fact, over the past three months, USDT’s supply has grown by 3.74%. Together, the top five stablecoins make up the majority of the stablecoin economy and the significantly large trade volume of dollar-pegged tokens. On November 17, 2022, USDT’s circulating supply was around 65.94 billion, and after a 3.74% increase, it has risen to 68.41 billion today. While USDT’s supply has grown over the past three months, the bottom four stablecoins have not seen any growth and, in fact, have all experienced declines.

For example, usd coin’s circulating supply on November 17, 2022, was around 44.40 billion, but it has since dropped to the current 40.98 billion. BUSD had a circulating supply of 23.03 billion on November 17, 2022, and it is now roughly 15.69 billion, a decrease of 31.87%. Makerdao’s DAI token has a circulating supply of 5.09 billion today, compared to 5.44 billion three months ago, a 6.43% decrease. The fifth-largest stablecoin by market valuation, FRAX, had a circulating supply of 1.177 billion on November 17, 2022, and now has 1.024 billion as of February 14, 2023, a decrease of 12.99%.

Over the past five years, stablecoins have greatly expanded, with some dollar-linked tokens failing to endure. The stability of the reserve and the issuer’s ability to uphold it are crucial factors in a stablecoin’s success. The Terra UST collapse of 2022 underlined this importance, and the past year has demonstrated that the stablecoin economy is greatly impacted by external factors like economic conditions, market volatility, and regulatory developments.

What are your thoughts on Tether’s recent supply growth compared to the rest of the stablecoin market? Share your thoughts in the comments section below.